All of the fill in the sentence blank segments are answered. There's no need to repeat what has already been answered.

All of the fill in the sentence blank segments are answered. There's no need to repeat what has already been answered.

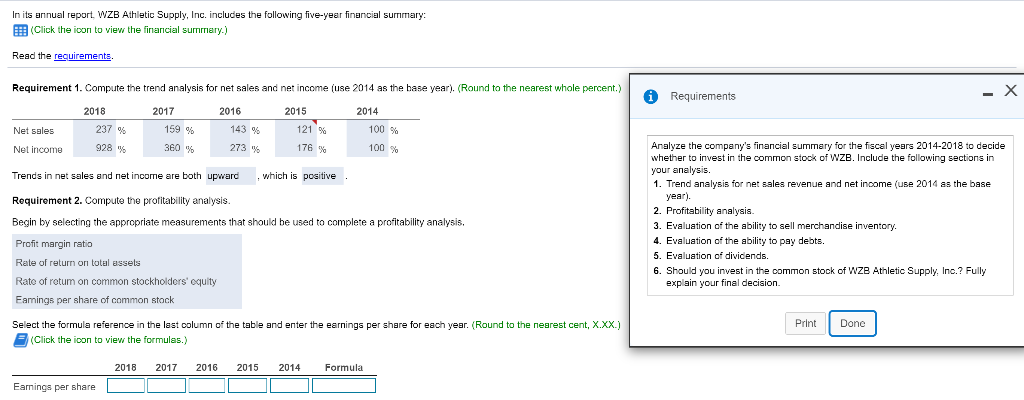

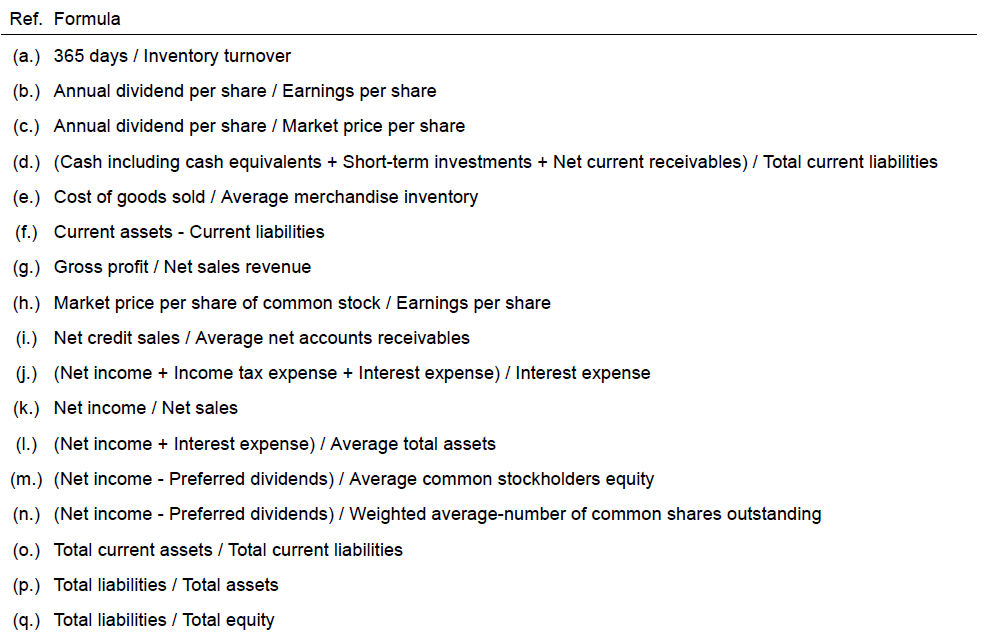

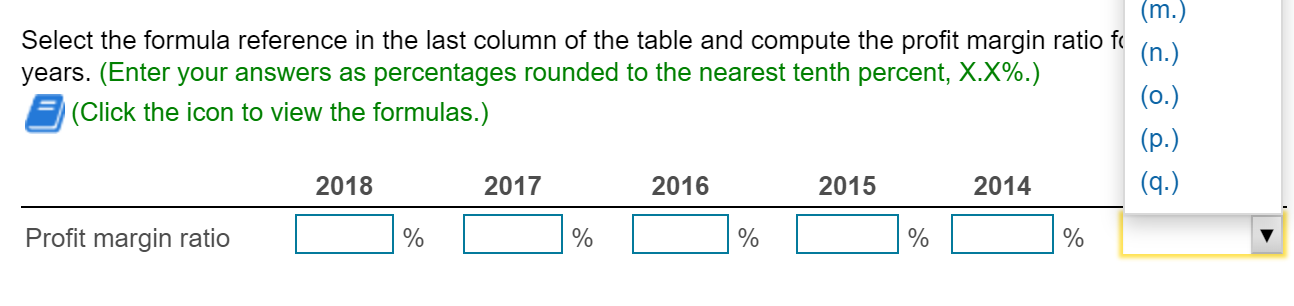

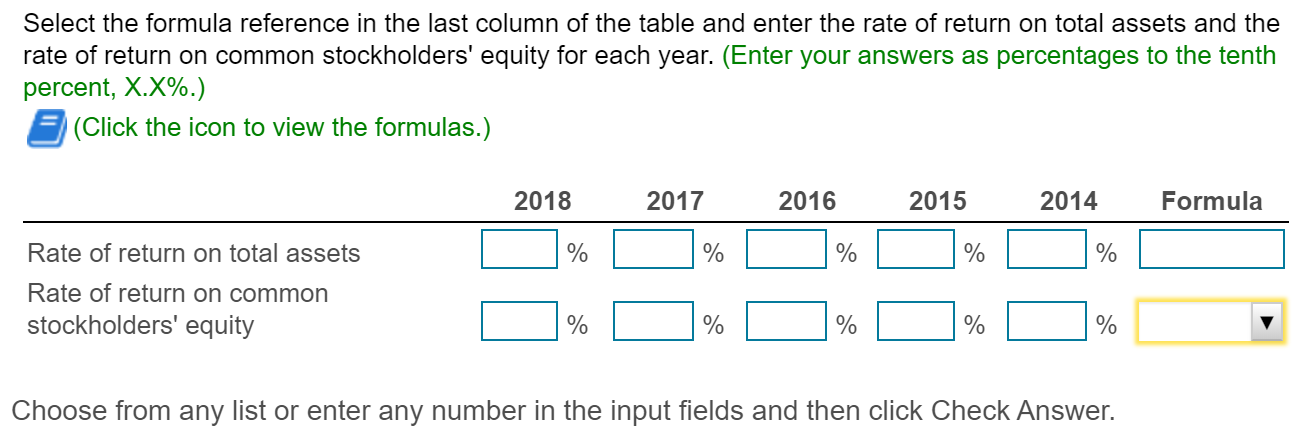

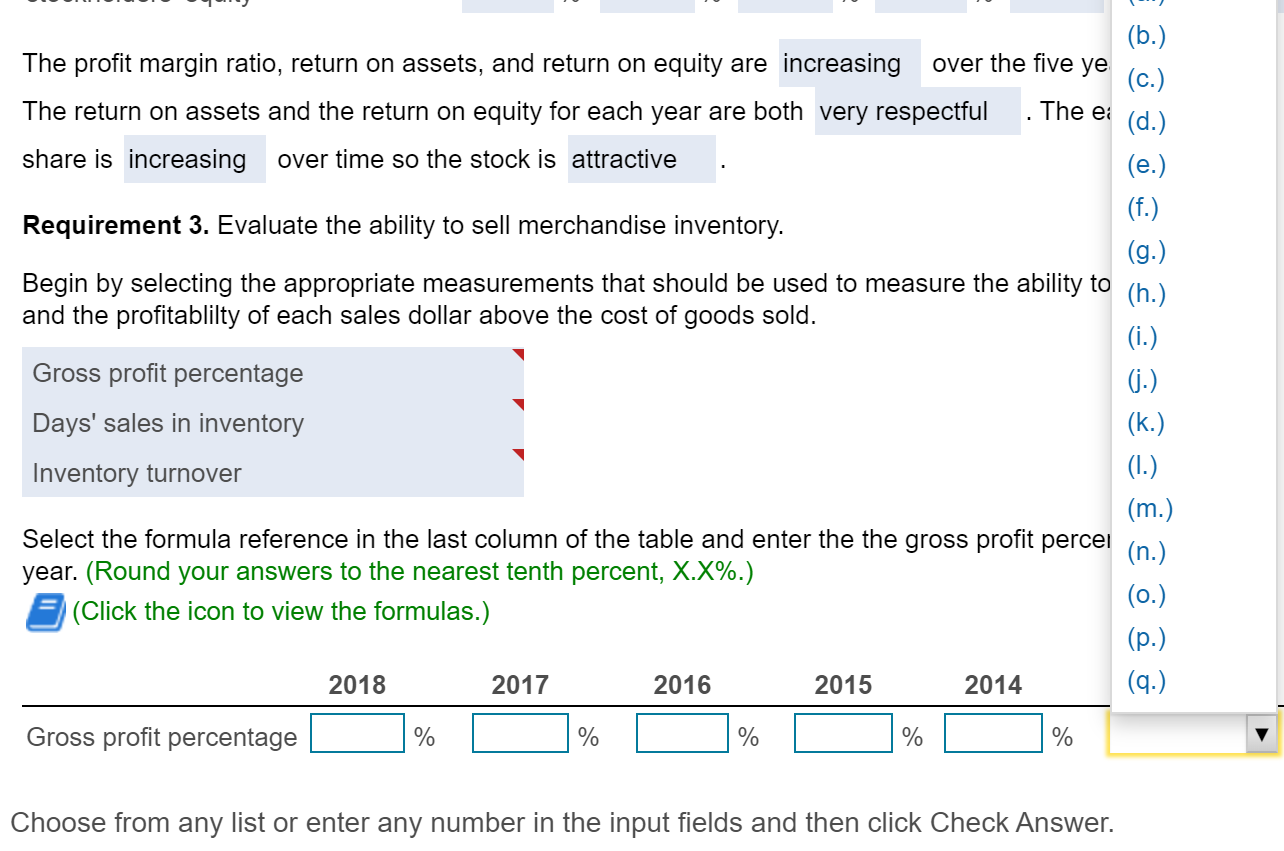

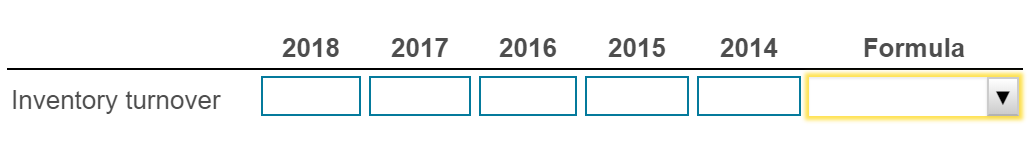

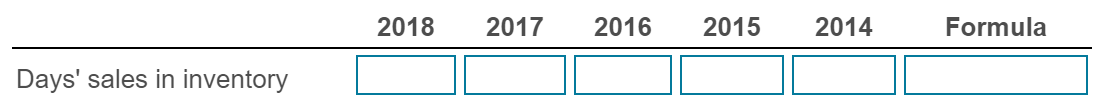

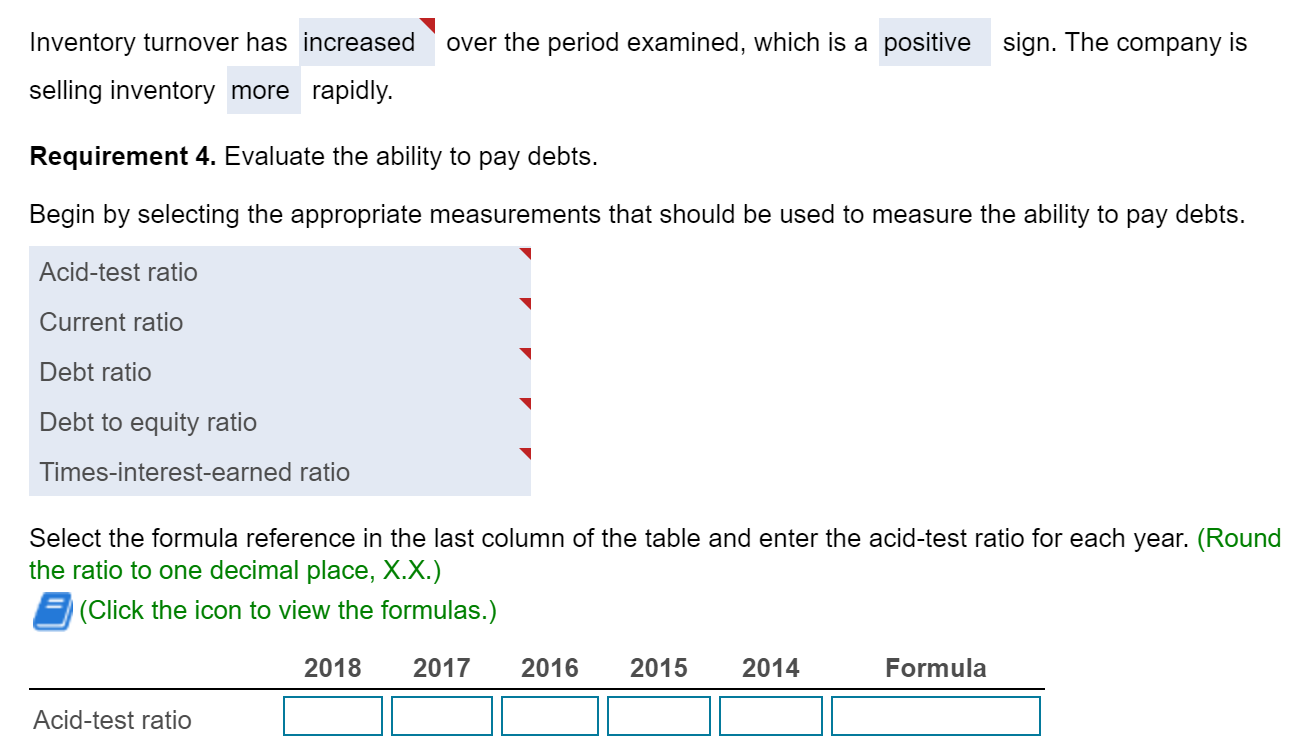

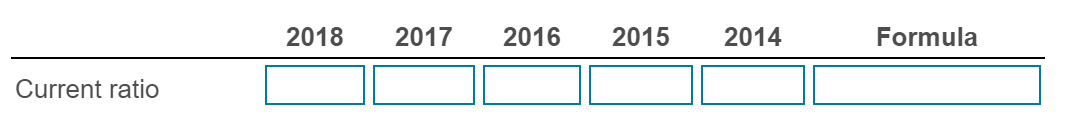

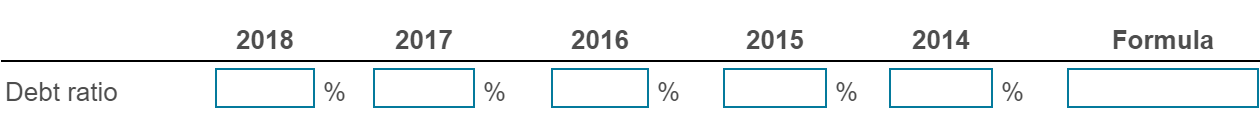

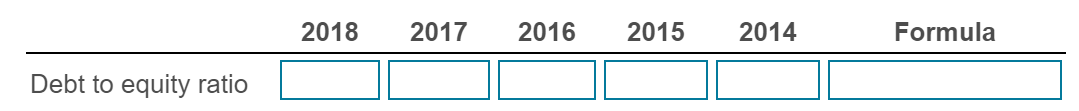

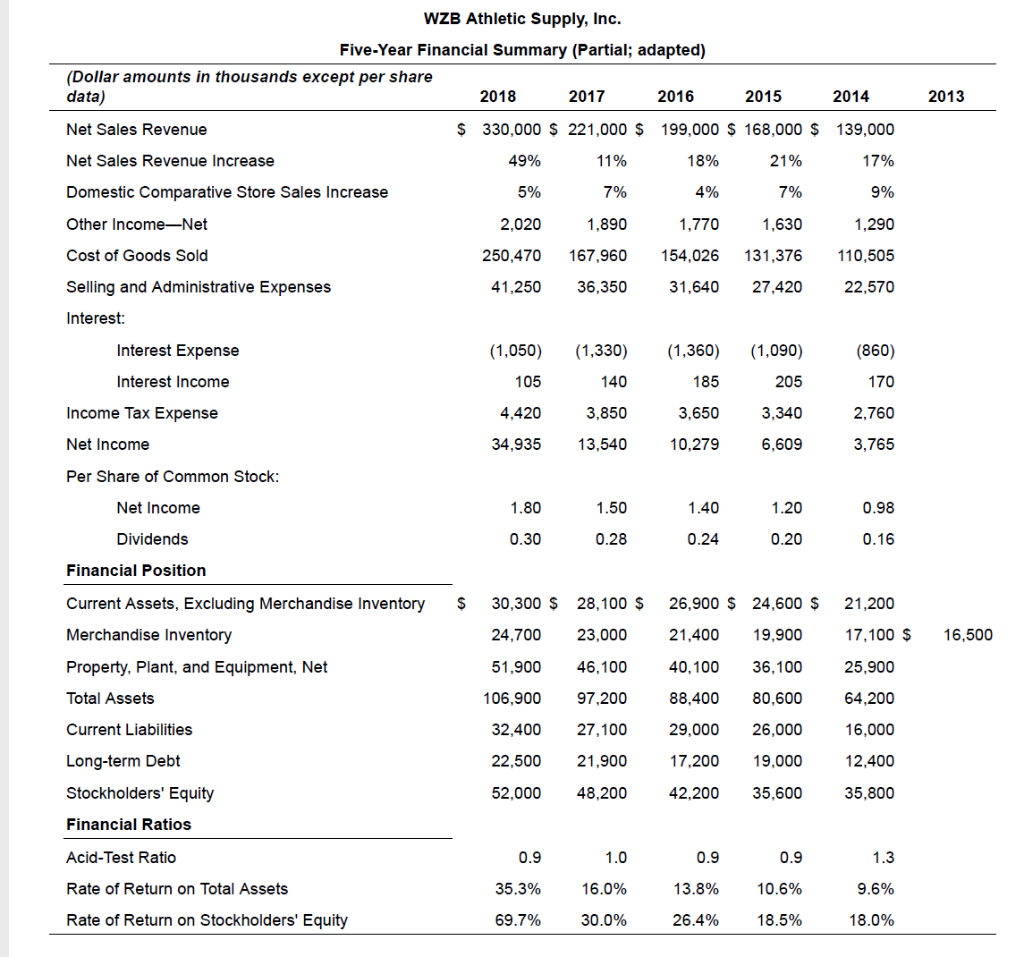

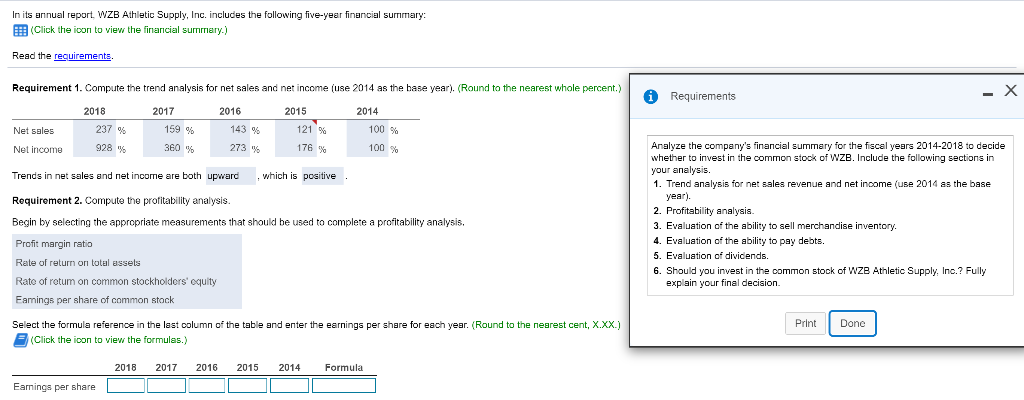

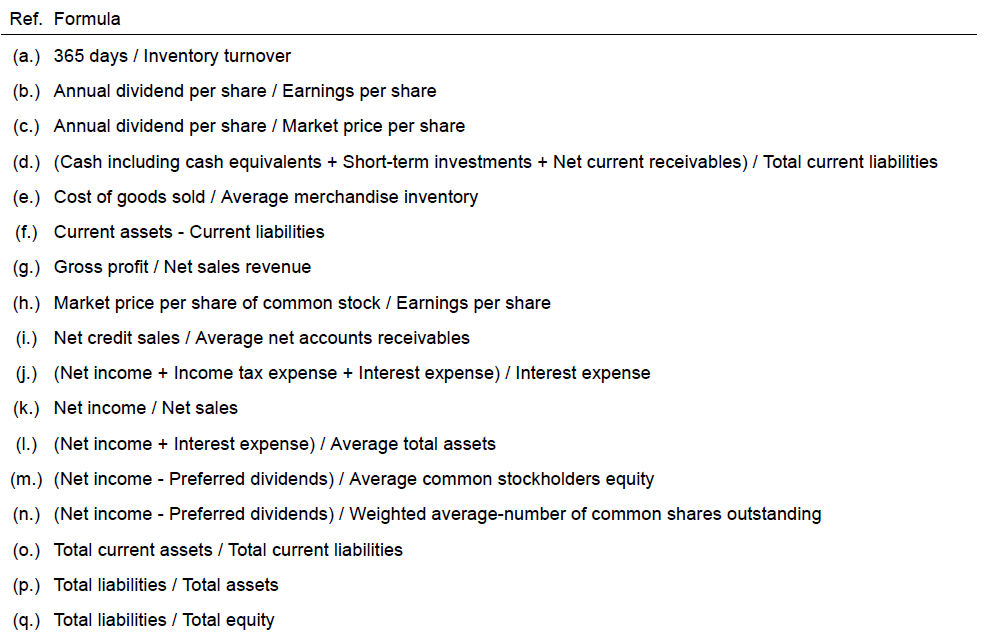

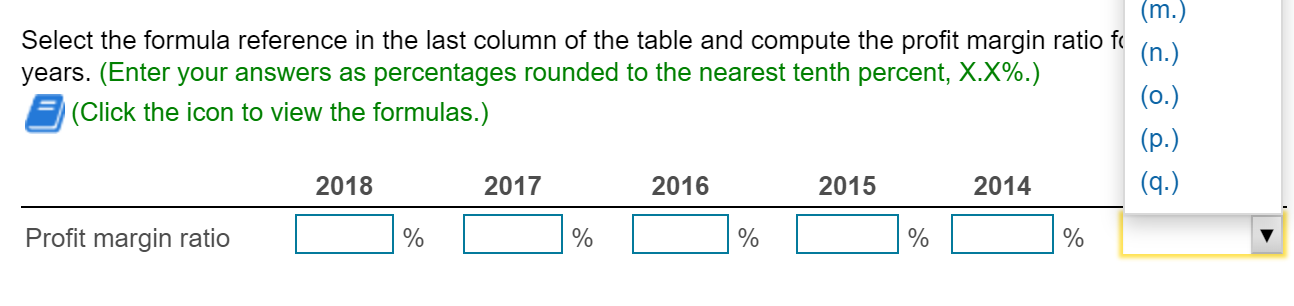

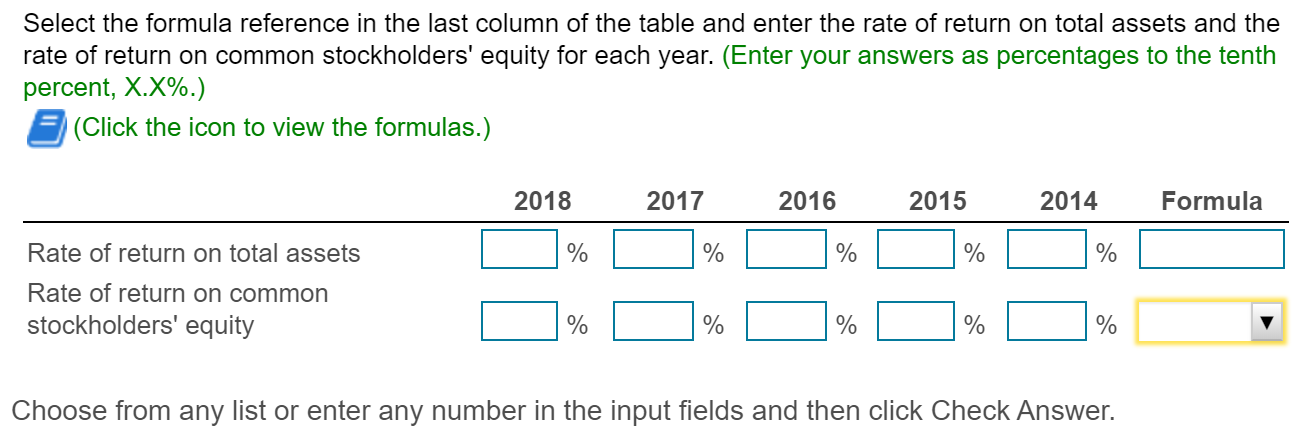

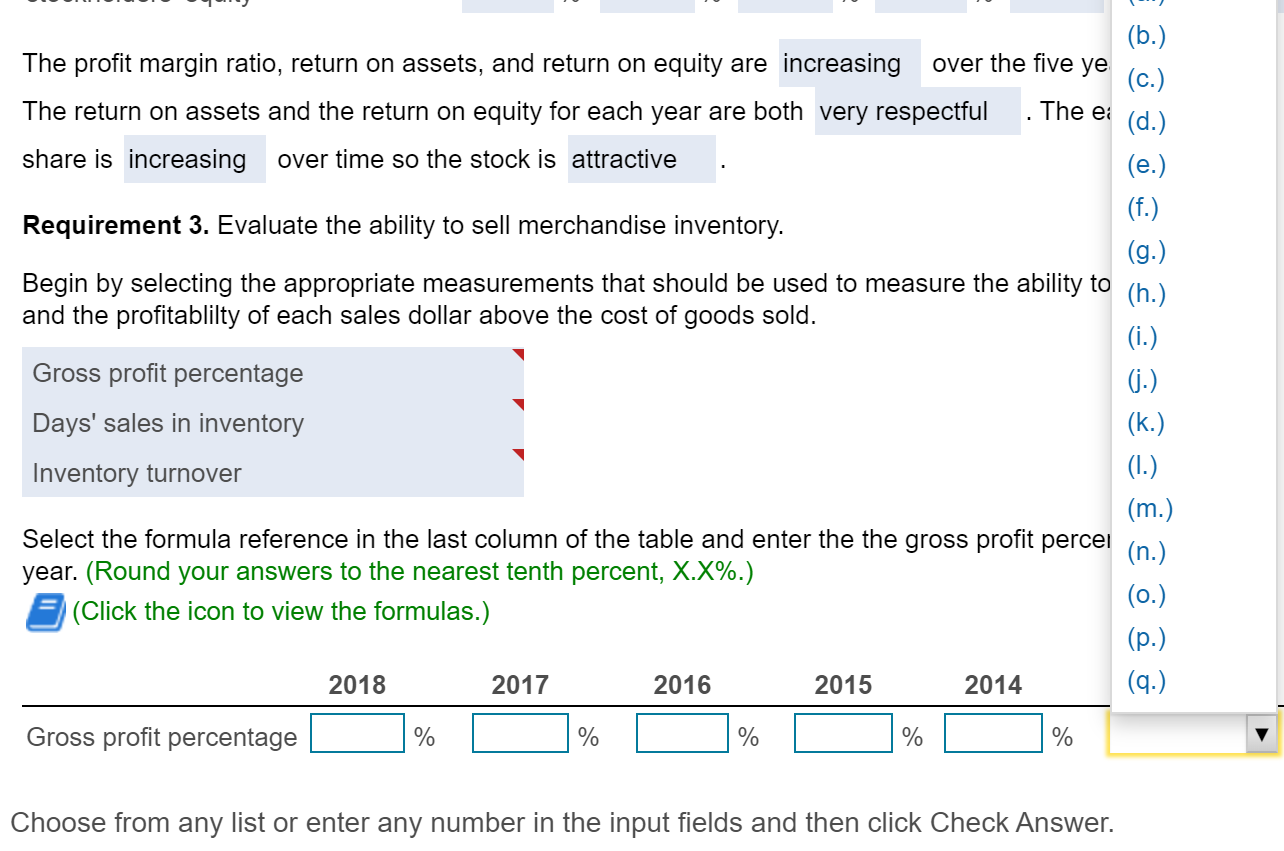

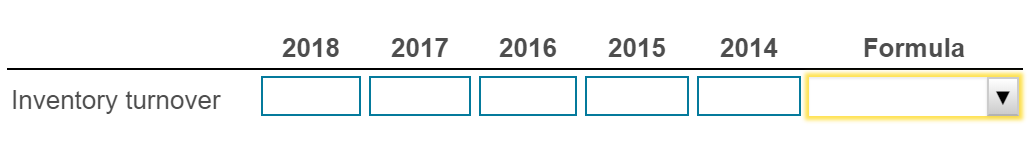

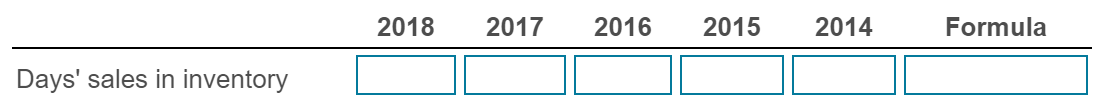

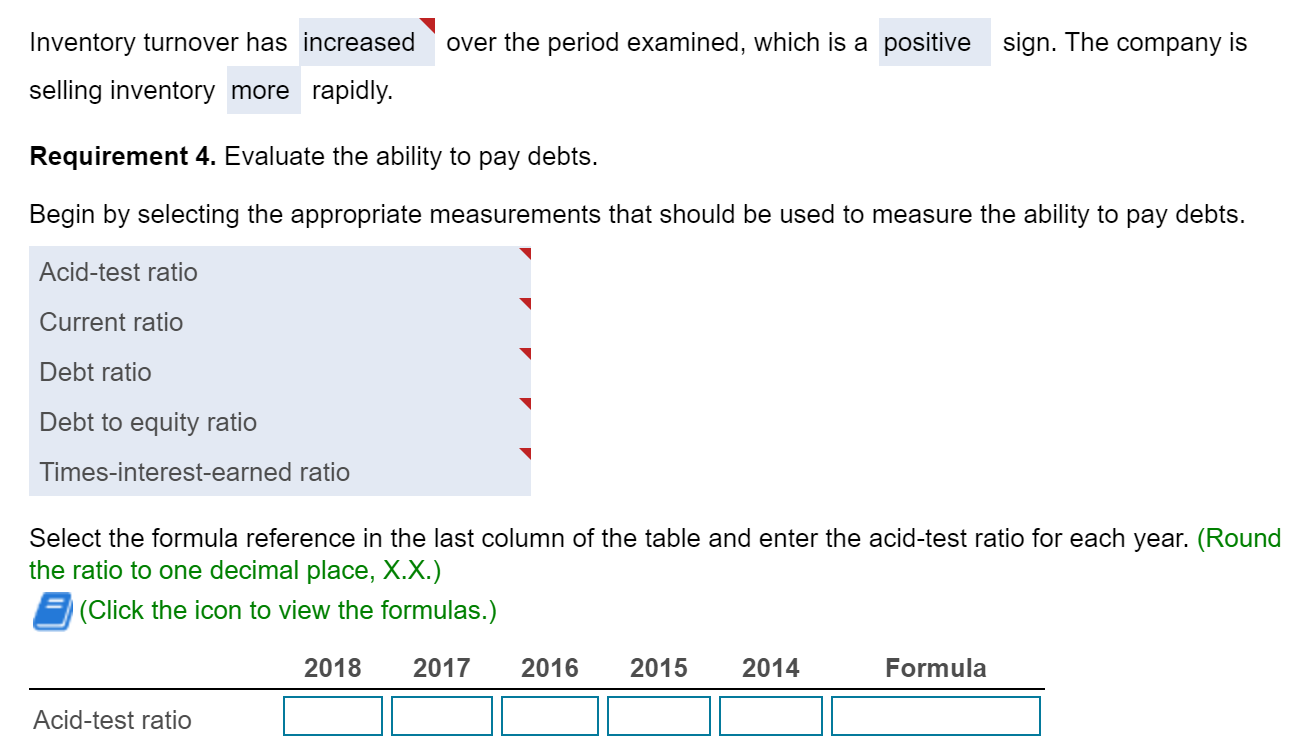

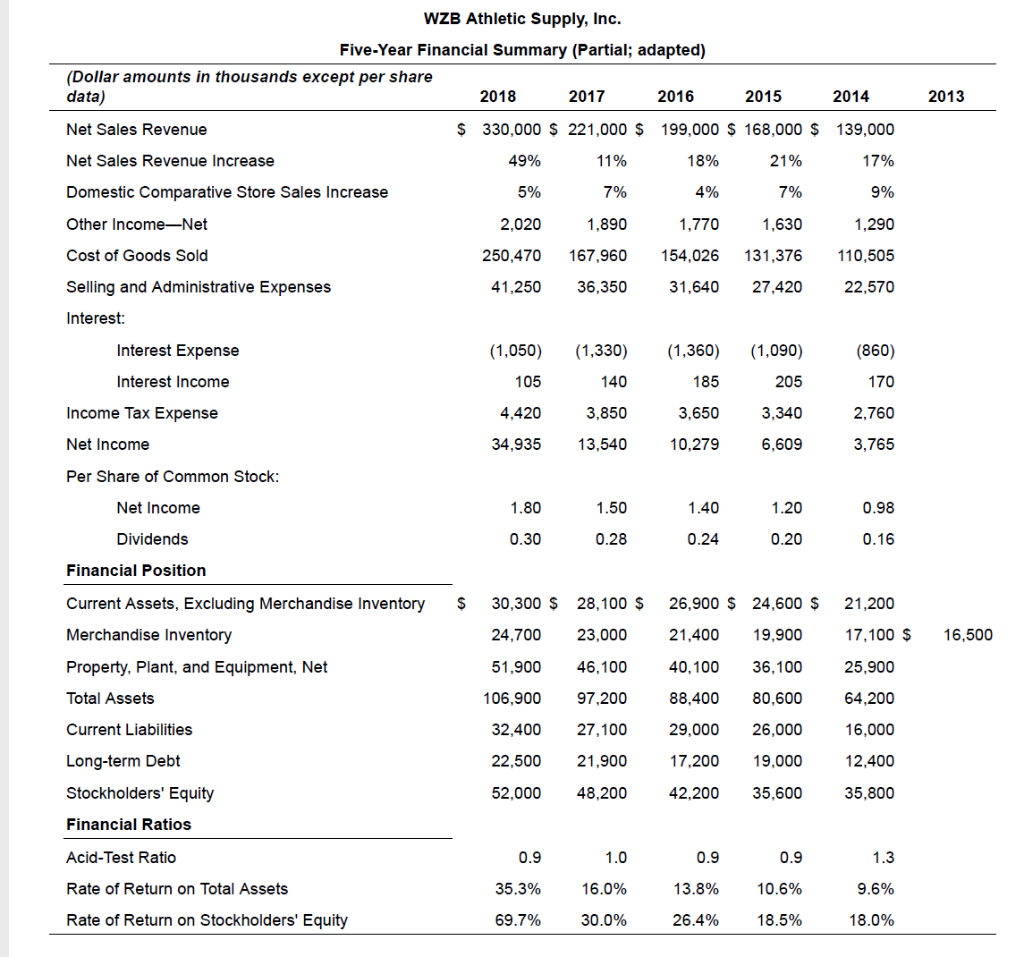

In its annual report WZB Athletic Supply, Inc. includes the following five-year financial surrimary: (Click the icon to view the financial summary) Read the requirements Requirement 1. Compute the trend analysis for net sales and net income (use 2014 as the base year). (Round to the nearest whole percent.) - X Requirements 2018 2017 2015 2014 2016 143 % Net sales 237 % 159 % 121 % 100 % Net income 928 % 380 % 273 % 176 % 100 % Trends in net sales and net income are both upward which is positive. Requirement 2. Compute the profitability analysis. Begin by selecting the appropriate measurements that should be used to complete a profitability analysis. Analyze the company's financial summary for the fiscal years 2014-2018 to decide whether to invest in the common stock of WZB. Include the following sections in your analysis. 1. Trend analysis for net sales revenue and net income (use 2014 as the base year). 2. Profitability analysis. 3. Evaluation of the ability to sell merchandise inventory. 4. Evaluation of the ability to pay debts. 5. Evaluation of dividends. 6. Should you invest in the common stock of WZB Athletic Supply: Inc.? Fully explain your final decision Profit margin ratio Rate of return on total assets Rate of rotum on common stockholders' equity Earnings per share of common stock Print Done Select the formula reference in the last column of the table and enter the earnings per share for each year. (Round to the nearest cent, X.XX.) (Click the icon to view the formulas.) 2018 2017 2016 2015 2014 Formula Earnings per share Ref. Formula (a.) 365 days / Inventory turnover (b.) Annual dividend per share / Earnings per share (c.) Annual dividend per share / Market price per share (d.) (Cash including cash equivalents + Short-term investments + Net current receivables) / Total current liabilities (e.) Cost of goods sold / Average merchandise inventory (f.) Current assets - Current liabilities (g.) Gross profit / Net sales revenue (h.) Market price per share of common stock / Earnings per share (i.) Net credit sales / Average net accounts receivables (j.) (Net income + Income tax expense + Interest expense) / Interest expense (k.) Net income / Net sales (1.) (Net income + Interest expense) / Average total assets (m.) (Net income - Preferred dividends) / Average common stockholders equity (n.) (Net income - Preferred dividends) / Weighted average-number of common shares outstanding (0.) Total current assets / Total current liabilities (p.) Total liabilities / Total assets (9.) Total liabilities / Total equity Select the formula reference in the last column of the table and compute the profit margin ratio fc years. (Enter your answers as percentages rounded to the nearest tenth percent, X.X%.) (Click the icon to view the formulas.) (m.) (n.) (0.) (p.) (q.) 2018 2017 2016 2015 2014 Profit margin ratio % % % % % Select the formula reference in the last column of the table and enter the rate of return on total assets and the rate of return on common stockholders' equity for each year. (Enter your answers as percentages to the tenth percent, X.X%.) (Click the icon to view the formulas.) 2018 2017 2016 2015 2014 Formula Rate of return on total assets % % % % % Rate of return on common stockholders' equity % % % % % Choose from any list or enter any number in the input fields and then click Check Answer. The ei (d.) (b.) The profit margin ratio, return on assets, and return on equity are increasing over the five ye (c.) The return on assets and the return on equity for each year are both very respectful share is increasing over time so the stock is attractive (e.) (f.) Requirement 3. Evaluate the ability to sell merchandise inventory. (g.) Begin by selecting the appropriate measurements that should be used to measure the ability to (h.) and the profitablilty of each sales dollar above the cost of goods sold. (i.) Gross profit percentage (j.) Days' sales in inventory (k.) Inventory turnover (1.) (m.) Select the formula reference in the last column of the table and enter the the gross profit percel (n.) year. (Round your answers to the nearest tenth percent, X.X%.) (0.) (Click the icon to view the formulas.) (p.) 2018 2017 2016 2015 2014 (q.) 1 Gross profit percentage % % % % % Choose from any list or enter any number in the input fields and then click Check Answer. 2018 2017 2016 2015 2014 Formula Inventory turnover 2018 2017 2016 2015 2014 Formula Days' sales in inventory Inventory turnover has increased over the period examined, which is a positive sign. The company is selling inventory more rapidly. Requirement 4. Evaluate the ability to pay debts. Begin by selecting the appropriate measurements that should be used to measure the ability to pay debts. Acid-test ratio Current ratio Debt ratio Debt to equity ratio Times-interest-earned ratio Select the formula reference in the last column of the table and enter the acid-test ratio for each year. (Round the ratio to one decimal place, X.X.) (Click the icon to view the formulas.) 2018 2017 2016 2015 2014 Formula Acid-test ratio 2018 2017 2016 2015 2014 Formula Current ratio 2018 2017 2016 2015 2014 Formula Debt ratio % % % % % 2018 2017 2016 2015 2014 Formula Debt to equity ratio 2018 2017 2016 2015 2014 Formula Times-interest-earned ratio 2018 2017 2016 2015 2014 Formula Dividend payout % % % % % The dividend per share is increasing over time so the stock is attractive Requirement 6. Should you invest in the common stock of WRN Athletic Supply, Inc.? Fully explain your final decision. WRN's trend of net sales, net income, inventory turnover, earnings per share, and times-interest-earned have improved . All other measures have held steady or improved There are no apparent trouble spots in WRN's data. Therefore, invest in WRN for increasing dividends and steady growth. This question is complete. Move your cursor over or tap on the red arrows to see incorrect answers. data) 2013 WZB Athletic Supply, Inc. Five-Year Financial Summary (Partial; adapted) (Dollar amounts in thousands except per share 2018 2017 2016 2015 2014 Net Sales Revenue $ 330,000 $ 221,000 $ 199,000 $ 168,000 $ 139,000 Net Sales Revenue Increase 49% 11% 18% 21% 17% Domestic Comparative Store Sales Increase 5% 7% 4% 7% 9% Other Income-Net 2,020 1,890 1,770 1,630 1,290 Cost of Goods Sold 250,470 167,960 154,026 131,376 110,505 Selling and Administrative Expenses 41.250 36,350 31,640 27,420 22,570 Interest: Interest Expense (1,050) (1,330) (1,360) (860) (1,090) 205 Interest Income 105 140 185 170 Income Tax Expense 4,420 3,850 3,650 3,340 2,760 Net Income 34,935 13,540 10,279 6,609 3,765 Per Share of Common Stock: Net Income 1.80 1.50 1.40 1.20 0.98 Dividends 0.30 0.28 0.24 0.20 0.16 Financial Position $ 30,300 $ 28,100 $ 26,900 $ 24,600 $ 21,200 Current Assets, Excluding Merchandise Inventory Merchandise Inventory Property, Plant, and Equipment, Net 24,700 23,000 21,400 19,900 17,100 $ 16,500 51,900 46.100 40,100 36,100 25,900 Total Assets 106,900 97,200 88,400 80,600 64,200 Current Liabilities 32,400 27,100 29,000 26,000 16,000 Long-term Debt 22.500 21,900 17,200 19,000 12,400 Stockholders' Equity 52.000 48,200 42,200 35,600 35,800 Financial Ratios Acid-Test Ratio 0.9 1.0 0.9 0.9 1.3 Rate of Return on Total Assets 35.3% 16.0% 13.8% 10.6% 9.6% Rate of Return on Stockholders' Equity 69.7% 30.0% 26.4% 18.5% 18.0% In its annual report WZB Athletic Supply, Inc. includes the following five-year financial surrimary: (Click the icon to view the financial summary) Read the requirements Requirement 1. Compute the trend analysis for net sales and net income (use 2014 as the base year). (Round to the nearest whole percent.) - X Requirements 2018 2017 2015 2014 2016 143 % Net sales 237 % 159 % 121 % 100 % Net income 928 % 380 % 273 % 176 % 100 % Trends in net sales and net income are both upward which is positive. Requirement 2. Compute the profitability analysis. Begin by selecting the appropriate measurements that should be used to complete a profitability analysis. Analyze the company's financial summary for the fiscal years 2014-2018 to decide whether to invest in the common stock of WZB. Include the following sections in your analysis. 1. Trend analysis for net sales revenue and net income (use 2014 as the base year). 2. Profitability analysis. 3. Evaluation of the ability to sell merchandise inventory. 4. Evaluation of the ability to pay debts. 5. Evaluation of dividends. 6. Should you invest in the common stock of WZB Athletic Supply: Inc.? Fully explain your final decision Profit margin ratio Rate of return on total assets Rate of rotum on common stockholders' equity Earnings per share of common stock Print Done Select the formula reference in the last column of the table and enter the earnings per share for each year. (Round to the nearest cent, X.XX.) (Click the icon to view the formulas.) 2018 2017 2016 2015 2014 Formula Earnings per share Ref. Formula (a.) 365 days / Inventory turnover (b.) Annual dividend per share / Earnings per share (c.) Annual dividend per share / Market price per share (d.) (Cash including cash equivalents + Short-term investments + Net current receivables) / Total current liabilities (e.) Cost of goods sold / Average merchandise inventory (f.) Current assets - Current liabilities (g.) Gross profit / Net sales revenue (h.) Market price per share of common stock / Earnings per share (i.) Net credit sales / Average net accounts receivables (j.) (Net income + Income tax expense + Interest expense) / Interest expense (k.) Net income / Net sales (1.) (Net income + Interest expense) / Average total assets (m.) (Net income - Preferred dividends) / Average common stockholders equity (n.) (Net income - Preferred dividends) / Weighted average-number of common shares outstanding (0.) Total current assets / Total current liabilities (p.) Total liabilities / Total assets (9.) Total liabilities / Total equity Select the formula reference in the last column of the table and compute the profit margin ratio fc years. (Enter your answers as percentages rounded to the nearest tenth percent, X.X%.) (Click the icon to view the formulas.) (m.) (n.) (0.) (p.) (q.) 2018 2017 2016 2015 2014 Profit margin ratio % % % % % Select the formula reference in the last column of the table and enter the rate of return on total assets and the rate of return on common stockholders' equity for each year. (Enter your answers as percentages to the tenth percent, X.X%.) (Click the icon to view the formulas.) 2018 2017 2016 2015 2014 Formula Rate of return on total assets % % % % % Rate of return on common stockholders' equity % % % % % Choose from any list or enter any number in the input fields and then click Check Answer. The ei (d.) (b.) The profit margin ratio, return on assets, and return on equity are increasing over the five ye (c.) The return on assets and the return on equity for each year are both very respectful share is increasing over time so the stock is attractive (e.) (f.) Requirement 3. Evaluate the ability to sell merchandise inventory. (g.) Begin by selecting the appropriate measurements that should be used to measure the ability to (h.) and the profitablilty of each sales dollar above the cost of goods sold. (i.) Gross profit percentage (j.) Days' sales in inventory (k.) Inventory turnover (1.) (m.) Select the formula reference in the last column of the table and enter the the gross profit percel (n.) year. (Round your answers to the nearest tenth percent, X.X%.) (0.) (Click the icon to view the formulas.) (p.) 2018 2017 2016 2015 2014 (q.) 1 Gross profit percentage % % % % % Choose from any list or enter any number in the input fields and then click Check Answer. 2018 2017 2016 2015 2014 Formula Inventory turnover 2018 2017 2016 2015 2014 Formula Days' sales in inventory Inventory turnover has increased over the period examined, which is a positive sign. The company is selling inventory more rapidly. Requirement 4. Evaluate the ability to pay debts. Begin by selecting the appropriate measurements that should be used to measure the ability to pay debts. Acid-test ratio Current ratio Debt ratio Debt to equity ratio Times-interest-earned ratio Select the formula reference in the last column of the table and enter the acid-test ratio for each year. (Round the ratio to one decimal place, X.X.) (Click the icon to view the formulas.) 2018 2017 2016 2015 2014 Formula Acid-test ratio 2018 2017 2016 2015 2014 Formula Current ratio 2018 2017 2016 2015 2014 Formula Debt ratio % % % % % 2018 2017 2016 2015 2014 Formula Debt to equity ratio 2018 2017 2016 2015 2014 Formula Times-interest-earned ratio 2018 2017 2016 2015 2014 Formula Dividend payout % % % % % The dividend per share is increasing over time so the stock is attractive Requirement 6. Should you invest in the common stock of WRN Athletic Supply, Inc.? Fully explain your final decision. WRN's trend of net sales, net income, inventory turnover, earnings per share, and times-interest-earned have improved . All other measures have held steady or improved There are no apparent trouble spots in WRN's data. Therefore, invest in WRN for increasing dividends and steady growth. This question is complete. Move your cursor over or tap on the red arrows to see incorrect answers. data) 2013 WZB Athletic Supply, Inc. Five-Year Financial Summary (Partial; adapted) (Dollar amounts in thousands except per share 2018 2017 2016 2015 2014 Net Sales Revenue $ 330,000 $ 221,000 $ 199,000 $ 168,000 $ 139,000 Net Sales Revenue Increase 49% 11% 18% 21% 17% Domestic Comparative Store Sales Increase 5% 7% 4% 7% 9% Other Income-Net 2,020 1,890 1,770 1,630 1,290 Cost of Goods Sold 250,470 167,960 154,026 131,376 110,505 Selling and Administrative Expenses 41.250 36,350 31,640 27,420 22,570 Interest: Interest Expense (1,050) (1,330) (1,360) (860) (1,090) 205 Interest Income 105 140 185 170 Income Tax Expense 4,420 3,850 3,650 3,340 2,760 Net Income 34,935 13,540 10,279 6,609 3,765 Per Share of Common Stock: Net Income 1.80 1.50 1.40 1.20 0.98 Dividends 0.30 0.28 0.24 0.20 0.16 Financial Position $ 30,300 $ 28,100 $ 26,900 $ 24,600 $ 21,200 Current Assets, Excluding Merchandise Inventory Merchandise Inventory Property, Plant, and Equipment, Net 24,700 23,000 21,400 19,900 17,100 $ 16,500 51,900 46.100 40,100 36,100 25,900 Total Assets 106,900 97,200 88,400 80,600 64,200 Current Liabilities 32,400 27,100 29,000 26,000 16,000 Long-term Debt 22.500 21,900 17,200 19,000 12,400 Stockholders' Equity 52.000 48,200 42,200 35,600 35,800 Financial Ratios Acid-Test Ratio 0.9 1.0 0.9 0.9 1.3 Rate of Return on Total Assets 35.3% 16.0% 13.8% 10.6% 9.6% Rate of Return on Stockholders' Equity 69.7% 30.0% 26.4% 18.5% 18.0%

All of the fill in the sentence blank segments are answered. There's no need to repeat what has already been answered.

All of the fill in the sentence blank segments are answered. There's no need to repeat what has already been answered.