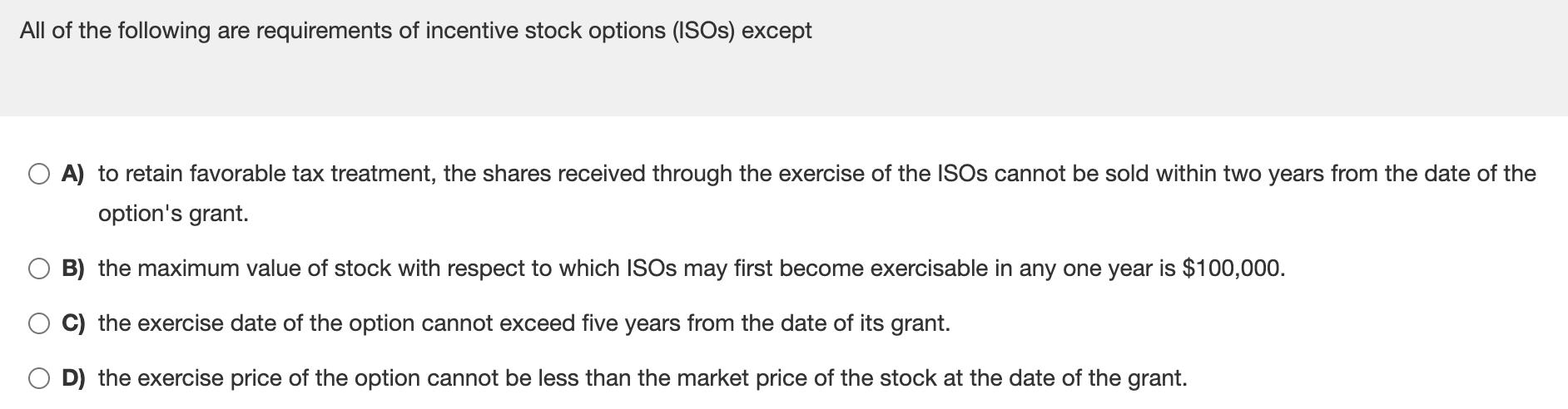

All of the following are requirements of incentive stock options (ISOs) except A) to retain favorable tax treatment, the shares received through the exercise

All of the following are requirements of incentive stock options (ISOs) except A) to retain favorable tax treatment, the shares received through the exercise of the ISOs cannot be sold within two years from the date of the option's grant. OB) the maximum value of stock with respect to which ISOs may first become exercisable in any one year is $100,000. C) the exercise date of the option cannot exceed five years from the date of its grant. D) the exercise price of the option cannot be less than the market price of the stock at the date of the grant.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below You are correct that option B the max...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started