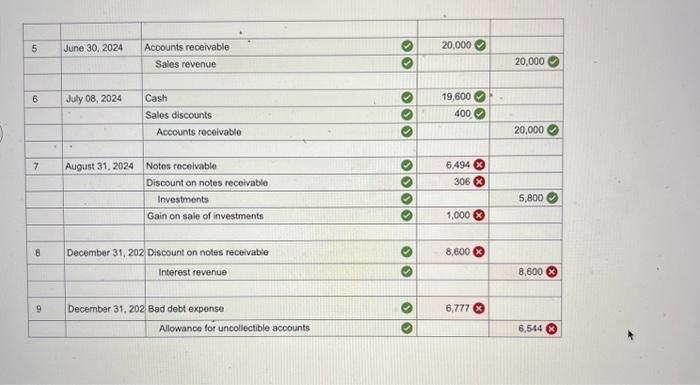

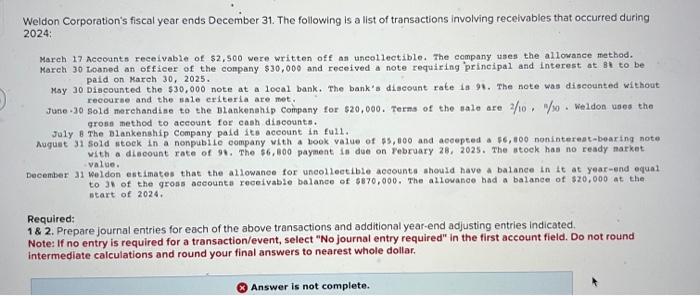

all I need are the numbers that are wrong they are not placed in the wrong spot and they are also incorrect please give a new number that is correct for rhe numbers that have a X on them unlike other chegg experts that just flipped the incorrect number into a diff box

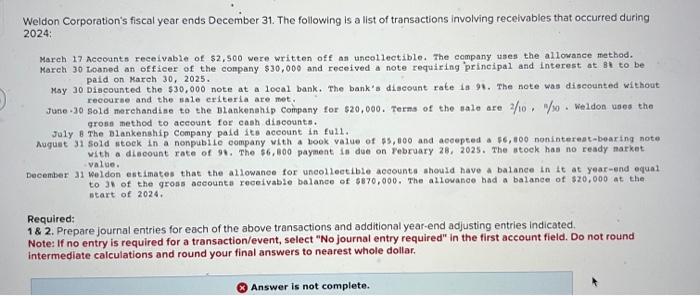

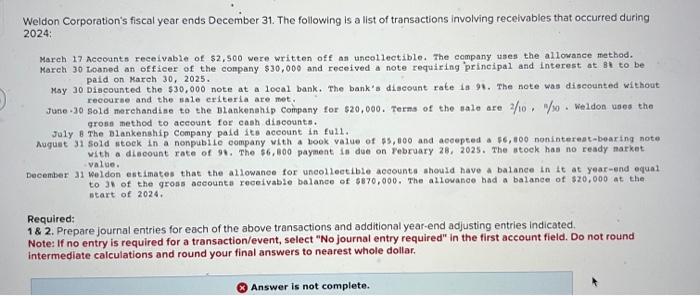

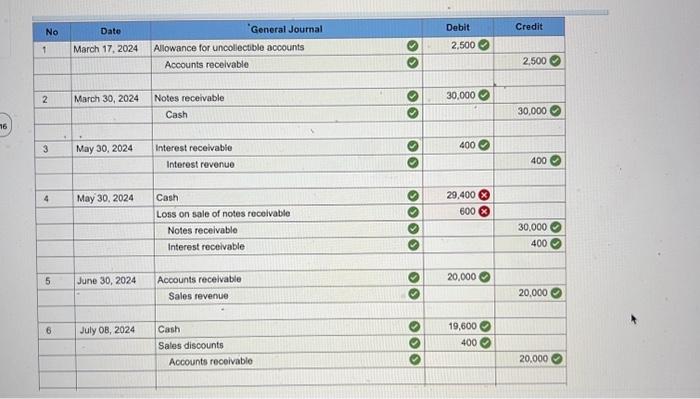

\begin{tabular}{|c|c|c|c|c|c|} \hline No & Dato & 'General Journa & & Debit & Credit \\ \hline \multirow[t]{2}{*}{1} & March 17, 2024 & Allowance for uncollectible accounts & 0 & 2,5000 & \\ \hline & & Accounts recelvable & 0 & & 2,5000 \\ \hline \multirow[t]{3}{*}{2} & March 30,2024 & Notes receivable & 0 & 30,0000 & \\ \hline & & Cash & 0 & & 30,0000 \\ \hline & . & & & & \\ \hline \multirow[t]{2}{*}{3} & Nay 30,2024 & Interest receivabie & 0 & 4000 & \\ \hline & & Interest revenue & 0 & & 4000 \\ \hline \multirow[t]{4}{*}{4} & May 30,2024 & Cash & 0 & 29,400 & \\ \hline & & Loss on sale of notes recelvable & 0 & 600 & \\ \hline & & Notes recelvable & 0 & & 30.0000 \\ \hline & & Interest receivable & 0 & & 4000 \\ \hline \multirow[t]{3}{*}{5} & June 30,2024 & Accounts receivable & 0 & 20,0000 & \\ \hline & & Sales revenue & 0 & & 20,0000 \\ \hline & & & & & \\ \hline \multirow[t]{4}{*}{6} & July 0B,2024 & Cash & 0 & 19,6000 & \\ \hline & & Sales discounts & 0 & 4000 & \\ \hline & & Accounts receivable & 0 & & 20.0000 \\ \hline & & & & & \\ \hline \end{tabular} Weldon Corporation's fiscal year ends December 31. The following is a list of transactions involving receivables that occurred during 2024: March 17 Accounts receivable of $2,500 were written off an uneollectible. The company uses the allowance method. Karch 30 toaned an officer of the company $30,000 and received a note requiring principal and interest at 81 to be paid on March 30,2025 . Msy 30 Discounted the $30,000 note at a local bank. The bank's discount rate ia 92 . The note was discounted without recourse and the nale exiteria are met. June - 30 sold nerehandine to the Blankenahip Company for $20,000. Terms of the sale are 2/10, 1/50. Weldon uses the grosis method to account for cash discounts. July 8 The Blankenship Company pald its account in full. Auguet 31 sold stock in a nonpubile eompany with a book value of $5,800 and accepted a 56 , 800 noninterest-bearing note with a discount rate of 98 . The $6,800 paymeat in due on rebruary 28,2025 . The atock has no ready narket value. Decenter 11 Weldon estimates that the allowanee for uncollectible accounts ahould have a balanee in it at year-end equal to 38 of the gross accounts receivable balance of 5870,000 . The allowance bad a balance of $20,000 at the ntart of 2024 . Required: 1\& 2. Prepare journal entries for each of the above transactions and additional year-end adjusting entries indicated. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round intermediate calculations and round your final answers to nearest whole dollar. \begin{tabular}{|c|c|c|c|c|c|} \hline & & . & & & \\ \hline \multirow[t]{2}{*}{5} & June 30,2024 & Acoounts receivable & 0 & 20.0000 & \\ \hline & & Sales revenue & 0 & & 20,000 \\ \hline \multirow[t]{3}{*}{6} & July 08, 2024 & Cash & 0 & 19,600 & - \\ \hline & r & Sales discounts & 0 & 400,0 & + \\ \hline & & Accounts receivable & 0 & & 20,0000 \\ \hline & & & & & \\ \hline \multirow[t]{4}{*}{7} & August 31,2024 & Notes receivable & 0 & 6.494 & \\ \hline & \pm & Discount on notes receivablo & 0 & 306 & \\ \hline & & Investments & 0 & & 5,8000 \\ \hline & & Gain on sale of investments & 0 & 1,000 & \\ \hline \multirow[t]{2}{*}{8} & December 31,202 & 2 Discount on notes receivable & 0 & 8,600 & \\ \hline & & Interest revenue & 0 & & 8,600 \\ \hline \multirow[t]{2}{*}{9} & December 31,202 & Bad debt expense & & 6.777 & \\ \hline & & Allowance for uncollectible accounts & 0 & & 6,544 \\ \hline \end{tabular}