Answered step by step

Verified Expert Solution

Question

1 Approved Answer

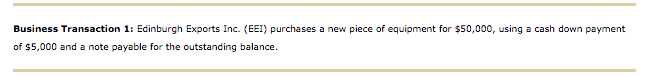

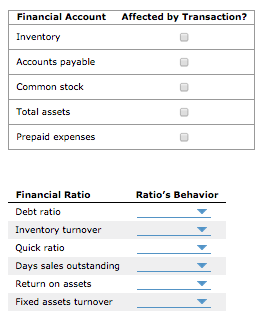

ALL DROP DOWN OPTIONS ARE: Decreases, No Change, or Increases Edinburgh Exports Inc. Statement of Financial Condition Cash Marketable securities Accounts receivable $20,000 20,000 10,000

ALL DROP DOWN OPTIONS ARE: Decreases, No Change, or Increases

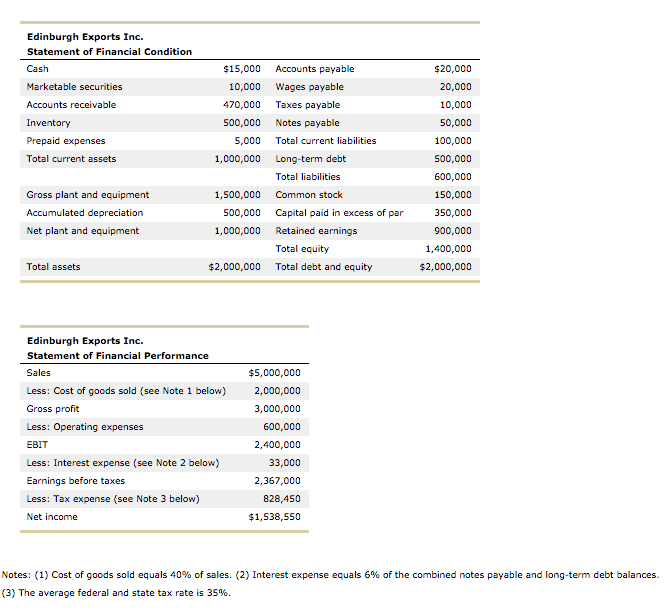

Edinburgh Exports Inc. Statement of Financial Condition Cash Marketable securities Accounts receivable $20,000 20,000 10,000 50,000 100,000 500,000 600,000 150,000 350,000 900,000 1,400,000 $2,000,000 $15,000 Accounts payable 10,000 Wages payable 470,000 Taxes payable 500,000 Notes payable Prepaid expenses 5,000 Total current liabilities Total current assets 1,000,000 Long-term debt Total liabilities Gross plant and equipment Accumulated depreciation Net plant and equipment 1,500,000 Common stock 500,000 1,000,000 Capital paid in excess of par Retained earnings Total equity Total debt and equity Total assets $2,000,000 Edinburgh Exports Inc. Statement of Financial Performance Sales Less: Cost of goods sold (see Note 1 below) Gross profit Less: Operating expenses EBIT Less: Interest expense (see Note 2 below) Earnings before taxes Less: Tax expense (see Note 3 below) Net income $5,000,000 2,000,000 3,000,000 600,000 2,400,000 33,000 2,367,000 828,450 $1,538,550 Notes: (1) Cost of goods sold equals 40% of sales. (2) Interest expense equals 6% of the combined notes payable and long-term debt balances. (3) The average federal and state tax rate is 35%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started