Answered step by step

Verified Expert Solution

Question

1 Approved Answer

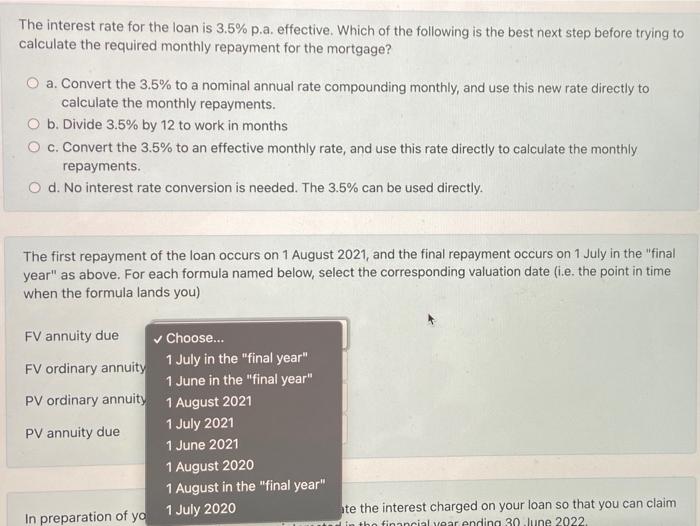

All drop down options are the same for the other 3 The interest rate for the loan is 3.5% p.a. effective. Which of the following

All drop down options are the same for the other 3

The interest rate for the loan is 3.5% p.a. effective. Which of the following is the best next step before trying to calculate the required monthly repayment for the mortgage? O a. Convert the 3.5% to a nominal annual rate compounding monthly, and use this new rate directly to calculate the monthly repayments. O b. Divide 3.5% by 12 to work in months O c. Convert the 3.5% to an effective monthly rate, and use this rate directly to calculate the monthly repayments. O d. No interest rate conversion is needed. The 3.5% can be used directly. The first repayment of the loan occurs on 1 August 2021, and the final repayment occurs on 1 July in the "final year" as above. For each formula named below, select the corresponding valuation date (i.e. the point in time when the formula lands you) FV annuity due Choose... FV ordinary annuity 1 July in the "final year" 1 June in the "final year" PV ordinary annuity 1 August 2021 PV annuity due 1 July 2021 1 June 2021 1 August 2020 1 August in the "final year" In preparation of yo 1 July 2020 ate the interest charged on your loan so that you can claim the financial year endina 30 lune 2022

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started