All goes together. this is one question

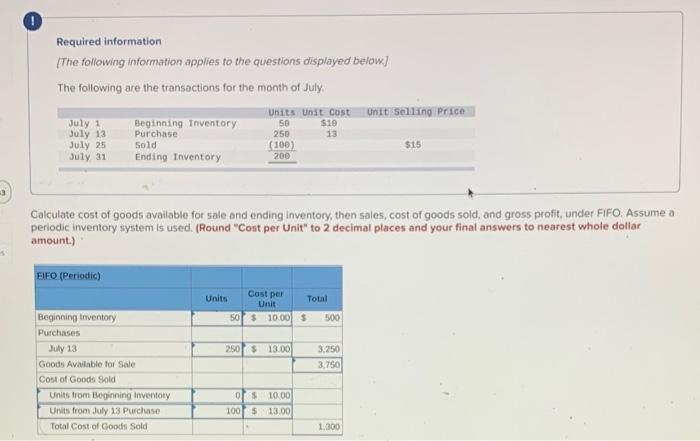

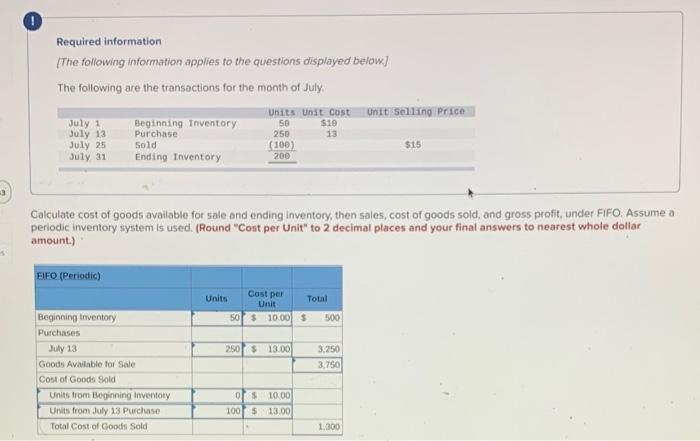

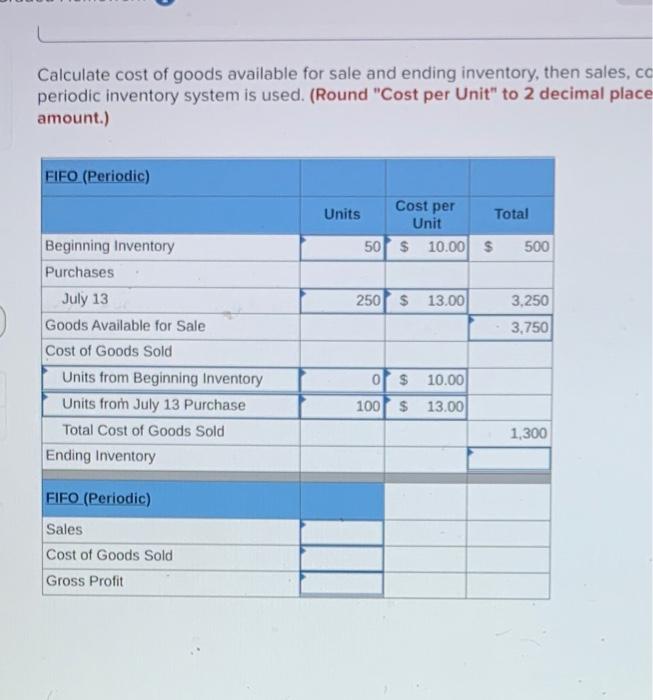

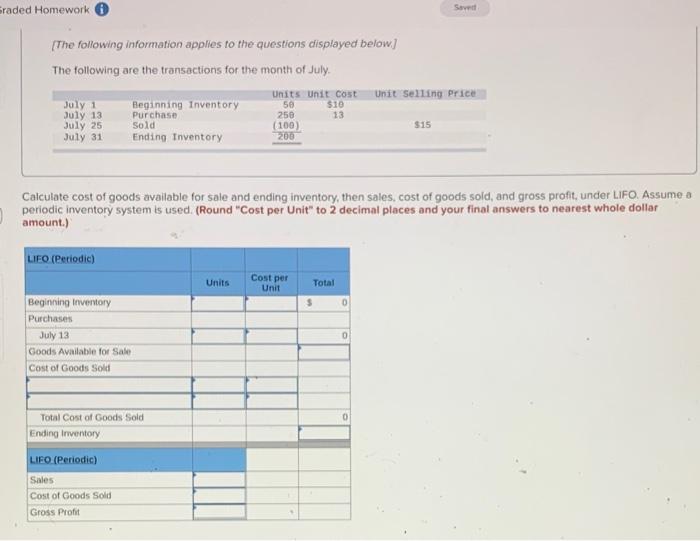

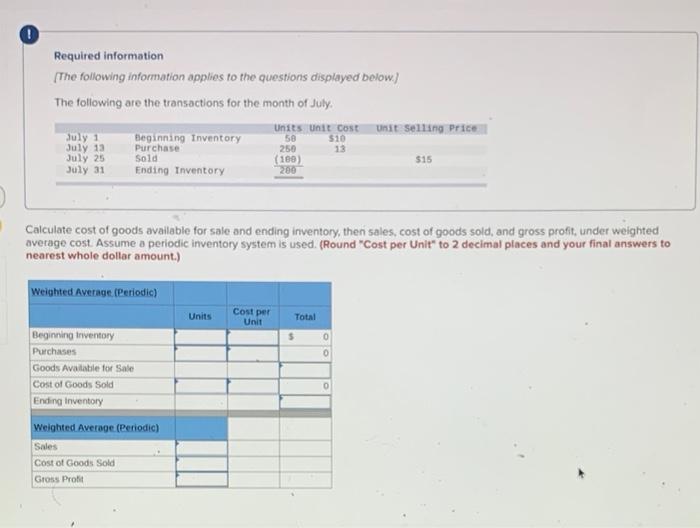

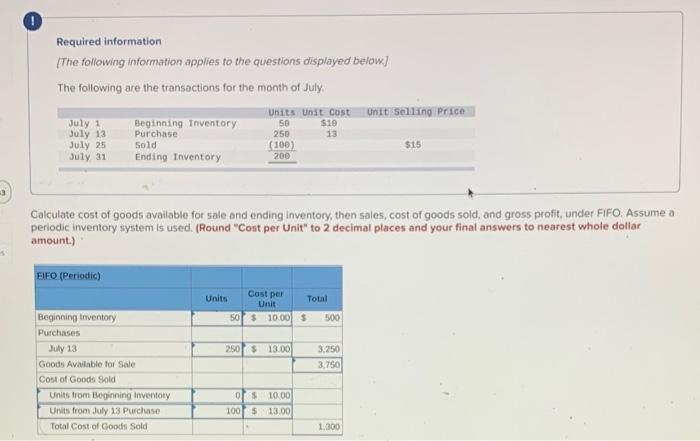

Required information The following information applies to the questions displayed below.) The following are the transactions for the month of July Units Unit cost Unit Selling Price July 1 Beginning Tnventory 50 July 13 Purchase 250 13 July 25 (100) $15 July 31 Ending Inventory 200 $10 Sold Calculate cost of goods available for sale and ending Inventory, then sales, cost of goods sold, and gross profit, under FIFO. Assume a periodic Inventory system is used (Round "Cost per Unit" to 2 decimal places and your final answers to nearest whole dollar amount.) BIFO (Periodic) Units Cost per Unit Total 50 $ 10.00 $ 500 250 $ 13.00 3.250 3.750 Beginning inventory Purchases July 13 Goods Available for Sale Cost of Goods Sold Units from Beginning inventory Units from July 13 Purchase Total Cost of Goods Sold ors 10.00 100 5 13.00 1.300 Calculate cost of goods available for sale and ending inventory, then sales, co periodic inventory system is used. (Round "Cost per Unit" to 2 decimal place amount.) FIFO (Periodic) Cost per Units Total Unit 50 $ 10.00 $ 500 250 $ 13.00 3.250 3,750 Beginning Inventory Purchases July 13 Goods Available for Sale Cost of Goods Sold Units from Beginning Inventory Units from July 13 Purchase Total Cost of Goods Sold Ending Inventory of $ 10.00 100 $ 13.00 1,300 FIFO (Periodic) Sales Cost of Goods Sold Gross Profit raded Homework Sound (The following information applies to the questions displayed below) The following are the transactions for the month of July. Units Unit cost Unit selling Price July 1 Beginning Inventory 50 $10 July 13 Purchase 250 13 July 25 Sold (100) July 31 Ending Inventory 200 $15 Calculate cost of goods available for sale and ending inventory, then sales, cost of goods sold, and gross profit, under LIFO. Assume a periodic inventory system is used. (Round "Cost per Unit" to 2 decimal places and your final answers to nearest whole dollar amount.) LEO (Periodic) Units Cost per Unit Total $ 0 Beginning inventory Purchases July 13 Goods Available for Sale Cost of Goods Sold 0 0 Total Cost of Goods Sold Ending Inventory LIEO (Periodic) Sales Cost of Goods Sold Gross Profit 0 Required information [The following information applies to the questions displayed below) The following are the transactions for the month of July. units unit cost selling Price July 1 Beginning Inventory July 13 Purchase 250 13 July 25 (188) July 31 Ending Inventory 200 50 $10 Sold $15 Calculate cost of goods available for sale and ending inventory, then sales, cost of goods sold, and gross profit, under weighted average cost. Assume a periodic inventory system is used. (Round "Cost per Unit" to 2 decimal places and your final answers to nearest whole dollar amount.) Weighted Average. (Periodic) Units Cost per Total Unit $ Beginning inventory Purchases Goods Available for Sale Cost of Goods Sold Ending Inventory Weighted Average (Periodic) Sales Cost of Goods Sold Gross Profit