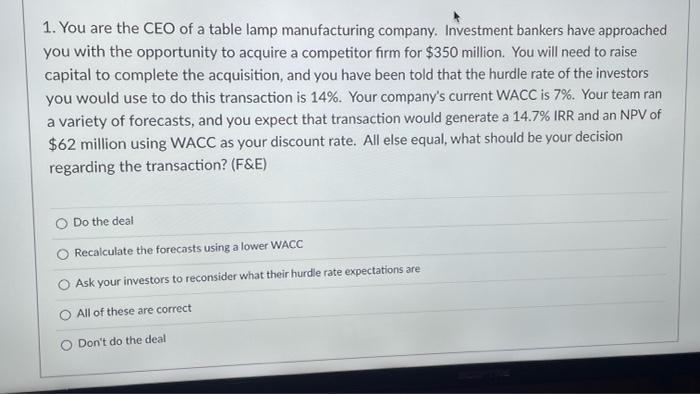

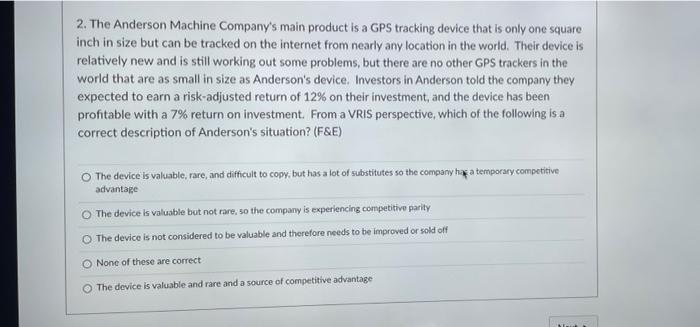

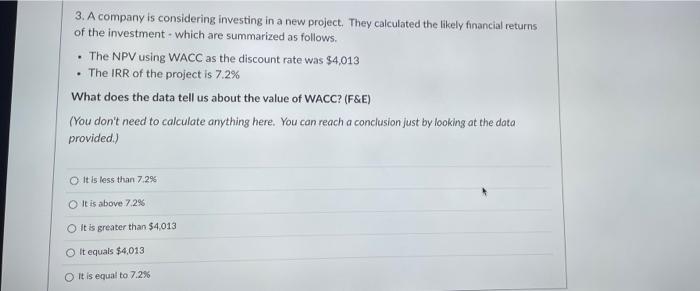

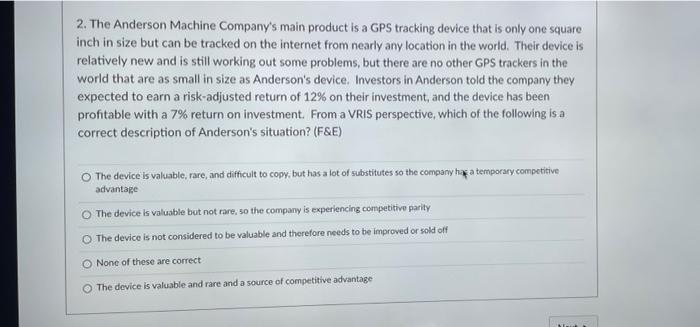

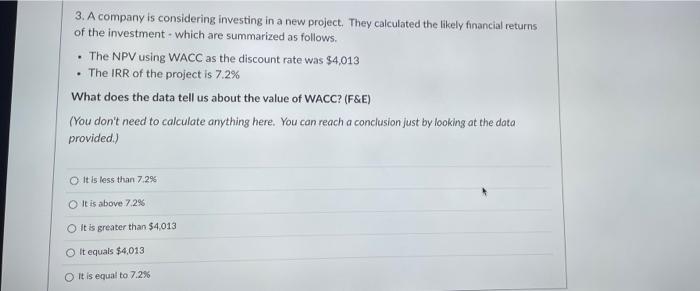

1. You are the CEO of a table lamp manufacturing company. Investment bankers have approached you with the opportunity to acquire a competitor firm for $350 million. You will need to raise capital to complete the acquisition, and you have been told that the hurdle rate of the investors you would use to do this transaction is 14%. Your company's current WACC is 7%. Your team ran a variety of forecasts, and you expect that transaction would generate a 14.7% IRR and an NPV of $62 million using WACC as your discount rate. All else equal, what should be your decision regarding the transaction? (F&E) Do the deal Recalculate the forecasts using a lower WACC Ask your investors to reconsider what their hurdle rate expectations are All of these are correct Don't do the deal 2. The Anderson Machine Company's main product is a GPS tracking device that is only one square inch in size but can be tracked on the internet from nearly any location in the world. Their device is relatively new and is still working out some problems, but there are no other GPS trackers in the world that are as small in size as Anderson's device. Investors in Anderson told the company they expected to earn a risk-adjusted return of 12% on their investment, and the device has been profitable with a 7% return on investment. From a VRIS perspective, which of the following is a correct description of Anderson's situation? (F&E) The device is valuable, rare, and difficult to copy, but has a lot of substitutes so the company ha a temporary competitive advantage The device is valuable but not rare, so the company is experiencing competitive parity The device is not considered to be valuable and therefore needs to be improved or sold off None of these are correct The device is valuable and rare and a source of competitive advantage . 3. A company is considering investing in a new project. They calculated the likely financial returns of the investment which are summarized as follows. The NPV using WACC as the discount rate was $4.013 The IRR of the project is 7.2% What does the data tell us about the value of WACC? (F&E) (You don't need to calculate anything here. You can reach a conclusion just by looking at the data provided) It is less than 7.2% It is above 7.2% It is greater than $4,013 It equals $4,013 It is equal to 7.2%