Answered step by step

Verified Expert Solution

Question

1 Approved Answer

All parts. But specifically in part (c), when you pro rate the $4,000 loss do you prorate it as $1,000 before the April distribution and

All parts. But specifically in part (c), when you pro rate the $4,000 loss do you prorate it as $1,000 before the April distribution and $3,000 after? I noticed in the other explanation already posted for this question they pro rated 1/2 before the April distribution and 1/2 after so I was just wondering why you pro rate it that way if you do.

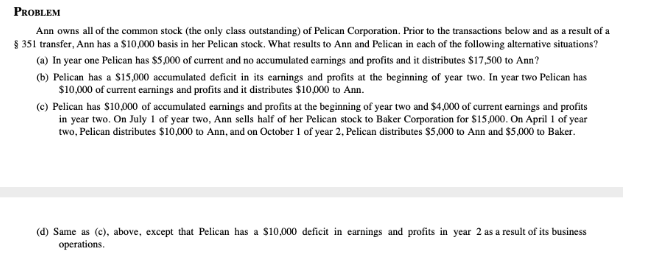

PROBLEM Ann owns all of the common stock (the only class outstanding) of Pelican Corporation. Prior to the transactions below and as a result of a $ 351 transfer, Ann has a $10,000 basis in her Pelican stock. What results to Ann and Pelican in each of the following alternative situations? (a) In year one Pelican has $5,000 of current and no accumulated earnings and profits and it distributes $17,500 to Ann? (6) Pelican has a S15,000 accumulated deficit in its earnings and profits at the beginning of year two. In year two Pelican has $10,000 of current earnings and profits and it distributes $10,000 to Ann. (c) Pelican has $10,000 of accumulated earnings and profits at the beginning of year two and $4,000 of current earnings and profits in year two. On July 1 of year two, Ann sells half of her Pelican stock to Baker Corporation for $15,000. On April 1 of year two, Pelican distributes $10,000 to Ann, and on October 1 of year 2, Pelican distributes $5,000 to Ann and $5,000 to Baker. (d) Same as (c), above, except that Pelican has a $10,000 deficit in earnings and profits in year 2 as a result of its business operations. PROBLEM Ann owns all of the common stock (the only class outstanding) of Pelican Corporation. Prior to the transactions below and as a result of a $ 351 transfer, Ann has a $10,000 basis in her Pelican stock. What results to Ann and Pelican in each of the following alternative situations? (a) In year one Pelican has $5,000 of current and no accumulated earnings and profits and it distributes $17,500 to Ann? (6) Pelican has a S15,000 accumulated deficit in its earnings and profits at the beginning of year two. In year two Pelican has $10,000 of current earnings and profits and it distributes $10,000 to Ann. (c) Pelican has $10,000 of accumulated earnings and profits at the beginning of year two and $4,000 of current earnings and profits in year two. On July 1 of year two, Ann sells half of her Pelican stock to Baker Corporation for $15,000. On April 1 of year two, Pelican distributes $10,000 to Ann, and on October 1 of year 2, Pelican distributes $5,000 to Ann and $5,000 to Baker. (d) Same as (c), above, except that Pelican has a $10,000 deficit in earnings and profits in year 2 as a result of its business operationsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started