Answered step by step

Verified Expert Solution

Question

1 Approved Answer

All one question. Please answer parts you are able to in excel. Thanks The property is a income-producing asset that costs $3,455,000 with an initial

All one question. Please answer parts you are able to in excel. Thanks

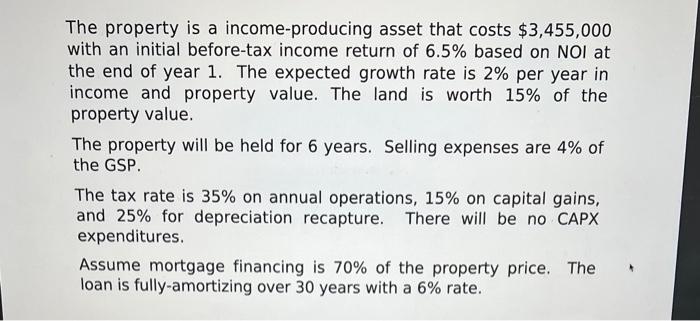

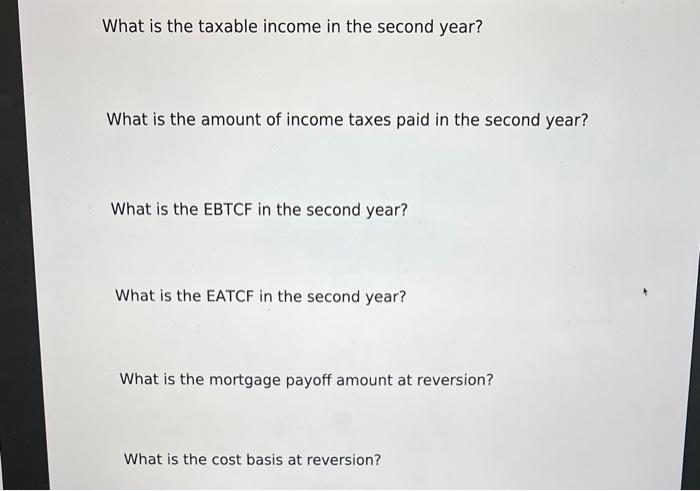

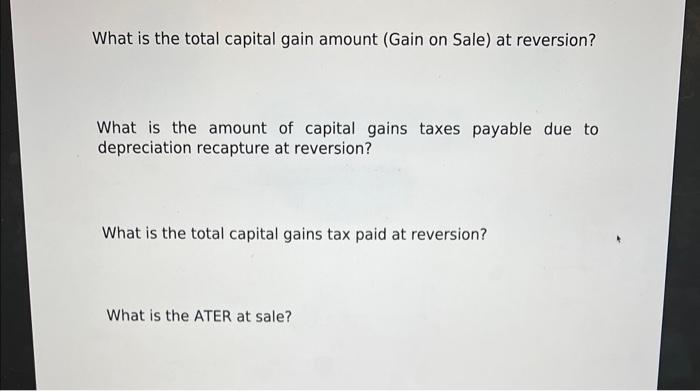

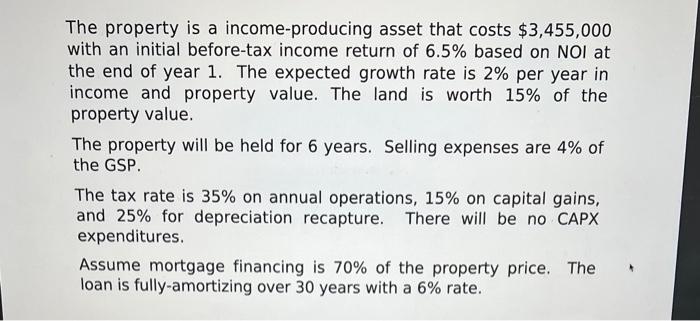

The property is a income-producing asset that costs $3,455,000 with an initial before-tax income return of 6.5% based on NOI at the end of year 1 . The expected growth rate is 2% per year in income and property value. The land is worth 15% of the property value. The property will be held for 6 years. Selling expenses are 4% of the GSP. The tax rate is 35% on annual operations, 15% on capital gains, and 25% for depreciation recapture. There will be no CAPX expenditures. Assume mortgage financing is 70% of the property price. The loan is fully-amortizing over 30 years with a 6% rate. What is the taxable income in the second year? What is the amount of income taxes paid in the second year? What is the EBTCF in the second year? What is the EATCF in the second year? What is the mortgage payoff amount at reversion? What is the cost basis at reversion? What is the total capital gain amount (Gain on Sale) at reversion? What is the amount of capital gains taxes payable due to depreciation recapture at reversion? What is the total capital gains tax paid at reversion? What is the ATER at sale? The property is a income-producing asset that costs $3,455,000 with an initial before-tax income return of 6.5% based on NOI at the end of year 1 . The expected growth rate is 2% per year in income and property value. The land is worth 15% of the property value. The property will be held for 6 years. Selling expenses are 4% of the GSP. The tax rate is 35% on annual operations, 15% on capital gains, and 25% for depreciation recapture. There will be no CAPX expenditures. Assume mortgage financing is 70% of the property price. The loan is fully-amortizing over 30 years with a 6% rate. What is the taxable income in the second year? What is the amount of income taxes paid in the second year? What is the EBTCF in the second year? What is the EATCF in the second year? What is the mortgage payoff amount at reversion? What is the cost basis at reversion? What is the total capital gain amount (Gain on Sale) at reversion? What is the amount of capital gains taxes payable due to depreciation recapture at reversion? What is the total capital gains tax paid at reversion? What is the ATER at sale

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started