All of the employees are paid on a weekly basis on Friday. This project will focus on payroll for the dates ending 01/15/20 and 01/24/2020.

- All of the employees are paid on a weekly basis on Friday. This project will focus on payroll for the dates ending 01/15/20 and 01/24/2020. All employees earn 3 hours of vacation each pay period. For all voluntary benefits, there is a 50/50 cost sharing agreement. Please include calculations for Social Security and Medicare regardless if these are put on hold because of the Corona Virus.

1. to open an Excel spreadsheet and create two tabs at the bottom – one for each payroll period.

2. create columns for the employee name, filing status, pay rate, gross pay, mandatory voluntary deductions, vacation, and gross pay. Assume that the employees have no cumulative earnings prior to these payroll periods.

3. decide the pay rate for all employees and the number of hours worked. The number of hours worked must be different between the two payroll periods. In addition, three employees must have overtime in each payroll period.

4. Columns must also be created for hours worked, overtime, and Net Pay.

5. decide the cost of each voluntary benefit for each employee.

6. must include the mandatory withholdings. Use 6.2 percent for Social Security and 1.45 percent for Medicare for each employee.

7. For FUTA, use .08 of the first $7,000 of each employee. For SUTA, use 5.4% of the first $8,500 of each employee.

8. In calculating totals in the worksheet, students must use Excel formulas including SUM, SUMIF, SUMIFS, and Subtraction. A formula should also be included to tie information between two worksheets.

9. must also include conditional formatting with at least two rules applied.

10. should use the formatting features of Excel to give the worksheet a professional appearance.

11. prepare two-word documents showing general journal entries for the employee and employer side, payment of wages, accrual of vacation time, and payment of tax liabilities.

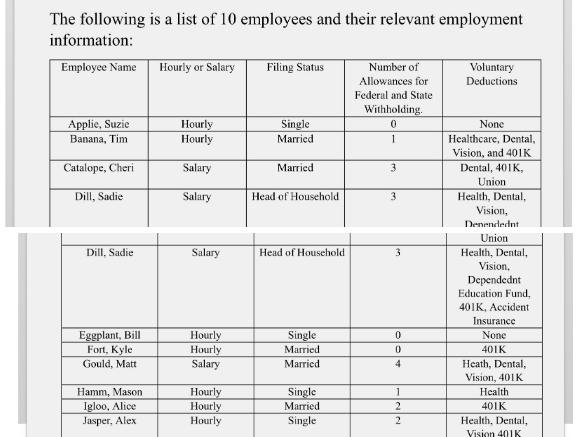

The following is a list of 10 employees and their relevant employment information: Employee Name Applic, Suzie Banana, Tim Catalope, Cheri Dill, Sadie. Dill, Sadie Eggplant, Bill Fort, Kyle Gould, Matt Hamm, Mason Igloo, Alice Jasper, Alex Hourly or Salary Hourly Hourly Salary Salary Salary Hourly Hourly Salary Hourly Hourly Hourly Filing Status Single Married Married Head of Household Head of Household Single Married Married. Single Married Single Number of Allowances for Federal and State Withholding. 0 1 3 3 3 0 0 4 122 Voluntary Deductions None Healthcare, Dental, Vision, and 401K Dental, 401K, Union Health, Dental, Vision, Denendednt Union Health, Dental, Vision, Dependednt Education Fund, 401K, Accident Insurance None 401K Heath, Dental, Vision, 401K Health 401K Health, Dental, Vision 401K

Step by Step Solution

3.53 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

The accounting manager can take the following actions to improve the companys financial management p...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started