Question

All of the following are self-employed taxpayers EXCEPT: Markus, an independent consultant who performs services for a manufacturing firm in exchange for a fee.

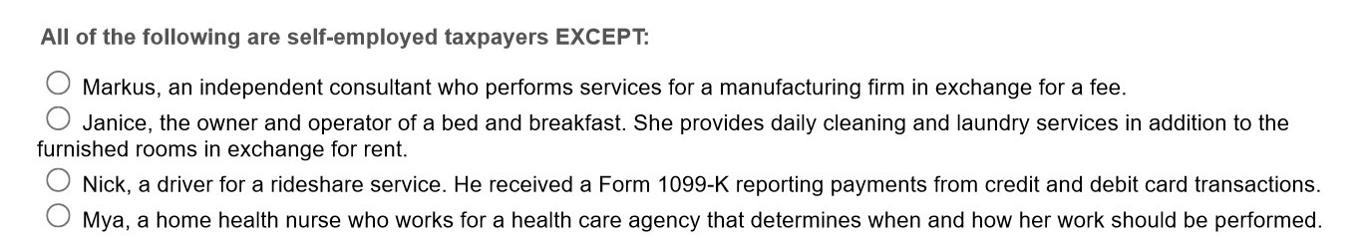

All of the following are self-employed taxpayers EXCEPT: Markus, an independent consultant who performs services for a manufacturing firm in exchange for a fee. Janice, the owner and operator of a bed and breakfast. She provides daily cleaning and laundry services in addition to the furnished rooms in exchange for rent. Nick, a driver for a rideshare service. He received a Form 1099-K reporting payments from credit and debit card transactions. Mya, a home health nurse who works for a health care agency that determines when and how her work should be performed.

Step by Step Solution

3.35 Rating (170 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below The c...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Principles of Auditing and Other Assurance Services

Authors: Ray Whittington, Kurt Pany

19th edition

978-0077804770, 78025613, 77804775, 978-0078025617

Students also viewed these Law questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App