All in the same problem

All in the same problem

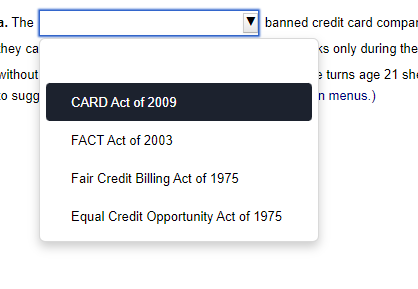

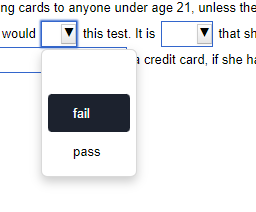

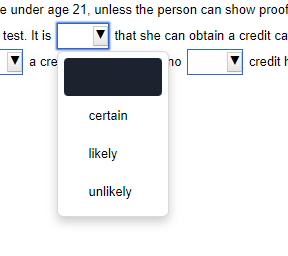

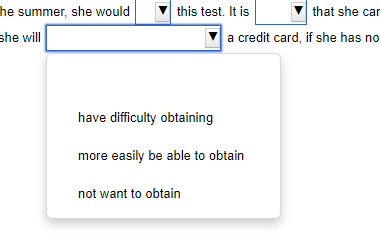

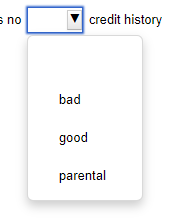

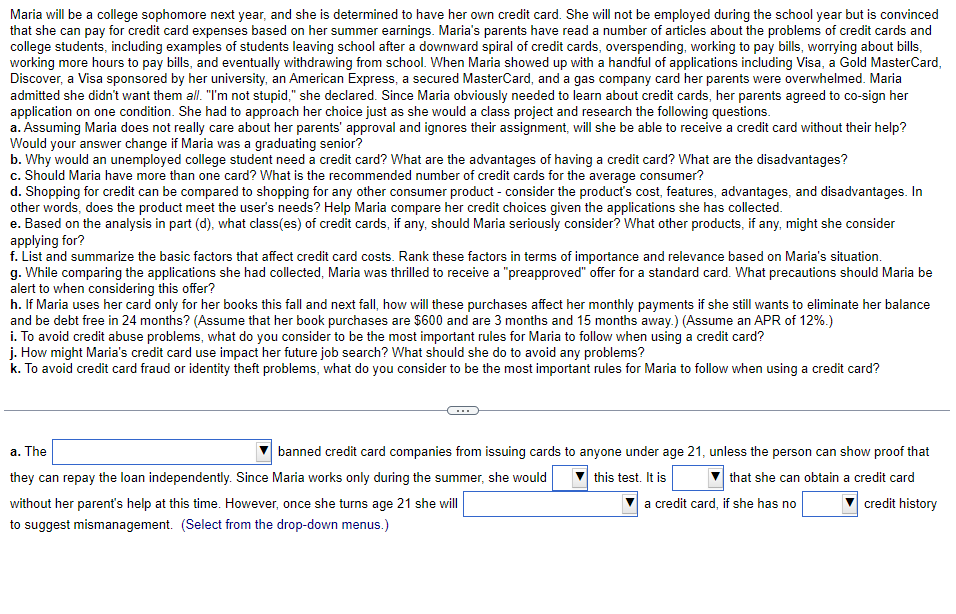

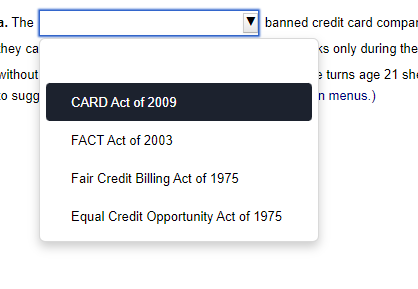

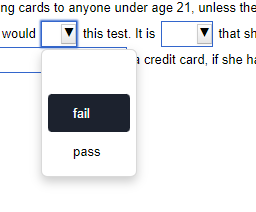

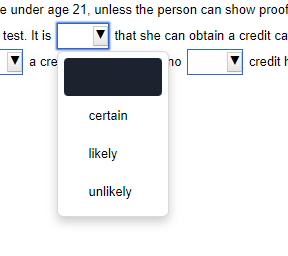

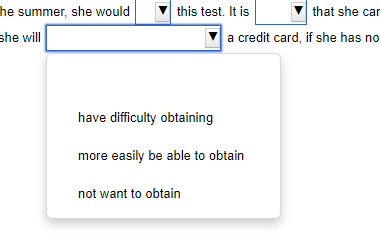

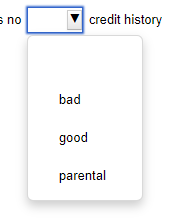

Maria will be a college sophomore next year, and she is determined to have her own credit card. She will not be employed during the school year but is convinced that she can pay for credit card expenses based on her summer earnings. Maria's parents have read a number of articles about the problems of credit cards and college students, including examples of students leaving school after a downward spiral of credit cards, overspending, working to pay bills, worrying about bills, working more hours to pay bills, and eventually withdrawing from school. When Maria showed up with a handful of applications including Visa, a Gold MasterCard, Discover, a Visa sponsored by her university, an American Express, a secured MasterCard, and a gas company card her parents were overwhelmed. Maria admitted she didn't want them all. "I'm not stupid," she declared. Since Maria obviously needed to learn about credit cards, her parents agreed to co-sign her application on one condition. She had to approach her choice just as she would a class project and research the following questions. a. Assuming Maria does not really care about her parents' approval and ignores their assignment, will she be able to receive a credit card without their help? Would your answer change if Maria was a graduating senior? b. Why would an unemployed college student need a credit card? What are the advantages of having a credit card? What are the disadvantages? c. Should Maria have more than one card? What is the recommended number of credit cards for the average consumer? d. Shopping for credit can be compared to shopping for any other consumer product - consider the product's cost, features, advantages, and disadvantages. In other words, does the product meet the user's needs? Help Maria compare her credit choices given the applications she has collected. e. Based on the analysis in part (d), what class(es) of credit cards, if any, should Maria seriously consider? What other products, if any, might she consider applying for? f. List and summarize the basic factors that affect credit card costs. Rank these factors in terms of importance and relevance based on Maria's situation. g. While comparing the applications she had collected, Maria was thrilled to receive a "preapproved" offer for a standard card. What precautions should Maria be alert to when considering this offer? h. If Maria uses her card only for her books this fall and next fall, how will these purchases affect her monthly payments if she still wants to eliminate her balance and be debt free in 24 months? (Assume that her book purchases are $600 and are 3 months and 15 months away.) (Assume an APR of 12% ) i. To avoid credit abuse problems, what do you consider to be the most important rules for Maria to follow when using a credit card? j. How might Maria's credit card use impact her future job search? What should she do to avoid any problems? k. To avoid credit card fraud or identity theft problems, what do you consider to be the most important rules for Maria to follow when using a credit card? a. The banned credit card companies from issuing cards to anyone under age 21 , unless the person can show the without her parent's help at this time. However, once she turns age 21 she will credit history to suggest mismanagement. (Select from the drop-down menus.) a. The banned credit card compat CARD Act of 2009 n menus.) FACT Act of 2003 Fair Credit Billing Act of 1975 Equal Credit Opportunity Act of 1975 ng cards to anyone under age 21, unless the would this test. It is that st a credit card, if she h pass e under age 21 , unless the person can show proot test. It is that she can obtain a credit cal a cre credit certain likely unlikely have difficulty obtaining more easily be able to obtain not want to obtain credit history

All in the same problem

All in the same problem