Answered step by step

Verified Expert Solution

Question

1 Approved Answer

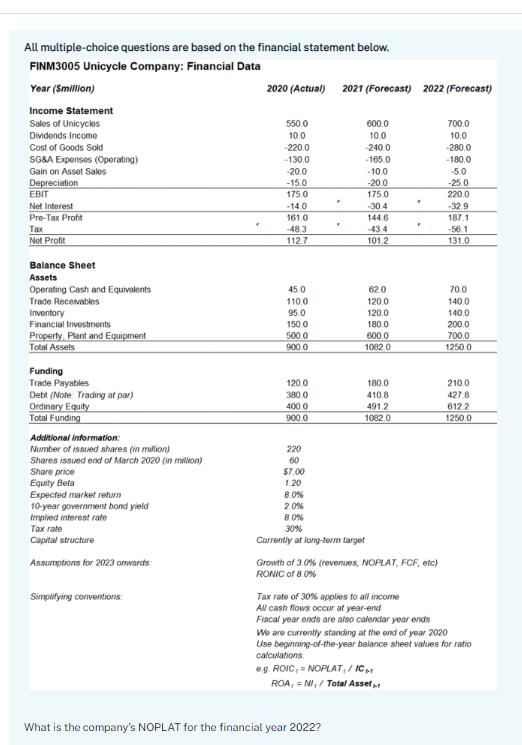

All multiple-choice questions are based on the financial statement below. FINM3005 Unicycle Company: Financial Data Year (Smillion) Income Statement Sales of Unicycles Dividends Income

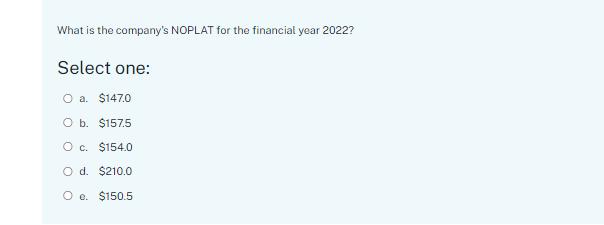

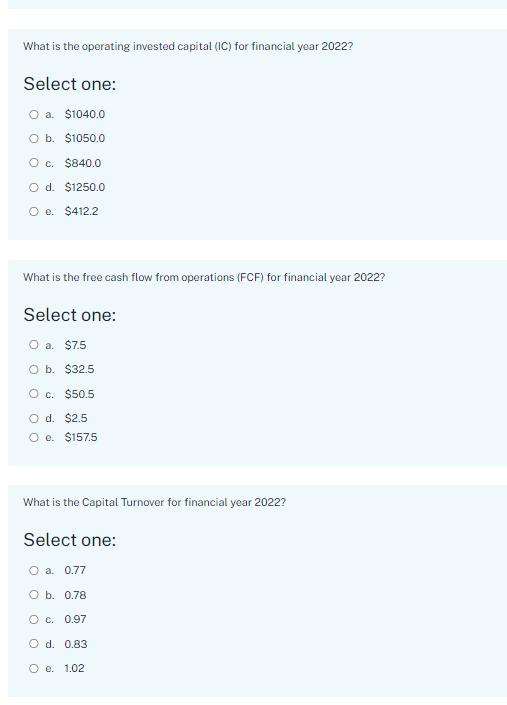

All multiple-choice questions are based on the financial statement below. FINM3005 Unicycle Company: Financial Data Year (Smillion) Income Statement Sales of Unicycles Dividends Income Cost of Goods Sold SG&A Expenses (Operating) Gain on Asset Sales Depreciation EBIT Net Interest Pre-Tex Profit Tax Net Profit Balance Sheet Assets Operating Cash and Equivalents Trade Receivables Inventory Financial Investments Property. Plant and Equipment Total Assets Funding Trade Payables Debt (Note: Trading at par) Ordinary Equity Total Funding Additional information: Number of issued shares (in million) Shares issued end of March 2020 (in million) Share price Equity Beta Expected market return 10-year government bond yield Implied interest rate Tax rate Capital structure Assumptions for 2023 onwards Simplifying conventions What is the company's NOPLAT for the financial year 2022? 2020 (Actual) 2021 (Forecast) 2022 (Forecast) 550.0 600.0 700.0 10.0 10.0 10.0 -220.0 -240.0 -280.0 -130.0 -165.0 -180.0 -20.0 -10.0 -5.0 -15.0 -20.0 -25.0 175.0 175.0 220.0 -14.0 -30.4 -32.9 161.0 144.6 187.1 -48.3 -43.4 -56.1 112.7 101.2 131.0 45.0 62.0 70.0 110.0 120.0 140.0 95.0 120.0 140.0 150.0 180.0 200.0 500.0 600.0 700.0 900.0 1082.0 12500 120.0 180.0 210.0 380.0 410.8 427.8 400.0 491,2 612.2 900.0 1082.0 1250.0 220 60 $7.00 1.20 8.0% 2.0% 8.0% 30% Currently at long-term target Growth of 3.0% (revenues, NOPLAT, FCF, etc) RONIC of 8.0% Tax rate of 30% applies to all income All cash flows occur at year-end Fiscal year ends are also calendar year ends We are currently standing at the end of year 2020 Use beginning-of-the-year balance sheet values for ratio calculations. e.g. ROIC, = NOPLAT, / IC ROA, NI,/ Total Asset F F F What is the company's NOPLAT for the financial year 2022? Select one: O a. $147.0 O b. $157.5 O c. $154.0 O d. $210.0 O e. $150.5 What is the operating invested capital (IC) for financial year 2022? Select one: O a. $1040.0 O b. $1050.0 O c. $840.0 O d. $1250.0 Oe. $412.2 What is the free cash flow from operations (FCF) for financial year 2022? Select one: O a. $7.5 O b. $32.5 O c. $50.5 O d. $2.5 O e. $157.5 What is the Capital Turnover for financial year 2022? Select one: O a. 0.77 O b. 0.78 O c. 0.97 O d. 0.83 O e. 1.02

Step by Step Solution

★★★★★

3.53 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

1 Answer 1540 Explanation using the formula NOPLAT EBIT x 1 Tax Rate EB...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started