Answered step by step

Verified Expert Solution

Question

1 Approved Answer

All questions please! thanks 1. Describe Characteristics of Bond and Bond markets. 2. Describe how a bond value(price) is determined with its elements (Par value,

All questions please! thanks

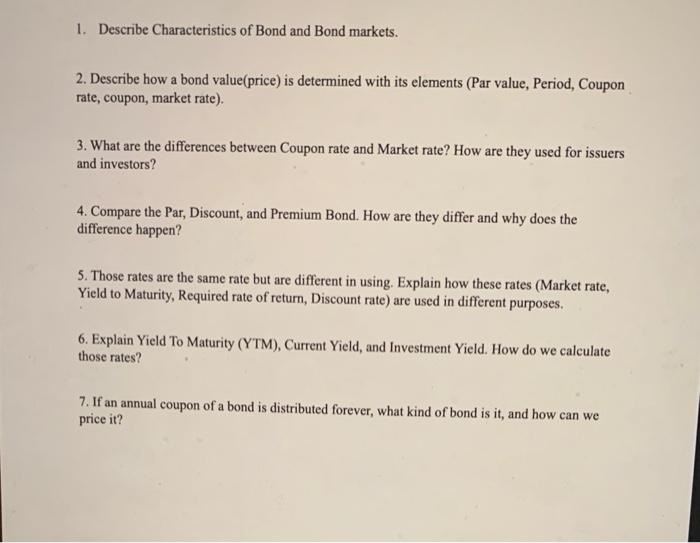

1. Describe Characteristics of Bond and Bond markets. 2. Describe how a bond value(price) is determined with its elements (Par value, Period, Coupon rate, coupon, market rate). 3. What are the differences between Coupon rate and Market rate? How are they used for issuers and investors? 4. Compare the Par, Discount, and Premium Bond. How are they differ and why does the difference happen? 5. Those rates are the same rate but are different in using. Explain how these rates (Market rate, Yield to Maturity, Required rate of return, Discount rate) are used in different purposes. 6. Explain Yield To Maturity (YTM), Current Yield, and Investment Yield. How do we calculate those rates? 7. If an annual coupon of a bond is distributed forever, what kind of bond is it, and how can we price it? 1. Describe Characteristics of Bond and Bond markets. 2. Describe how a bond value(price) is determined with its elements (Par value, Period, Coupon rate, coupon, market rate). 3. What are the differences between Coupon rate and Market rate? How are they used for issuers and investors? 4. Compare the Par, Discount, and Premium Bond. How are they differ and why does the difference happen? 5. Those rates are the same rate but are different in using. Explain how these rates (Market rate, Yield to Maturity, Required rate of return, Discount rate) are used in different purposes. 6. Explain Yield To Maturity (YTM), Current Yield, and Investment Yield. How do we calculate those rates? 7. If an annual coupon of a bond is distributed forever, what kind of bond is it, and how can we price it Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started