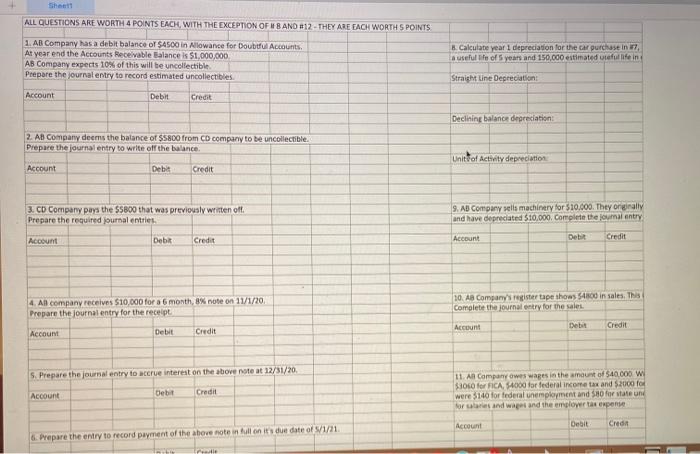

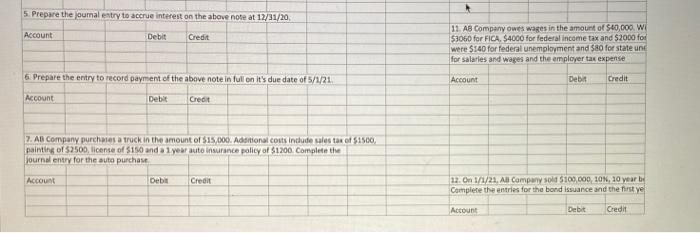

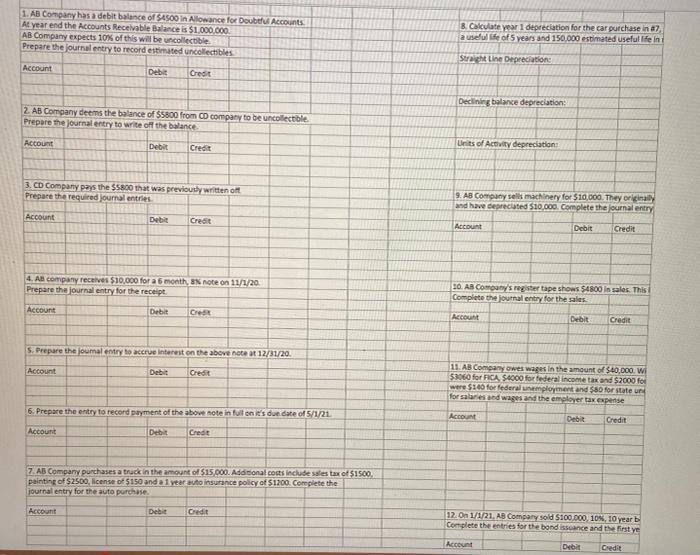

ALL QUESTIONS ARE WORTH 4 POINTS EACH, WITH THE EXCEPTION OF #BAND #12 - THEY ARE EACH WORTHS POINTS 1. AB Company has a debit balance of $4500 in Allowance for Dout Accounts At year end the Accounts Receivable Balance is $1,000,000 AB Company expects 10% of this will be uncollectible Prepare the journal entry to record estimated uncollectibles B. Calculate year 1 depreciation for the car purchase in 17. useful life of 5 years and 150,000 estimated utafute in Straight Line Depreciation Account Debit Credit Declining balance depreciation: 2. AB Company deems the balance of $5800 from CD company to be uncollectible Prepare the journal entry to write off the balance Units of Activity depreciation Account Debit Credit 3. CD Company pays the $5800 that was previously written oft Prepare the required journal entries 9. AB Company sells machinery for $10,000. They originally and have depreciated $10,000. Complete the journal entry Account Debit Credit Deb Credit Account 4. An company receives $10,000 for a 6 month, 8% note on 11/1/20 Prepare the journal entry for the receipt 10. AB Company's register tape shows $4800 in sales. This Complete the journal entry for the sale. Account Debit Credit Account Debit Credit 5. Prepare the journal entry to accrue interest on the above note at 12/31/20 Account Debut 11. An Company owes wages in the amount of $40.000 W for FICA 54000 for federal income tax and 52000 for were $140 for federal unemployment and S80 for state und for sales and want and the employer tas expert Credit Account Debit Cred 6. Prepare the entry to record payment of the above note in full on its due date of 1/21 Le 5. Prepare the journal entry to accrue interest on the above note at 12/31/20 Account Debit Credit 11. AB Company owes wares in the amount of $40,000 W 53060 for FICA $4000 for federal income tax and $2000 for were $140 for federal unemployment and 580 for state une for salaries and Wages and the employer tax expense 6. Prepare the entry to record payment of the above note in full on it's due date of 5/1/21 Account Debit Credit Account Debit Credit 7. AD Company purchases a truck in the amount of $15,000. Additional couts include sales tax of $1500, painting of $2500 license of $150 anda 1 year auto insurance policy of $1200 Complete the Journal entry for the auto purchase Account Debat Credit 12. On 1/1/21. All Company sold $100.000 108, 10 year by Complete the entries for the bond issuance and the first ye Account Debit Credit 1. AB Company has a debit balance of $4500 in Allowance for Doubtful Accounts At year end the Accounts Receivable Balance is $1.000.000 AB Company expects 10% of this will be uncollectible Prepare the journal entry to record estimated uncollectibles 8. Calculate year 1 depreciation for the car purchase in a a useful life of 5 years and 150.000 estimated useful life in Straight Line Depreciation Account Debe Credit Declining balance depreciation 2. AB Company deems the balance of $5800 from CD company to be uncollectible Prepare the journal entry to write of the balance Account Debit Credit Units of Activity depreciation 3. CD Company pays the 55800 that was previously written oft Prepare the required journal entries 9. AB Company sells machinery for $10,000. The originally and have deprecated $10.000. Complete the journal entry Account Credit Account Debit Credit 4. AB company receives $10,000 for a 6 month, note on 11/1/20 Prepare the journal entry for the receipt 30. AB Company's register tape shows $4800 in sales. This Complete the journal entry for the sales Account Debit Cr Account Debit Credit S. Prepare the journal entry to accrue interest on the above note a 12/31/20 Account Debit Credit 11. AB Company owes wages in the amount of $40,000 W $3060 for FICA $4000 for federal income tax and $2000 for were $140 for federal employment and $80 for state und for salaries and wages and the employer tax expense Account Debit Credit 6. Prepare the entry to record payment of the above note in full one's dut date of 5/1/21 Account Credit 7. AB Company purchases a truck in the amount of $15.000. Additional costs include sales tax of $1500 painting of $2500, license of $150 anda 1 year auto insurance policy of $1200. Complete the journal entry for the auto purchase Account Debit Credit 12. On 1/1/21. AB Compary sold $100.000 108, 10 year Complete the entries for the bond issuance and the first ye Account Debit Credit