Answered step by step

Verified Expert Solution

Question

1 Approved Answer

All else equal, increasing interest rates will likely (1). This change in planned investment spending occurs because higher interest rates mean that A. consumers

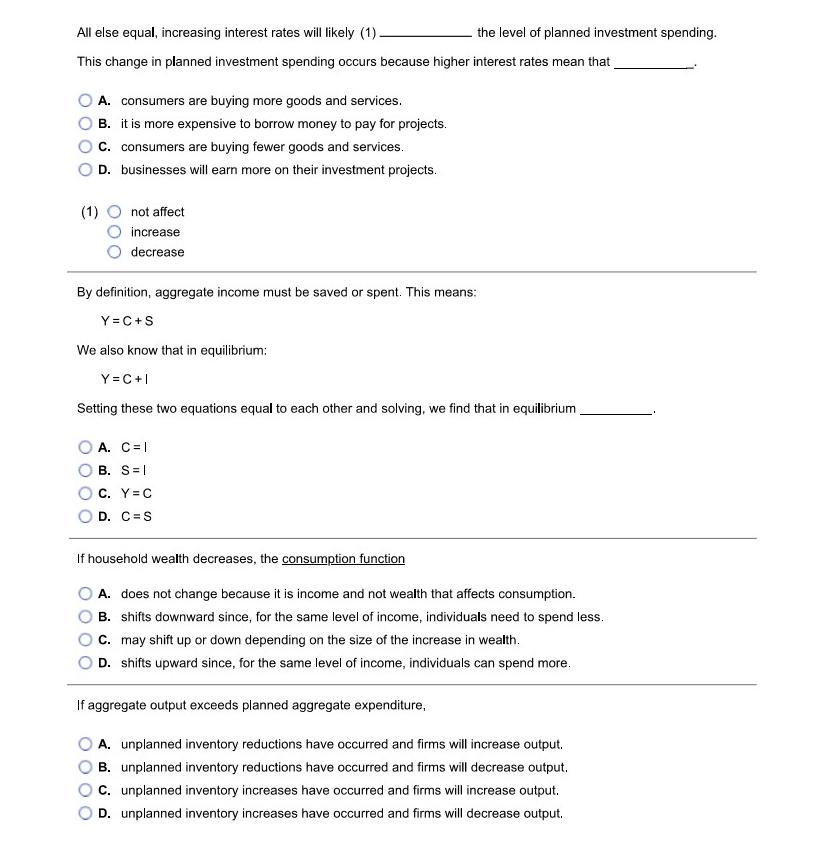

All else equal, increasing interest rates will likely (1). This change in planned investment spending occurs because higher interest rates mean that A. consumers are buying more goods and services. B. it is more expensive to borrow money to pay for projects. C. consumers are buying fewer goods and services. D. businesses will earn more on their investment projects. (1) 000 not affect increase decrease the level of planned investment spending. By definition, aggregate income must be saved or spent. This means: Y=C+S We also know that in equilibrium: Y=C+I Setting these two equations equal to each other and solving, we find that in equilibrium A. C=1 B. SI C. Y C D. C=S If household wealth decreases, the consumption function A. does not change because it is income and not wealth that affects consumption. B. shifts downward since, for the same level of income, individuals need to spend less. C. may shift up or down depending on the size of the increase in wealth. D. shifts upward since, for the same level of income, individuals can spend more. If aggregate output exceeds planned aggregate expenditure, A. unplanned inventory reductions have occurred and firms will increase output. B. unplanned inventory reductions have occurred and firms will decrease output. C. unplanned inventory increases have occurred and firms will increase output. D. unplanned inventory increases have occurred and firms will decrease output.

Step by Step Solution

★★★★★

3.52 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Ans12 Decrease B this is because increase in interest rate will require higher i terest payments ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started