Answered step by step

Verified Expert Solution

Question

1 Approved Answer

all parts plz. thanks! For 2021, Walmart and Target had the following information (all values are in millions of dollars): Assume a 365-day year: a.

all parts plz. thanks!

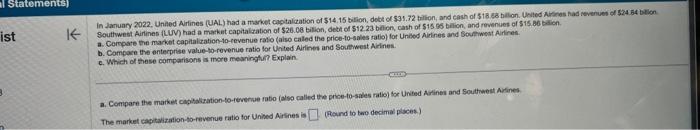

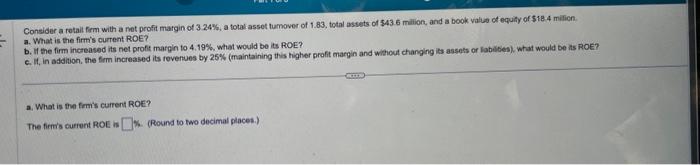

For 2021, Walmart and Target had the following information (all values are in millions of dollars): Assume a 365-day year: a. What is each company's acoounts recaivable days? b. What is each company's inventory turnower? c. Which company is managing its acoounts receivable and inventory more efficiently? a. What is each company's accounts recelvable disys? The accounts receivabie days for Waimart are days. (Round to two decimal places.) b. Compace the enterprise value-so-rovenue ratio for United Airlines and Sostewest Arines. c. Which of these comparisons is more meaningtur? Explain. The market capitaization-so-revenue ratio for Unined Airines is (Round to two decimal plsces.) Consider a retail ferm with a net profit margin of 3.24%, a total assot tumover of 1.83 , total assets of $43.6 milion, and a book value of equity of $18.4 milicn. a. What is the firm's current ROE? b. It the firm increased its net profi margin to 4.19%, what would be its ROE? c. If, in addition, the firm increased its revenues by 25% (maintaining this higher profit margin and whout changing ils assets or labilibes), what would be its ROE? a. What is the frm's current ROE? The firmis current ROE is 15. (Round to two decimal places.) For 2021, Walmart and Target had the following information (all values are in millions of dollars): Assume a 365-day year: a. What is each company's acoounts recaivable days? b. What is each company's inventory turnower? c. Which company is managing its acoounts receivable and inventory more efficiently? a. What is each company's accounts recelvable disys? The accounts receivabie days for Waimart are days. (Round to two decimal places.) b. Compace the enterprise value-so-rovenue ratio for United Airlines and Sostewest Arines. c. Which of these comparisons is more meaningtur? Explain. The market capitaization-so-revenue ratio for Unined Airines is (Round to two decimal plsces.) Consider a retail ferm with a net profit margin of 3.24%, a total assot tumover of 1.83 , total assets of $43.6 milion, and a book value of equity of $18.4 milicn. a. What is the firm's current ROE? b. It the firm increased its net profi margin to 4.19%, what would be its ROE? c. If, in addition, the firm increased its revenues by 25% (maintaining this higher profit margin and whout changing ils assets or labilibes), what would be its ROE? a. What is the frm's current ROE? The firmis current ROE is 15. (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started