Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ALL OF THEM is no penalty for wrong answers. Clack L a Manitoba company recorded $175,000 sales revenue and purchased $90.000 merchandise inventory during August.

ALL OF THEM

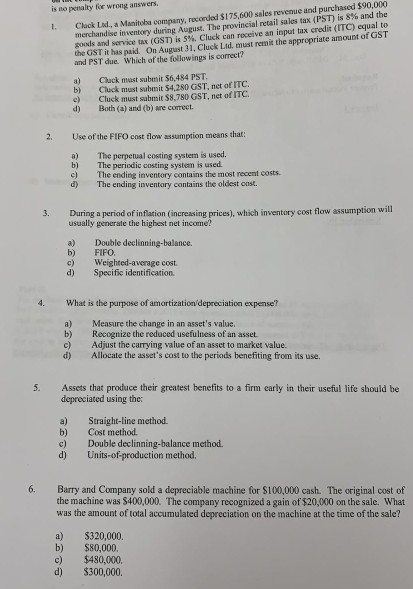

is no penalty for wrong answers. Clack L a Manitoba company recorded $175,000 sales revenue and purchased $90.000 merchandise inventory during August. The provincial retail sales tax (PST) is 8% and the goods and service tax (GST) is 5%. Cluck can receive an input tax credit (ITC) equal to the GST it has paid. On August 31, Cluck Lid must remit the appropriate amount of GST and PST due. Which of the followings is correct? Clack must submit $6,484 PST. Cluck must submit $4.280 GST, net of ITC. Cluck must submit $8,780 GST, net of ITC. Both (a) and (b) are corect. d) Use of the FIFO cost flow assumption means that: a) b) c) d) The perpetual costing system is used. The periodic costing system is used The ending inventory contains the most recent costs. The ending inventory contains the oldest cast. During a period of inflation (increasing prices), which inventory cost flow assumption will usually generate the highest net income? b) c) d) Double declinning-balance. FIFO. Weighted average cost. Specific identification What is the purpose of amortization/depreciation expense? a) b) c) Mensure the change in an asset's value. Recognize the reduced usefulness of an asset. Adjust the carrying value of an asset to market value. Allocate the asset's cast to the periods benefiting from its use. d) Assets that produce their greatest benefits to a firm early in their useful life should be depreciated using the: a) b) c) d) Straight-line method. Cost method. Double declinning-balance method. Units-of-production method. Barry and Company sold a depreciable machine for $100,000 cash. The original cost of the machine was $400,000. The company recognized a gain of $20,000 on the sale. What was the amount of total accumulated depreciation on the machine at the time of the sale? a) b) c) d) $320,000 $80,000 $480,000 $300,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started