Answered step by step

Verified Expert Solution

Question

1 Approved Answer

all is there . Inflation in project analysis tis often easy to overlook the impact of inflation on the net present value of the project.

all is there

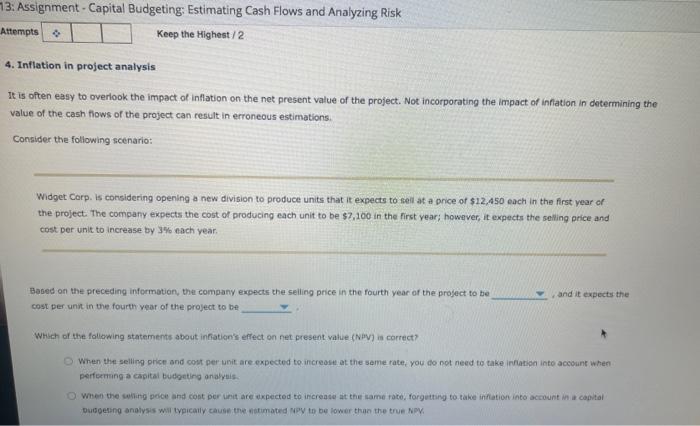

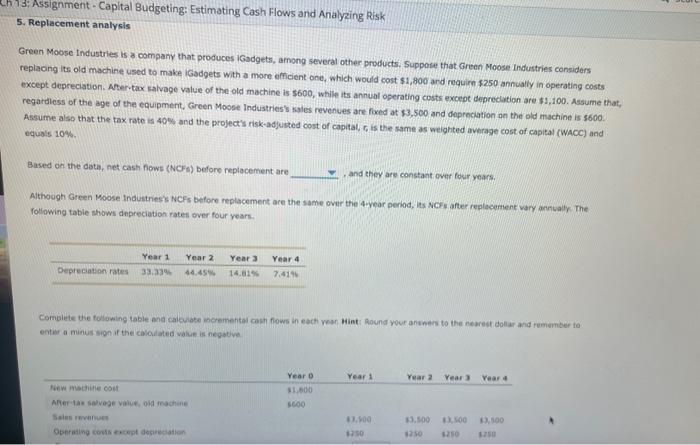

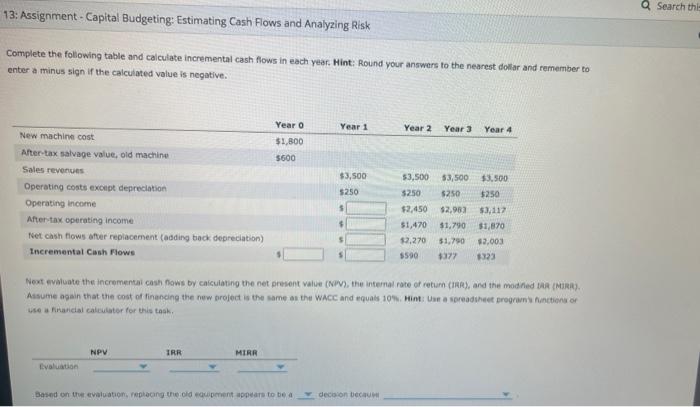

. Inflation in project analysis tis often easy to overlook the impact of inflation on the net present value of the project. Not incorporating the impact of inflation in ontermining the value of the cash flows of the project can result in erroneous estimations. Consider the following scenario: Widget Corp. is considering opening a new division to produce units that it expects to sell at a price of $12,450 each in the first year of the project. The company expects the cost of producing each unit to be $7,100 in the first year; however, it expects the selling price and cost per unit to increase by 3% nach year. Based on the preceding information, the company expects the selling price in the fourth year of the project to be cost per unn in the fourth year of the project to be Which of the following statements about infiation's effect on net present value (Niv) is correct? When the selling price and cost per unit are expected to increost at the same rate, you do not need to take irfation inte account when perfoetung a capital budgeting analyuis. When the whing perce and cont per unit are expected to increase at the same fate, forgetting to take infation into acrount in a caphal Green Moose Industries is a company that produces iGadgets, among several other products, Suppose that Green Moose Industries considers. replacing its old machine used to make IGadgets with a more efficient one, which would cost $1,800 ard requirn 1250 annually in operating costs except depreciation. Aher-tax walvage value of the old machine is 5600 , while its annual operating costs except depreclation are $1, 100. Assume that. regardless of the age of the equipment, Green Moose Industries's sales revenues are foced at 53,500 and deprociation on the old machine is 5600 . Assume alse that the tax rate is 40% and the project's risk-adjusted cost of capital, r, is the same as weighited average cost of capital (Wacc) and equols 10% Based on the data, net cash fows (NCFs) before replocement are , and they are constant ower four years. Athough Green Moose Industries's NCFis before replacement are the same over the 4year period, iss NcFs after replacurhent vary arntily The following tabie shows depreciation ratel over four years. Complete the folluwing table and calcuate moremehtal cokn fows in each year Hint: Round vour ananes to the neared doliar and remamber to enter a minus sign if the cibloilated value is negative. 13: Assignment - Capital Budgeting: Estimating Cash Flows and Analyzing Risk Complete the following table and calculate incremental cash flows in each year. Hint: Round your answers to the nearest dollar and remember to enter a minus sign if the calculated value is negative. Assume again that the cost of finaneing the new broject is the same as the WAcC and equals 10 . Mim: Uze a soreaduheet prograni hanctions of Whe a finanidal calculater for this task. decoion tecauti. . Inflation in project analysis tis often easy to overlook the impact of inflation on the net present value of the project. Not incorporating the impact of inflation in ontermining the value of the cash flows of the project can result in erroneous estimations. Consider the following scenario: Widget Corp. is considering opening a new division to produce units that it expects to sell at a price of $12,450 each in the first year of the project. The company expects the cost of producing each unit to be $7,100 in the first year; however, it expects the selling price and cost per unit to increase by 3% nach year. Based on the preceding information, the company expects the selling price in the fourth year of the project to be cost per unn in the fourth year of the project to be Which of the following statements about infiation's effect on net present value (Niv) is correct? When the selling price and cost per unit are expected to increost at the same rate, you do not need to take irfation inte account when perfoetung a capital budgeting analyuis. When the whing perce and cont per unit are expected to increase at the same fate, forgetting to take infation into acrount in a caphal Green Moose Industries is a company that produces iGadgets, among several other products, Suppose that Green Moose Industries considers. replacing its old machine used to make IGadgets with a more efficient one, which would cost $1,800 ard requirn 1250 annually in operating costs except depreciation. Aher-tax walvage value of the old machine is 5600 , while its annual operating costs except depreclation are $1, 100. Assume that. regardless of the age of the equipment, Green Moose Industries's sales revenues are foced at 53,500 and deprociation on the old machine is 5600 . Assume alse that the tax rate is 40% and the project's risk-adjusted cost of capital, r, is the same as weighited average cost of capital (Wacc) and equols 10% Based on the data, net cash fows (NCFs) before replocement are , and they are constant ower four years. Athough Green Moose Industries's NCFis before replacement are the same over the 4year period, iss NcFs after replacurhent vary arntily The following tabie shows depreciation ratel over four years. Complete the folluwing table and calcuate moremehtal cokn fows in each year Hint: Round vour ananes to the neared doliar and remamber to enter a minus sign if the cibloilated value is negative. 13: Assignment - Capital Budgeting: Estimating Cash Flows and Analyzing Risk Complete the following table and calculate incremental cash flows in each year. Hint: Round your answers to the nearest dollar and remember to enter a minus sign if the calculated value is negative. Assume again that the cost of finaneing the new broject is the same as the WAcC and equals 10 . Mim: Uze a soreaduheet prograni hanctions of Whe a finanidal calculater for this task. decoion tecauti Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started