Answered step by step

Verified Expert Solution

Question

1 Approved Answer

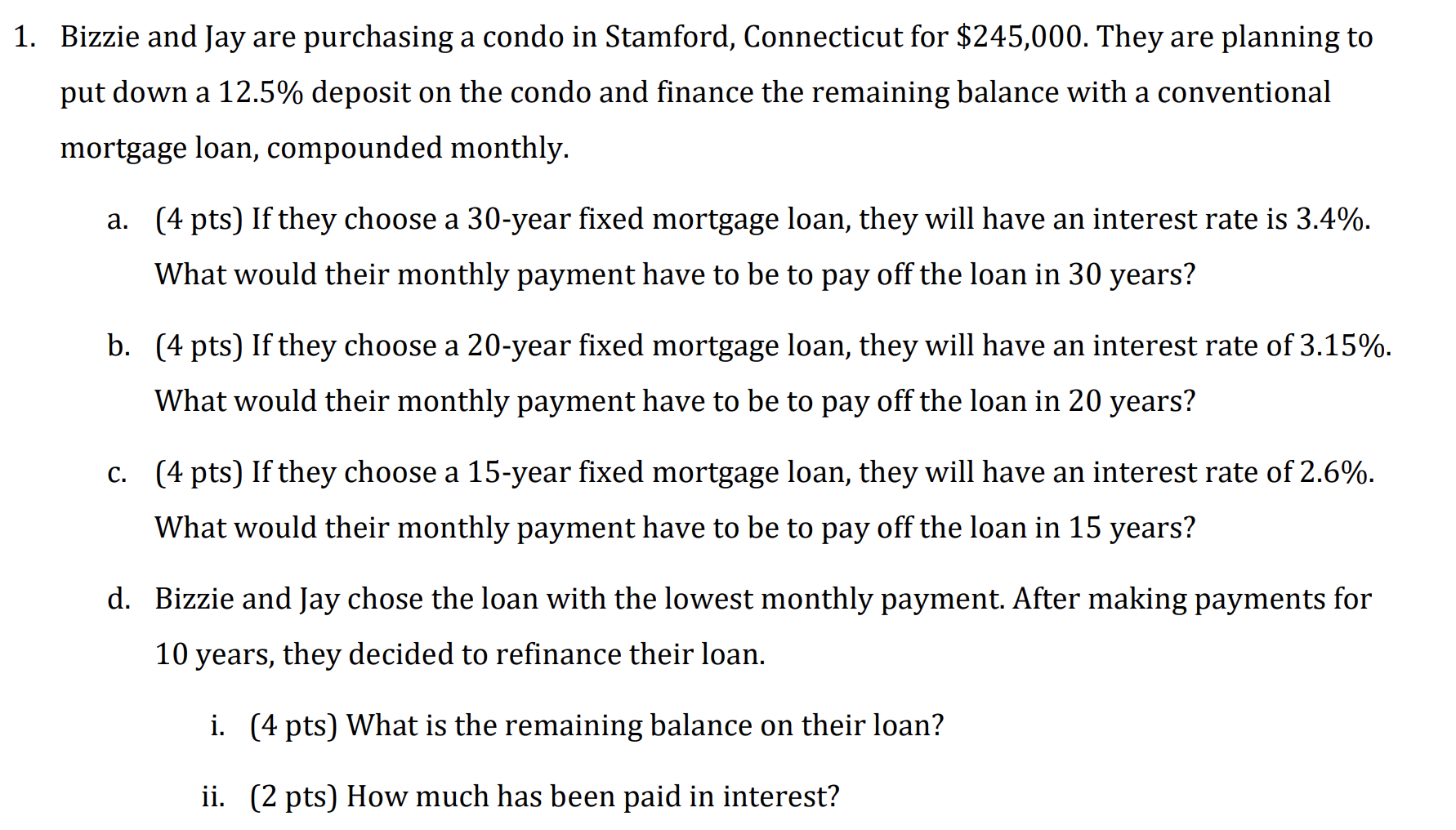

All parts of Questions 1 1. Bizzie and Jay are purchasing a condo in Stamford, Connecticut for $245,000. They are planning to put down a

All parts of Questions 1

1. Bizzie and Jay are purchasing a condo in Stamford, Connecticut for $245,000. They are planning to put down a 12.5% deposit on the condo and finance the remaining balance with a conventional mortgage loan, compounded monthly. a. (4 pts) If they choose a 30-year fixed mortgage loan, they will have an interest rate is 3.4%. What would their monthly payment have to be to pay off the loan in 30 years? b. (4 pts) If they choose a 20-year fixed mortgage loan, they will have an interest rate of 3.15%. What would their monthly payment have to be to pay off the loan in 20 years? C. (4 pts) If they choose a 15-year fixed mortgage loan, they will have an interest rate of 2.6%. What would their monthly payment have to be to pay off the loan in 15 years? d. Bizzie and Jay chose the loan with the lowest monthly payment. After making payments for 10 years, they decided to refinance their loan. i. (4 pts) What is the remaining balance on their loan? ii. (2 pts) How much has been paid in interestStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started