All I need help with is the formal memo. (part 2 of the question)

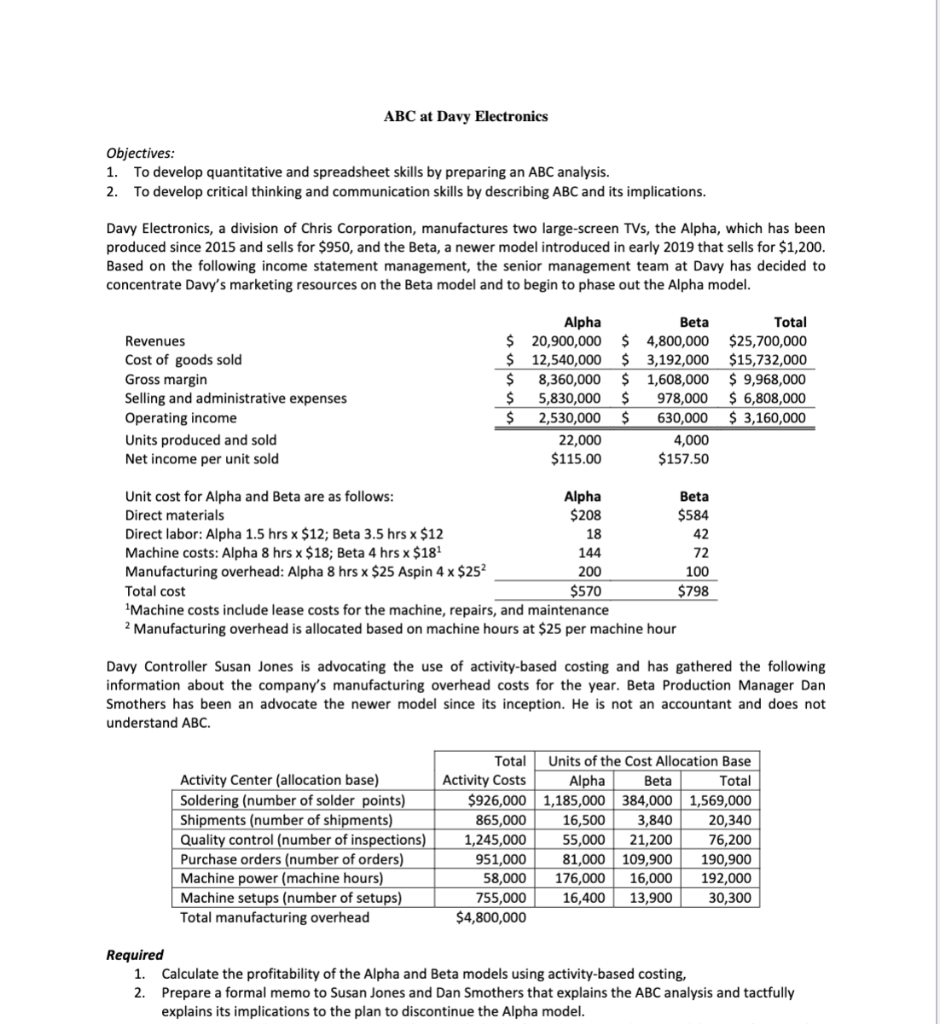

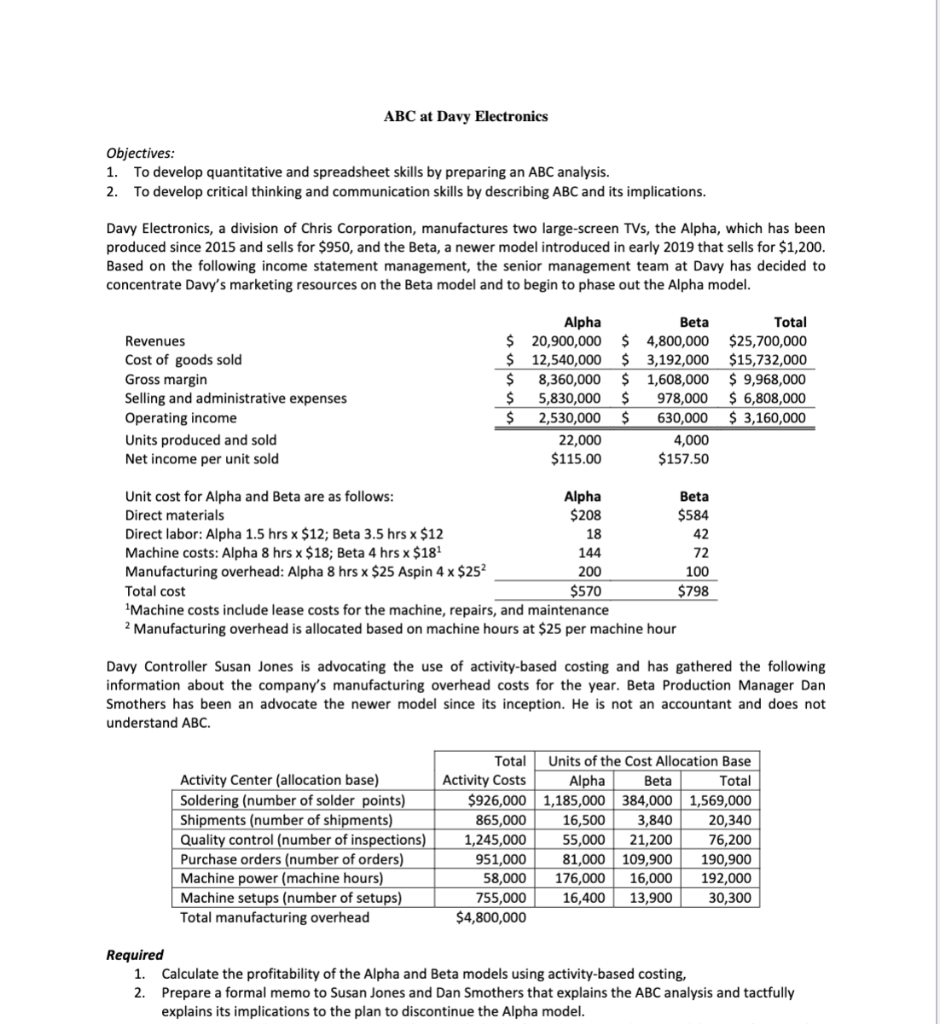

ABC at Davy Electronics Objectives: 1. To develop quantitative and spreadsheet skills by preparing an ABC analysis. 2. To develop critical thinking and communication skills by describing ABC and its implications. Davy Electronics, a division of Chris Corporation, manufactures two large-screen TVs, the Alpha, which has been produced since 2015 and sells for $950, and the Beta, a newer model introduced in early 2019 that sells for $1,200. Based on the following income statement management, the senior management team at Davy has decided to concentrate Davy's marketing resources on the Beta model and to begin to phase out the Alpha model. Revenues Cost of goods sold Gross margin Selling and administrative expenses Operating income Units produced and sold Net income per unit sold Alpha $ 20,900,000 $ 12,540,000 $ 8,360,000 $ 5,830,000 $ 2,530,000 22,000 $115.00 Beta Total $ 4,800,000 $25,700,000 $ 3,192,000 $15,732,000 $ 1,608,000 $ 9,968,000 $ 978,000 $ 6,808,000 $ 630,000 $ 3,160,000 4,000 $157.50 Unit cost for Alpha and Beta are as follows: Alpha Beta Direct materials $208 $584 Direct labor: Alpha 1.5 hrs x $12; Beta 3.5 hrs x $12 18 42 Machine costs: Alpha 8 hrs x $18; Beta 4 hrs x $181 144 72 Manufacturing overhead: Alpha 8 hrs x $25 Aspin 4 x $252 200 100 Total cost $570 $798 Machine costs include lease costs for the machine, repairs, and maintenance 2 Manufacturing overhead is allocated based on machine hours at $25 per machine hour Davy Controller Susan Jones is advocating the use of activity-based costing and has gathered the following information about the company's manufacturing overhead costs for the year. Beta Production Manager Dan Smothers has been an advocate the newer model since its inception. He is not an accountant and does not understand ABC. Activity Center (allocation base) Soldering (number of solder points) Shipments (number of shipments) Quality control (number of inspections) Purchase orders (number of orders) Machine power (machine hours) Machine setups (number of setups) Total manufacturing overhead Total Units of the Cost Allocation Base Activity Costs Alpha Beta Total $926,000 1,185,000 384,000 1,569,000 865,000 16,500 3,840 20,340 1,245,000 55,000 21,200 76,200 951,000 81,000 109,900 190,900 58,000 176,000 16,000 192,000 755,000 16,400 13,900 30,300 $4,800,000 Required 1. Calculate the profitability of the Alpha and Beta models using activity-based costing, 2. Prepare a formal memo to Susan Jones and Dan Smothers that explains the ABC analysis and tactfully explains its implications to the plan to discontinue the Alpha model