Question

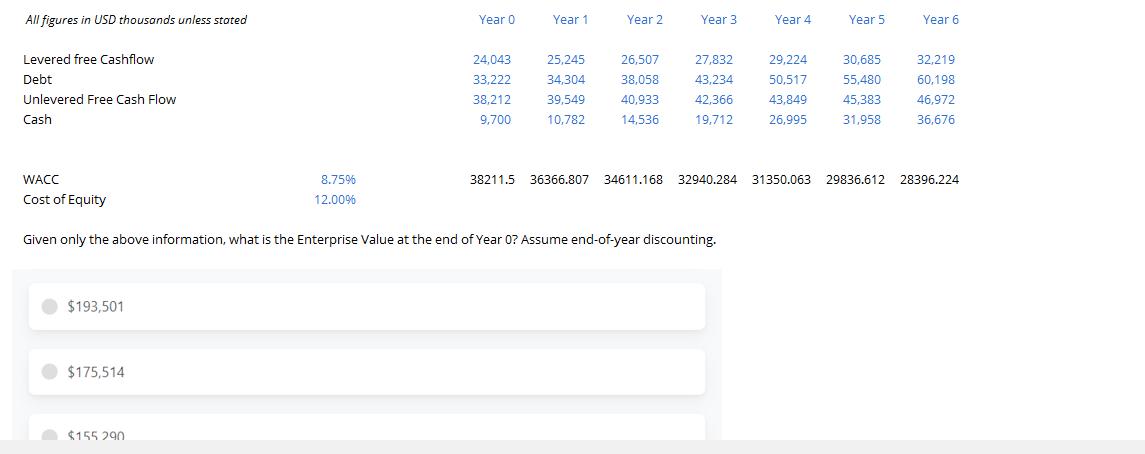

All figures in USD thousands unless stated Levered free Cashflow Debt Unlevered Free Cash Flow Cash $193,501 $175,514 8.75% 12.00% $155.290 Year 0 24,043

All figures in USD thousands unless stated Levered free Cashflow Debt Unlevered Free Cash Flow Cash $193,501 $175,514 8.75% 12.00% $155.290 Year 0 24,043 33,222 38,212 9,700 Year 1 25,245 34,304 39,549 10,782 Year 2 26,507 38,058 40,933 14,536 WACC Cost of Equity Given only the above information, what is the Enterprise Value at the end of Year 0? Assume end-of-year discounting. Year 3 27,832 43,234 42,366 19,712 Year 4 29,224 50,517 43,849 26,995 Year 5 30,685 55,480 45,383 31,958 Year 6 32,219 60,198 46,972 36,676 38211.5 36366.807 34611.168 32940.284 31350.063 29836.612 28396.224

Step by Step Solution

3.49 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Corporate Finance

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe

13th International Edition

1265533199, 978-1265533199

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App