Answered step by step

Verified Expert Solution

Question

1 Approved Answer

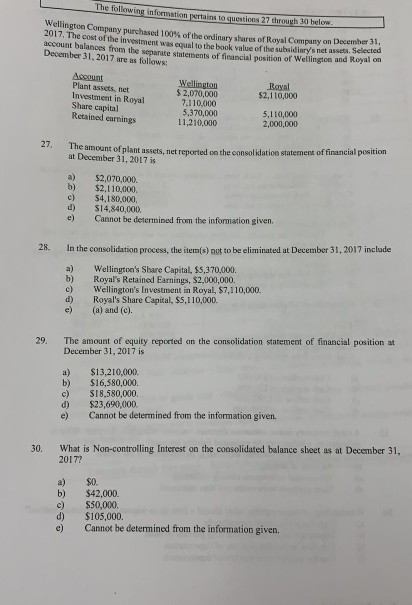

ALL OF THEM The following information strains la questions 27 through 30 below. Wellington Company purchased 100% of the ordinary shares of Royal Company on

ALL OF THEM

The following information strains la questions 27 through 30 below. Wellington Company purchased 100% of the ordinary shares of Royal Company on December 31 2017. The cost of the investment was goal to the book value of the subsidiary's net assets Seledica account balances from the separate statements of financial position of Wellington and Royal December 31, 2017 are as follows: Account Plant assets, bet Investment in Royal Share capital Retained earnings Royal $2,110,000 Wellington $2.070.000 7.110.000 5,370,000 11,210.000 5,110,000 2,000,000 27. The amount of plant assets, nct reported on the consolidation statement of financial position at December 31, 2017 is b) c) d) e) $2,070,000. $2.110,000 $4,180.000 $14,840,000 Cannot be determined from the information given. 28. In the consolidation process, the item(s) pot to be eliminated at December 31, 2017 include a) b) c) d) e) Wellington's Share Capital, $5,370,000. Royal's Retained Earnings, $2,000,000. Wellington's Investment in Royal, $7,110,000 Royal's Share Capital, $5,110,000 (a) and (c). 29. The amount of equity reported on the consolidation statement of financial position at December 31, 2017 is a) b) c) d) e) $13.210,000. $16.580.000 $18.580.000 $23,690,000 Cannot be determined from the information given. 30. What is Non-controlling Interest on the consolidated balance sheet as at December 31. 2017? a) b) c) d) c) SO. $42.000 $50,000 $105,000. Cannot be determined from the information givenStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started