Question

All earnings generated are paid out as dividends since the product market for its product isstable and expects no growth. The debt consists of perpetual

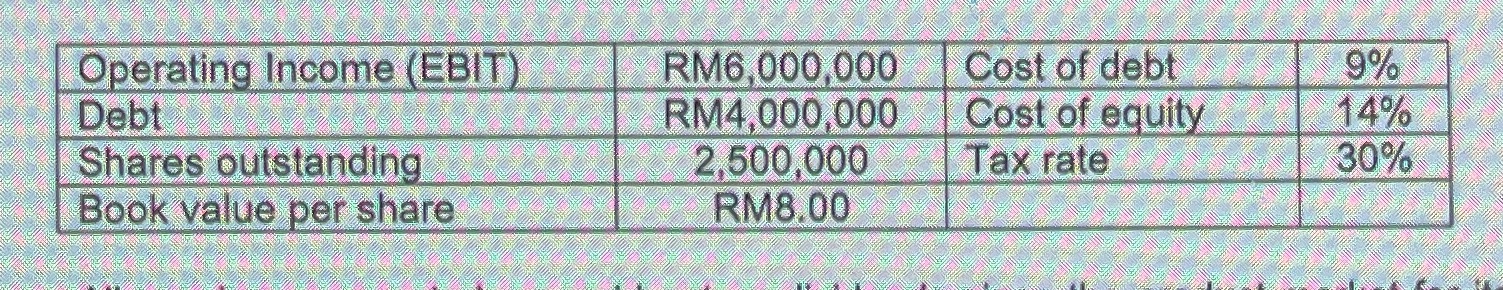

All earnings generated are paid out as dividends since the product market for its product isstable and expects no growth. The debt consists of perpetual bonds.Required:a) What are Ekovest Bhd's earning per share (EPS) and its price per share?b) Ekovest can increase its debt by RM7 million, to a total of RM11 million, using the newdebt to buy back and retire some of the shares at current price. Its interest rate on debtwill be 11% (it will have to call and refund the old debt), and its cost of new equity will risefrom 14% to 16%. Operating income will remain constant. Should Ekovest change itscapital structure?c) If Ekovest did not have to refund the old debt of RMX million, how would this effect things?

Operating Income (EBIT) RM6,000,000 Cost of debt 9% Debt RM4,000,000 Cost of equity 14% Shares outstanding 2,500,000 Tax rate 30% Book value per share RM8.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started