Answered step by step

Verified Expert Solution

Question

1 Approved Answer

All Parts to be solved 'A to Z ' is one of the largest laundry service provider for Suits. The firm has set a price

All Parts to be solved

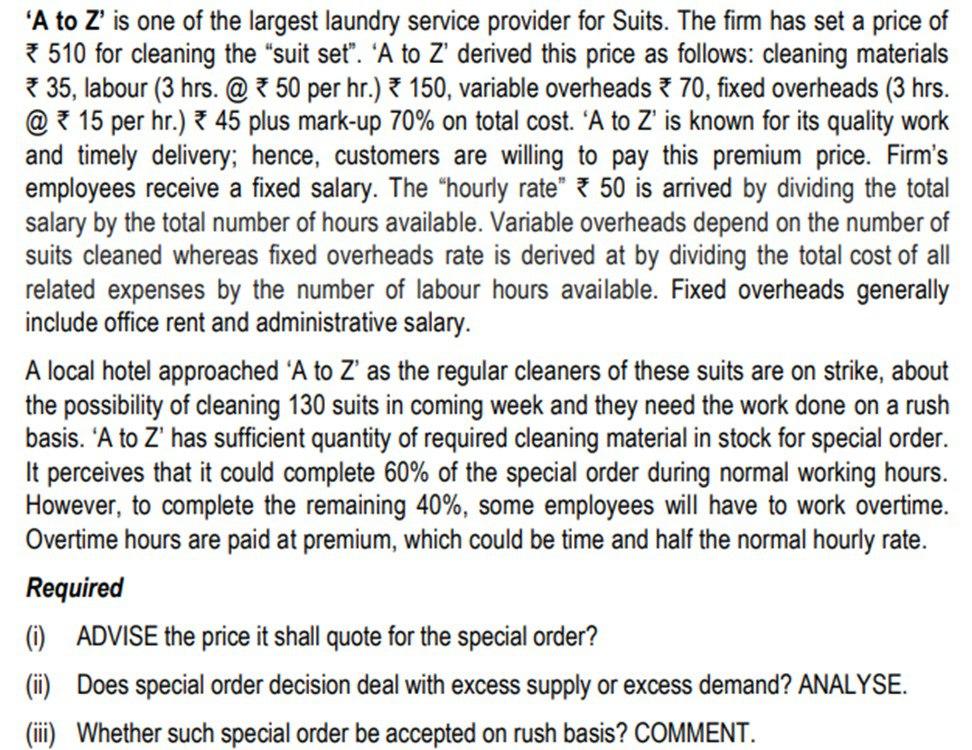

'A to Z ' is one of the largest laundry service provider for Suits. The firm has set a price of 510 for cleaning the "suit set". 'A to Z' derived this price as follows: cleaning materials 35 , labour (3 hrs. @ 50 per hr.) 150, variable overheads 70 , fixed overheads ( 3 hrs. @ 15 per hr.) 45 plus mark-up 70\% on total cost. 'A to Z' is known for its quality work and timely delivery; hence, customers are willing to pay this premium price. Firm's employees receive a fixed salary. The "hourly rate" 50 is arrived by dividing the total salary by the total number of hours available. Variable overheads depend on the number of suits cleaned whereas fixed overheads rate is derived at by dividing the total cost of all related expenses by the number of labour hours available. Fixed overheads generally include office rent and administrative salary. A local hotel approached 'A to Z' as the regular cleaners of these suits are on strike, about the possibility of cleaning 130 suits in coming week and they need the work done on a rush basis. 'A to Z' has sufficient quantity of required cleaning material in stock for special order. It perceives that it could complete 60% of the special order during normal working hours. However, to complete the remaining 40%, some employees will have to work overtime. Overtime hours are paid at premium, which could be time and half the normal hourly rate. Required (i) ADVISE the price it shall quote for the special order? (ii) Does special order decision deal with excess supply or excess demand? ANALYSE. (iii) Whether such special order be accepted on rush basis? COMMENTStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started