all of the information to answer the questions are in the top two pictures, i need help with the last page. The three pictures posted is the assignment in it's entirety. There is no other info.

th

th

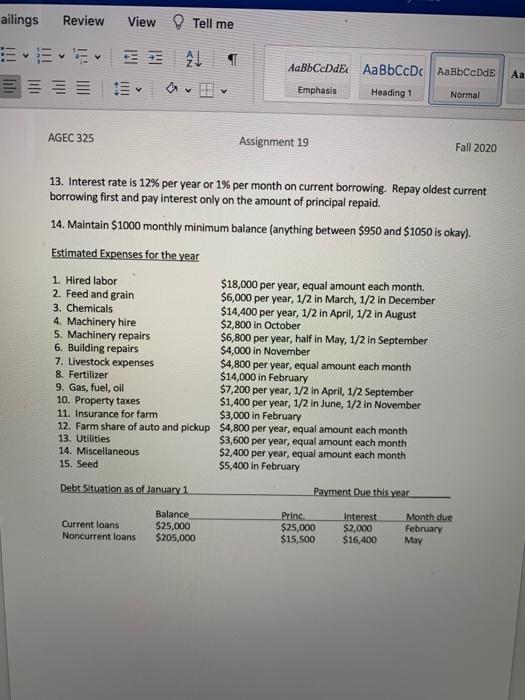

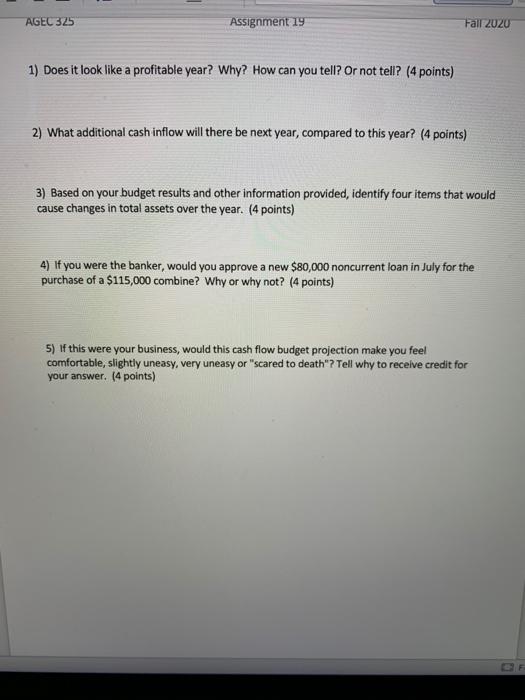

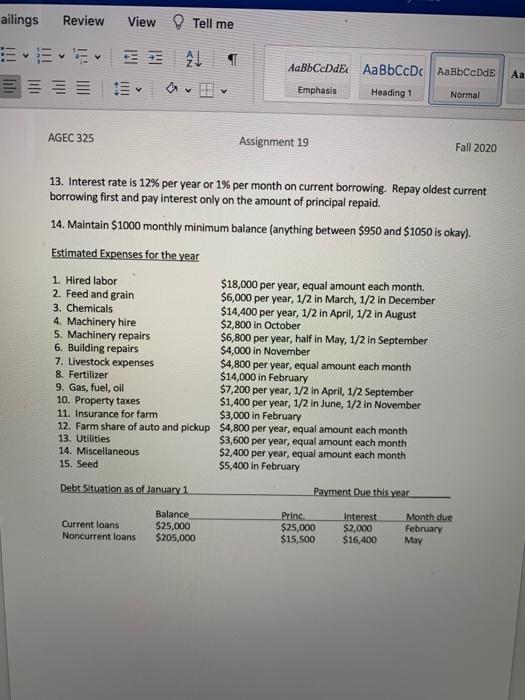

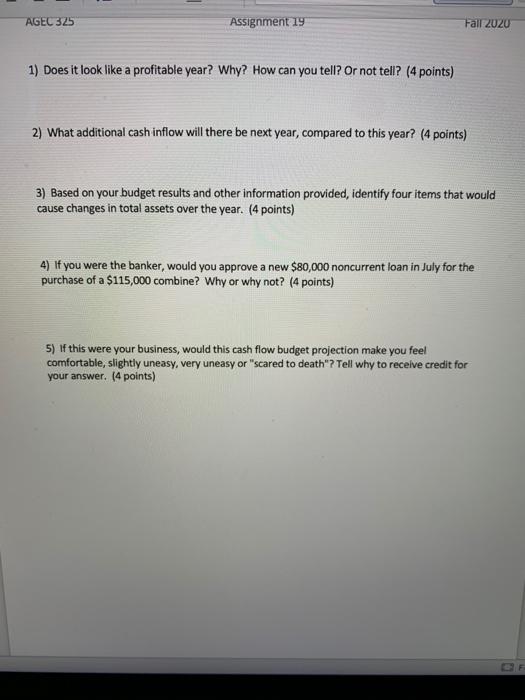

ARBE Emphasis Heading 1 Normal Str This problem involves working out a cash flow budget for next year. The following information should be all that is needed to complete this problem. The information is in no particular order so carefully check to be sure you have used it all before finishing the problem. Round everything to the nearest whole dollar. Complete a cash flow budget on the form provided. Beginning inventory (January 1): Wheat, 8,500 bu to sell in January Beef cows, 140 head Prices to use: Beef calves - 70 cents per pound Yields: 90% calf crop Wheat -$3.40 per bushel 32 bu, per acre Cotton - 72 cents per pound 575 lbs. per acre Additional Information 1. Sells all calves in August at average weight of 450 lbs. (Assume no replacements kept.) 2. Will raise 300 acres of cotton and 450 acres of wheat in 2008. 3. Plans to trade for a new pickup in March, paying $18,500 cash difference. There will be a new intermediate term loan of $14,000 to help pay for it. 4. The new intermediate loan on the pickup will have a semi-annual payment due in August of $2,300 for principal and $750 for interest. 5. Will sell a bull in April for $800 and buy a replacement in May for $2,000. 6. Income and Social Security tax of $15,200 due in March. 7. Family living expenses of $3,000 per month 8. Personal life insurance premium of $2,000 due in April. 9. Cash on hand January 1, $12,000. 10. Assume all cotton is sold at harvest in October and all wheat produced is stored for sale in the following year 11. Spouse's non-farm job nets $1,500 per month after all deductions 12. All new borrowing needed will be "current" borrowing except as indicated in #3 above. To simplify calculations, borrow and repay loans in even $100 units. Focu ailings Review View Tell me 21 AaBbCcDdEk AaBbCcDc AaBbccde Emphasis Heading 1 Normal AGEC 325 Assignment 19 Fall 2020 13. Interest rate is 12% per year or 1% per month on current borrowing. Repay oldest current borrowing first and pay interest only on the amount of principal repaid. 14. Maintain $1000 monthly minimum balance (anything between $950 and $1050 is okay). Estimated Expenses for the year 1. Hired labor $18,000 per year, equal amount each month. 2. Feed and grain $6,000 per year, 1/2 in March, 1/2 in December 3. Chemicals $14,400 per year, 1/2 in April, 1/2 in August 4. Machinery hire $2,800 in October 5. Machinery repairs $6,800 per year, half in May, 1/2 in September 6. Building repairs $4,000 in November 7. Livestock expenses $4,800 per year, equal amount each month 8. Fertilizer $14,000 in February 9. Gas, fuel, oil $7,200 per year, 1/2 in April, 1/2 September 10. Property taxes $1,400 per year, 1/2 in June, 1/2 in November 11. Insurance for farm $3,000 in February 12. Farm share of auto and pickup $4,800 per year, equal amount each month 13. Utilities $3,600 per year, equal amount each month 14. Miscellaneous $2,400 per year, equal amount each month 15. Seed $5,400 in February Debt Situation as of January 1 Payment Due this year Balance Princ Interest Month due Current loans $25,000 $25,000 $2,000 February Noncurrent loans $205,000 $15,500 $16,400 May AGEC 325 Assignment 19 Fall 2020 1) Does it look like a profitable year? Why? How can you tell? Or not tell? (4 points) 2) What additional cash inflow will there be next year, compared to this year? (4 points) 3) Based on your budget results and other information provided, identify four items that would cause changes in total assets over the year. (4 points) 4) If you were the banker, would you approve a new $80,000 noncurrent loan in July for the purchase of a $115,000 combine? Why or why not? (4 points) 5) If this were your business, would this cash flow budget projection make you feel comfortable, slightly uneasy, very uneasy or "scared to death"? Tell why to receive credit for your answer. (4 points) ARBE Emphasis Heading 1 Normal Str This problem involves working out a cash flow budget for next year. The following information should be all that is needed to complete this problem. The information is in no particular order so carefully check to be sure you have used it all before finishing the problem. Round everything to the nearest whole dollar. Complete a cash flow budget on the form provided. Beginning inventory (January 1): Wheat, 8,500 bu to sell in January Beef cows, 140 head Prices to use: Beef calves - 70 cents per pound Yields: 90% calf crop Wheat -$3.40 per bushel 32 bu, per acre Cotton - 72 cents per pound 575 lbs. per acre Additional Information 1. Sells all calves in August at average weight of 450 lbs. (Assume no replacements kept.) 2. Will raise 300 acres of cotton and 450 acres of wheat in 2008. 3. Plans to trade for a new pickup in March, paying $18,500 cash difference. There will be a new intermediate term loan of $14,000 to help pay for it. 4. The new intermediate loan on the pickup will have a semi-annual payment due in August of $2,300 for principal and $750 for interest. 5. Will sell a bull in April for $800 and buy a replacement in May for $2,000. 6. Income and Social Security tax of $15,200 due in March. 7. Family living expenses of $3,000 per month 8. Personal life insurance premium of $2,000 due in April. 9. Cash on hand January 1, $12,000. 10. Assume all cotton is sold at harvest in October and all wheat produced is stored for sale in the following year 11. Spouse's non-farm job nets $1,500 per month after all deductions 12. All new borrowing needed will be "current" borrowing except as indicated in #3 above. To simplify calculations, borrow and repay loans in even $100 units. Focu ailings Review View Tell me 21 AaBbCcDdEk AaBbCcDc AaBbccde Emphasis Heading 1 Normal AGEC 325 Assignment 19 Fall 2020 13. Interest rate is 12% per year or 1% per month on current borrowing. Repay oldest current borrowing first and pay interest only on the amount of principal repaid. 14. Maintain $1000 monthly minimum balance (anything between $950 and $1050 is okay). Estimated Expenses for the year 1. Hired labor $18,000 per year, equal amount each month. 2. Feed and grain $6,000 per year, 1/2 in March, 1/2 in December 3. Chemicals $14,400 per year, 1/2 in April, 1/2 in August 4. Machinery hire $2,800 in October 5. Machinery repairs $6,800 per year, half in May, 1/2 in September 6. Building repairs $4,000 in November 7. Livestock expenses $4,800 per year, equal amount each month 8. Fertilizer $14,000 in February 9. Gas, fuel, oil $7,200 per year, 1/2 in April, 1/2 September 10. Property taxes $1,400 per year, 1/2 in June, 1/2 in November 11. Insurance for farm $3,000 in February 12. Farm share of auto and pickup $4,800 per year, equal amount each month 13. Utilities $3,600 per year, equal amount each month 14. Miscellaneous $2,400 per year, equal amount each month 15. Seed $5,400 in February Debt Situation as of January 1 Payment Due this year Balance Princ Interest Month due Current loans $25,000 $25,000 $2,000 February Noncurrent loans $205,000 $15,500 $16,400 May AGEC 325 Assignment 19 Fall 2020 1) Does it look like a profitable year? Why? How can you tell? Or not tell? (4 points) 2) What additional cash inflow will there be next year, compared to this year? (4 points) 3) Based on your budget results and other information provided, identify four items that would cause changes in total assets over the year. (4 points) 4) If you were the banker, would you approve a new $80,000 noncurrent loan in July for the purchase of a $115,000 combine? Why or why not? (4 points) 5) If this were your business, would this cash flow budget projection make you feel comfortable, slightly uneasy, very uneasy or "scared to death"? Tell why to receive credit for your answer. (4 points)

th

th