Answered step by step

Verified Expert Solution

Question

1 Approved Answer

all question ask for 2017 unless otherwise stated 24. 25. What were weighted average shares used in computation of basic EPS? What were weighted average

all question ask for 2017 unless otherwise stated

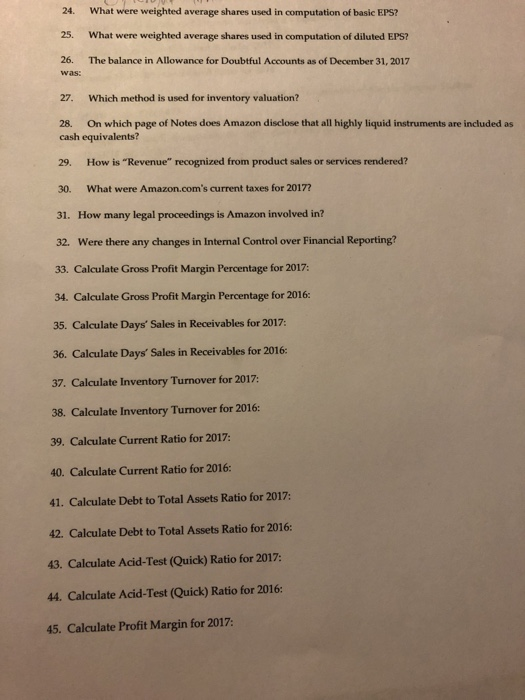

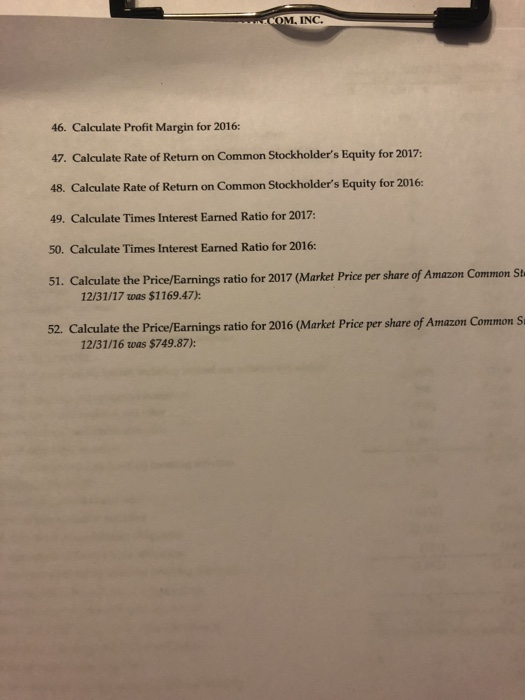

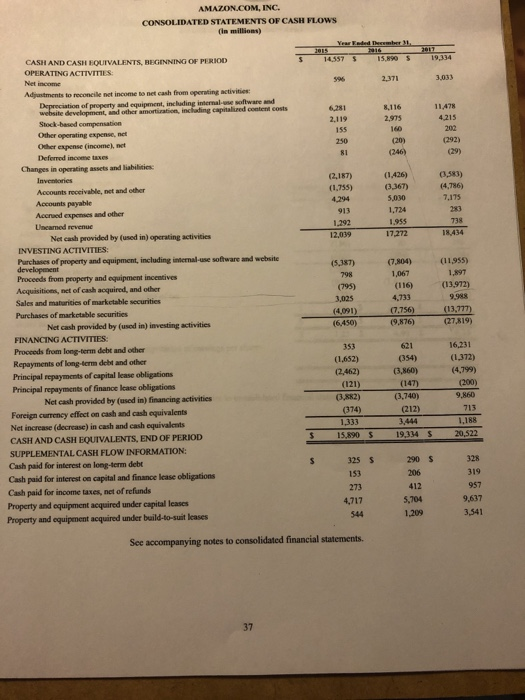

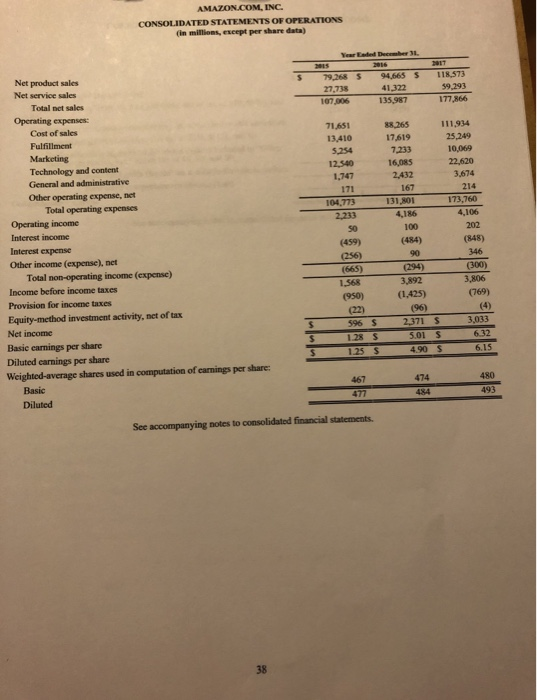

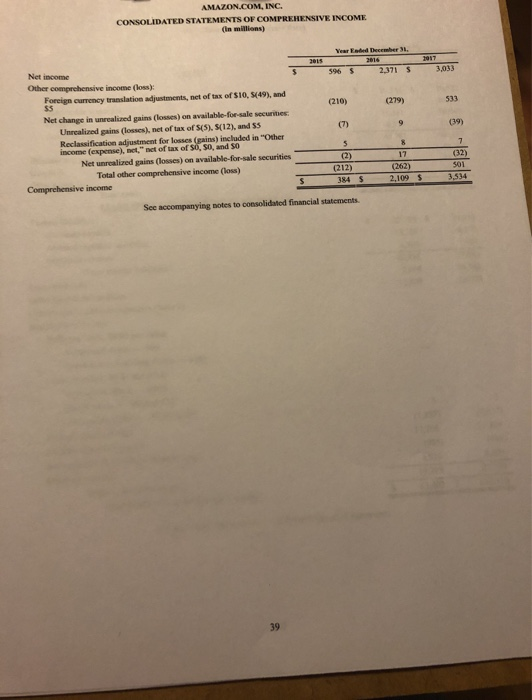

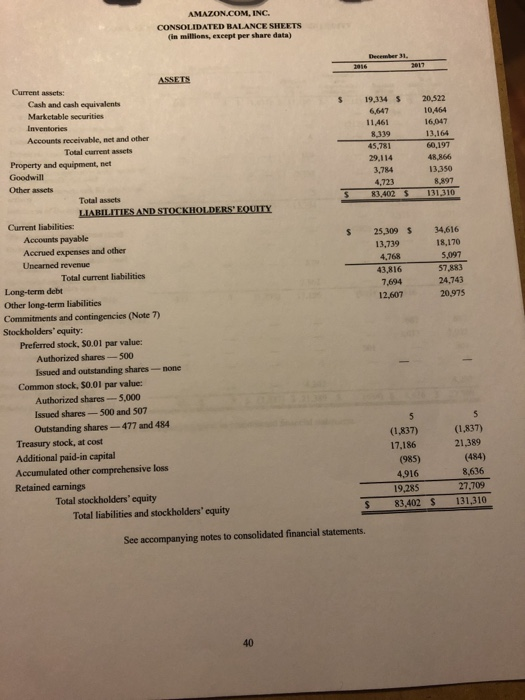

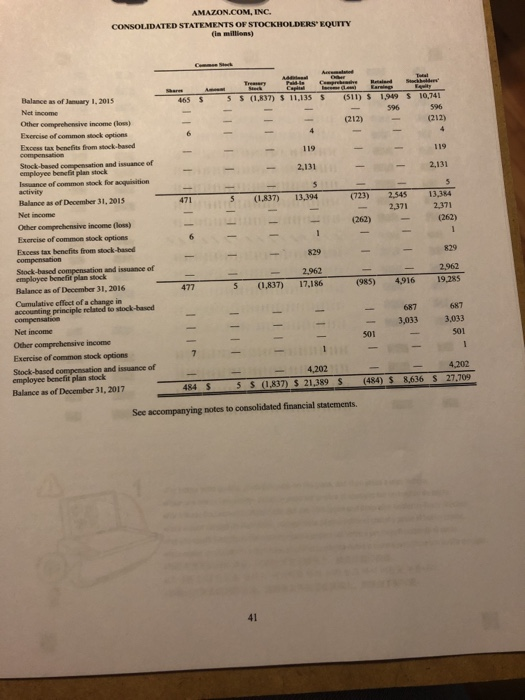

24. 25. What were weighted average shares used in computation of basic EPS? What were weighted average shares used in computation of diluted EPS? The balance in Allowance for Doubtful Accounts as of December 31, 2017 26. was: 27. Which method is used for inventory valuation? 28. On which page of Notes does Amazon disclose that all highly liquid instruments are included as cash equivalents? How is "Revenue" recognized from product sales or services rendered? 29. 30. What were Amazon.com's current taxes for 2017? 31. How many legal proceedings is Amazon involved in? 32. Were there any changes in Internal Control over Financial Reporting? 33. Calculate Gross Profit Margin Percentage for 2017: 34. Calculate Gross Profit Margin Percentage for 2016: 35. Calculate Days' Sales in Receivables for 2017: 36. Calculate Days' Sales in Receivables for 2016: 37. Calculate Inventory Turnover for 2017: 38. Calculate Inventory Turnover for 2016: 39. Calculate Current Ratio for 2017: 40. Calculate Current Ratio for 2016: 41. Calculate Debt to Total Assets Ratio for 2017: 42. Calculate Debt to Total Assets Ratio for 2016: 43. Calculate Acid-Test (Quick) Ratio for 2017: 44. Calculate Acid-Test (Quick) Ratio for 2016: 45. Calculate Profit Margin for 2017: UNICOM, INC. 46. Calculate Profit Margin for 2016: 47. Calculate Rate of Return on Common Stockholder's Equity for 2017: 48. Calculate Rate of Return on Common Stockholder's Equity for 2016: 49. Calculate Times Interest Earned Ratio for 2017: 50. Calculate Times Interest Earned Ratio for 2016: 51. Calculate the Price/Earnings ratio for 2017 (Market Price per share of Amazon Common St 12/31/17 was $1169.47): 52. Calculate the Price/Earnings ratio for 2016 (Market Price per share of Amazon Common S 12/31/16 was $749.87): AMAZON.COM, INC. CONSOLIDATED STATEMENTS OF CASH FLOWS (in millions) Yearded the 14.557 S 15.8905 19,334 596 2,371 3,033 6,281 2,119 155 8,116 2,975 160 (20) (246) 11.478 4 215 202 (292) (29) 250 BI (2,187) (1,755) 4.294 913 1,292 12,039 (1426) (3,367) 5,030 1,724 1.955 17.272 (4,786) 7,175 283 738 18.434 (7.804) 1,067 (116) CASH AND CASH EQUIVALENTS, BEGINNING OF PERIOD OPERATING ACTIVITIES: Net income Adjustments to reconcile net income to net cash from operating activities: Depreciation of property and equipment, including internal use software and website development, and other amortization, including capitalized content costs Stock-based compensation Other operating expense, net Other expense (income), net Deferred income taxes Changes in operating assets and liabilities: Inventories Accounts receivable, net and other Accounts payable Accred expenses and other Uncamed revenue Net cash provided by (used in) operating activities INVESTING ACTIVITIES: Purchases of property and equipment, including internal use software and website development Proceeds from property and equipment incentives Acquisitions, net of cash acquired, and other Sales and maturities of marketable securities Purchases of marketable securities Net cash provided by (used in) investing activities FINANCING ACTIVITIES: Proceeds from long-term debt and other Repayments of long-term debt and other Principal repayments of capital lease obligations Principal repayments of finance lease obligations Net cash provided by used in) financing activities Foreign currency effect on cash and cash equivalents Net increase (decrease) in cash and cash equivalents CASH AND CASH EQUIVALENTS, END OF PERIOD SUPPLEMENTAL CASH FLOW INFORMATION: Cash paid for interest on long-term debt Cash paid for interest on capital and finance lease obligations Cash paid for income taxes, net of refunds Property and equipment acquired under capital leases Property and equipment acquired under build-to-suit leases (5,387) 798 (795) 3,025 (4,091) (6.450) (11,955) 1.897 (13,972) 9.988 (13,777) (27,819) 4.733 (7.756) (9,876) 353 (1.652) (2,462) (121) (382) (374) 1,333 15.890 $ (354) (3.860) (147) (3,740) (212) 16,231 (1,372) (4.799) (200) 9,860 713 1,188 20,522 $ 19,334 $ S 3255 153 328 319 273 290 S 206 412 5,704 1,209 957 9,637 3,541 544 See accompanying notes to consolidated financial statements. 37 AMAZON.COM, INC. CONSOLIDATED STATEMENTS OF OPERATIONS (in millions, except per share data) Yearted December $ 79,268 5 27,738 94,665 $ 41.322 135,987 118 573 59,293 177,866 107,006 Net product sales Net service sales Total net sales Operating expenses: Cost of sales Fulfillment Marketing Technology and content General and administrative Other operating expense, net Total operating expenses Operating income Interest income Interest expense Other income (expense), net Total non-operating income (expense) Income before income taxes Provision for income taxes Equity-method investment activity, net of tax Net income Basic earnings per share Diluted earnings per share Weighted average shares used in computation of earnings per share: Basic Diluted 71.451 13.410 5.254 12.540 1,747 171 104,773 2,233 SO (459) (256) (665) 1.568 (950) (22) 596 S 1.28 $ 1.25 88.265 17.619 7,233 16,085 2.432 167 131,301 4,186 100 (484) 90 (294) 3,892 (1.425) (96) 2.371 $ 5.01 S 4.90 $ 111,934 25,249 10,069 22.620 3,674 214 173,760 4.106 202 (848) 346 (300) 3,806 (769) $ $ $ 3,033 632 6.15 474 480 467 477 484 493 See accompanying notes to consolidated financial statements. 38 AMAZON.COM, INC. CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (in millions) Year End Thecember 2015 59 $ 2.371 5 3,033 (210) (279) 513 (7) 9 (39) Net income $ Other comprehensive income (loss); Foreign currency translation adjustments, net of tax of $10, (49), and S5 Net change in unrealized gains (losses) on available for sale securities Unrealized gains (losses), net of tax of S(5), S(12), and 55 Reclassification adjustment for losses (gains) included in "Other income (expense), net, met of tax of S0, SO, and SO Net unrealized gains (losses) on available-for-sale securities Total other comprehensive income (los) Comprehensive income $ 5 (2) (212) 384 $ 17 (262) 2,109 $ 7 (32) 501 3,534 See accompanying notes to consolidated financial statements. 39 AMAZON.COM, INC. CONSOLIDATED BALANCE SHEETS (in millions, except per share data) December 31. 2012 $ 19,334 5 6,647 11.461 8339 45,781 29,114 3,784 4,723 83.4025 20,522 10.464 16,047 13,164 60,197 48.866 13,350 8.897 131,310 $ 25,309 $ 13,739 4,768 43,816 7,694 12,607 34,616 18,170 5,097 57,883 24,743 20.975 ASSETS Current assets: Cash and cash equivalents Marketable securities Inventories Accounts receivable, net and other Total current assets Property and equipment, net Goodwill Other assets Total assets LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities: Accounts payable Accrued expenses and other Uncanned revenue Total current liabilities Long-term debt Other long-term liabilities Commitments and contingencies (Note 7) Stockholders' equity: Preferred stock, S0.01 par value: Authorized shares-500 Issued and outstanding shares-none Common stock, $0.01 par value: Authorized shares -- 5.000 Issued shares-500 and 507 Outstanding shares-477 and 484 Treasury stock, at cost Additional paid-in capital Accumulated other comprehensive loss Retained earnings Total stockholders' equity Total liabilities and stockholders' cquity 5 (1,837) 17,186 (985) 4,916 19,285 83.402 S (1.837) 21,389 (484) 8,636 27,709 131,310 $ See accompanying notes to consolidated financial statements. 40 AMAZON.COM, INC. CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY (in millions) AR A Try Share 465 $ 5 $ (1.837) $ 11,135 5 Earleg (511) $ 1.949 $ 596 (212) 10,741 596 (212) 4 4 TITI 119 119 2.131 2.131 II TITULLI III 13,194 (1.837) 471 (723) 2.545 2,371 13,384 2,371 (262) Balance as of January 1, 2015 Net income Other comprehensive income (los) Exercise of common stock options Excess tax benefits from stock-based compensation Stock-based compensation and issuance of employee benefit plan stock Issuance of common Mock for acquisition activity Balance as of December 31, 2015 Net income Other comprehensive income (less) Exercise of common stock options Excess tax benefits from stock-based compensation Stock-based compensation and issuance of employee benefit plan stock Balance as of December 31, 2016 Cumulative effect of a change in accounting principle related to stock-based compensation Net income Other comprehensive income Exercise of common stock options Stock-based compensation and issuance of employee benefit plan stock Balance as of December 31, 2017 (262) 829 829 2.962 17,186 2,962 19,285 (985) (1,837) 4,916 477 687 3,033 III 687 3,033 501 501 4,202 5$ (1.837) $ 21,389 $ 4,202 (484) $ 8,636 S 27.709 484 5 See accompanying notes to consolidated financial statements, 41 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started