Answered step by step

Verified Expert Solution

Question

1 Approved Answer

all information is there PC Shopping Network may upgrade its modem pool. The old pool was bought two years ago for $35 million with a

all information is there

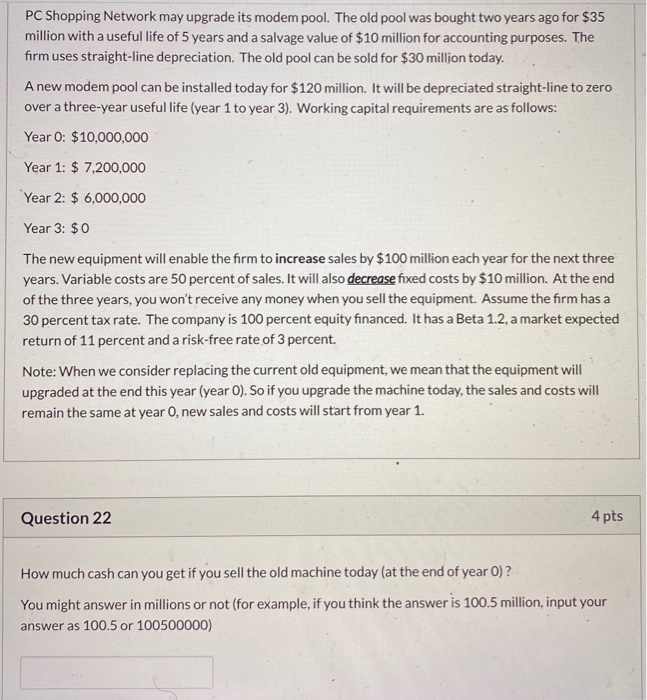

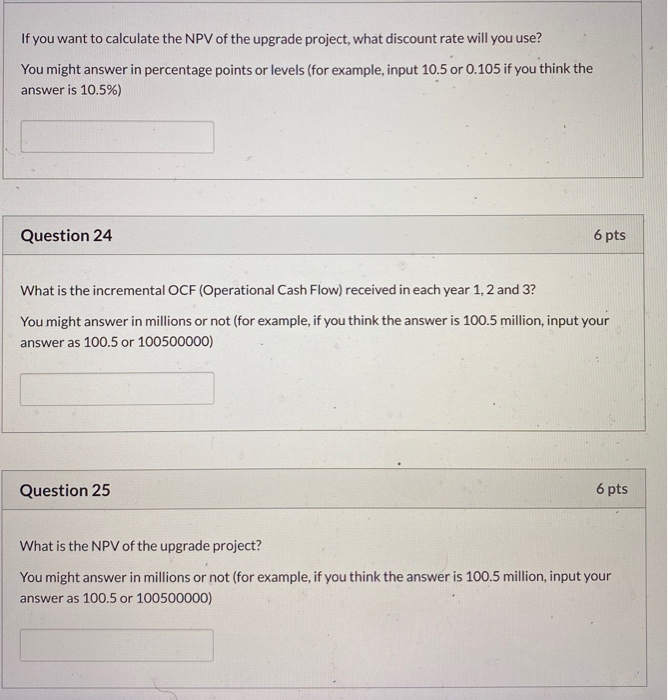

PC Shopping Network may upgrade its modem pool. The old pool was bought two years ago for $35 million with a useful life of 5 years and a salvage value of $10 million for accounting purposes. The firm uses straight-line depreciation. The old pool can be sold for $30 million today. A new modem pool can be installed today for $120 million. It will be depreciated straight-line to zero over a three-year useful life (year 1 to year 3). Working capital requirements are as follows: Year O: $10,000,000 Year 1: $ 7,200,000 Year 2: $ 6,000,000 Year 3: $0 The new equipment will enable the firm to increase sales by $100 million each year for the next three years. Variable costs are 50 percent of sales. It will also decrease fixed costs by $10 million. At the end of the three years, you won't receive any money when you sell the equipment. Assume the firm has a 30 percent tax rate. The company is 100 percent equity financed. It has a Beta 1.2, a market expected return of 11 percent and a risk-free rate of 3 percent. Note: When we consider replacing the current old equipment, we mean that the equipment will upgraded at the end this year (year 0). So if you upgrade the machine today, the sales and costs will remain the same at year 0, new sales and costs will start from year 1. Question 22 4 pts How much cash can you get if you sell the old machine today (at the end of year O)? You might answer in millions or not (for example, if you think the answer is 100.5 million, input your answer as 100.5 or 100500000) If you want to calculate the NPV of the upgrade project, what discount rate will you use? You might answer in percentage points or levels (for example, input 10.5 or 0.105 if you think the answer is 10.5%) Question 24 6 pts What is the incremental OCF (Operational Cash Flow) received in each year 1, 2 and 3? You might answer in millions or not (for example, if you think the answer is 100.5 million, input your answer as 100.5 or 100500000) Question 25 6 pts What is the NPV of the upgrade project? You might answer in millions or not (for example, if you think the answer is 100.5 million, input your answer as 100.5 or 100500000) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started