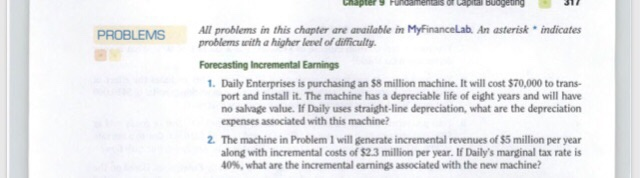

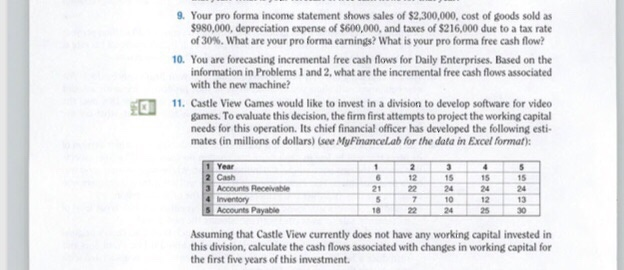

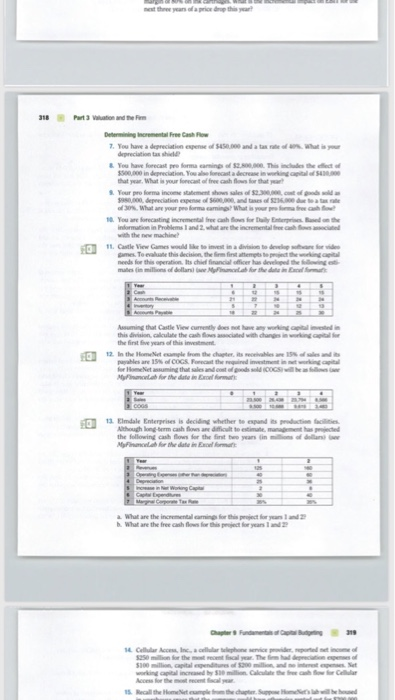

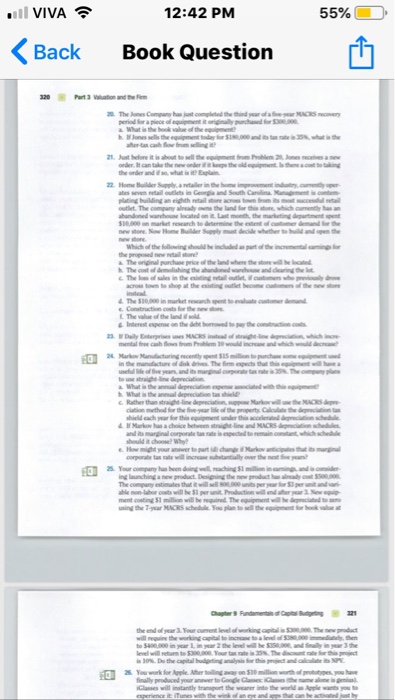

All problems in this chapter are arailable in Myfinancelab. An asterisk indicates problems uwith a higher lenel of difficulity PROBLEMS Forecasting Incremental Earnings 1. Daily Enterprises is purchasing an $8 million machine. It will cost $70,000 to trans- port and install it. The machine has a depreciable life of eight years and will have no salvage value. If Daily uses straight-line depreciation, what are the depreciation expenses associated with this machine? 2. The machine in Problem 1 will generate incremental revenues of $5 million per year along with incremental costs of $2.3 million per year. If Daily's marginal tax rate is 40%, what are the incremental earnings associated with the new machine? 9. Your pro forma income statement shows sales of $2,300,000, cost of goods sold as $980,000, depreciation expense of $600,000, and taxes of $216,000 due to a tax rate of 30%. What are your pro forma earnings? What is your pro forma free cash flow? 10. You are forecasting incremental free cash flows for Daily Enterprises. Based on the information in Problems 1 and 2, what are the incremental free cash flows associated with the new machine 11. Castle View Games would like to invest in a division to develop software for video games. To evaluate this decision, the firm first attempts to project the working capital needs for this operation. Its chief financial officer has developed the following esti- mates (in millions of dollars) (see MyFinancelab for the data in Excel format) Year 2 Cash Accounts Recevable 4 Inventory 12 15 24 10 24 15 24 12 25 15 24 13 30 21 5 Accounts Payable 18 Assuming that Castle View currently does not have any working capital invested in this division, calculate the cash flows associated with changes in working capital for the first five years of this investment etermining Incremental Free Cashw that year. What is your forecast of fee cash flows for that year Castle View Games would k to invest in a division to develog slane or vide ears of this invesment 12:42 PNM 55%; Back Book Question Back BooK Question Chapter 9 Fundamentals of Capital Budgeting 321 the end of year 3 Your current level of working capital is $300,000. The new product will require the working capital to increase to a level of $380,000 immediately, then to $400,000 in year 1, in year 2 the level will be $350,000, and finally in year 3 the level will return tSO0.000, Your tax rate is 35%. The discount rate for this project s 10%. Do the capital budgeting analysis for this project and calculate its NPV. 26 You work for Apple. After toiling away on $10 million worth of prototypes, you have finally produced your answer to Google Glasses: iGlasses (the name alone is genius). Glasses will instantly transport the wearer into the world as Apple wants you to experience it: iTunes with the wink of an eye and apps that can be activated just by looking at them. You think that these will sell for 5 years until the next big thing comes along for until users are unable to interact with actual human beings). Rev enues are projected to be $450 million per year along with expenses of $350 million. You will need to spend $60 million immediately on additional equipment that will be depreciated using the 5-year MACRS schedule. Additionally, you will use some fully depreciated existing equipment that has a market value of $10 million. As iGlasses are an outcome of the R&D center, Apple plans to charge $5 million of the annual costs of the center to the iGlasses product for 5 years, Finally,Apple's working capital levels will increase from their current level of $120 million to $140 million imme- diately. They will remain at the elevated level until year 5, when they will return to S120 million. Apple's discount rate for this project is 15% and its tax rate is 35%. Calculate the free cash flows and determine the NPV of this project All problems in this chapter are arailable in Myfinancelab. An asterisk indicates problems uwith a higher lenel of difficulity PROBLEMS Forecasting Incremental Earnings 1. Daily Enterprises is purchasing an $8 million machine. It will cost $70,000 to trans- port and install it. The machine has a depreciable life of eight years and will have no salvage value. If Daily uses straight-line depreciation, what are the depreciation expenses associated with this machine? 2. The machine in Problem 1 will generate incremental revenues of $5 million per year along with incremental costs of $2.3 million per year. If Daily's marginal tax rate is 40%, what are the incremental earnings associated with the new machine? 9. Your pro forma income statement shows sales of $2,300,000, cost of goods sold as $980,000, depreciation expense of $600,000, and taxes of $216,000 due to a tax rate of 30%. What are your pro forma earnings? What is your pro forma free cash flow? 10. You are forecasting incremental free cash flows for Daily Enterprises. Based on the information in Problems 1 and 2, what are the incremental free cash flows associated with the new machine 11. Castle View Games would like to invest in a division to develop software for video games. To evaluate this decision, the firm first attempts to project the working capital needs for this operation. Its chief financial officer has developed the following esti- mates (in millions of dollars) (see MyFinancelab for the data in Excel format) Year 2 Cash Accounts Recevable 4 Inventory 12 15 24 10 24 15 24 12 25 15 24 13 30 21 5 Accounts Payable 18 Assuming that Castle View currently does not have any working capital invested in this division, calculate the cash flows associated with changes in working capital for the first five years of this investment etermining Incremental Free Cashw that year. What is your forecast of fee cash flows for that year Castle View Games would k to invest in a division to develog slane or vide ears of this invesment 12:42 PNM 55%; Back Book Question Back BooK Question Chapter 9 Fundamentals of Capital Budgeting 321 the end of year 3 Your current level of working capital is $300,000. The new product will require the working capital to increase to a level of $380,000 immediately, then to $400,000 in year 1, in year 2 the level will be $350,000, and finally in year 3 the level will return tSO0.000, Your tax rate is 35%. The discount rate for this project s 10%. Do the capital budgeting analysis for this project and calculate its NPV. 26 You work for Apple. After toiling away on $10 million worth of prototypes, you have finally produced your answer to Google Glasses: iGlasses (the name alone is genius). Glasses will instantly transport the wearer into the world as Apple wants you to experience it: iTunes with the wink of an eye and apps that can be activated just by looking at them. You think that these will sell for 5 years until the next big thing comes along for until users are unable to interact with actual human beings). Rev enues are projected to be $450 million per year along with expenses of $350 million. You will need to spend $60 million immediately on additional equipment that will be depreciated using the 5-year MACRS schedule. Additionally, you will use some fully depreciated existing equipment that has a market value of $10 million. As iGlasses are an outcome of the R&D center, Apple plans to charge $5 million of the annual costs of the center to the iGlasses product for 5 years, Finally,Apple's working capital levels will increase from their current level of $120 million to $140 million imme- diately. They will remain at the elevated level until year 5, when they will return to S120 million. Apple's discount rate for this project is 15% and its tax rate is 35%. Calculate the free cash flows and determine the NPV of this project