Answered step by step

Verified Expert Solution

Question

1 Approved Answer

all questions pliz QUESTION 4 (10 marks) Company ABC issues ordinary shares that pay dividends on every 1 January. The dividend growth was 2% from

all questions pliz

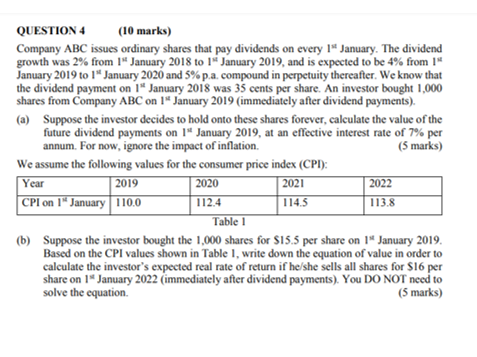

QUESTION 4 (10 marks) Company ABC issues ordinary shares that pay dividends on every 1" January. The dividend growth was 2% from I" January 2018 to 19 January 2019, and is expected to be 4% from 1 January 2019 to 1" January 2020 and 5%p.a. compound in perpetuity thereafter. We know that the dividend payment on 1 January 2018 was 35 cents per share. An investor bought 1,000 shares from Company ABC on 19 January 2019 (immediately after dividend payments). (a) Suppose the investor decides to hold onto these shares forever, calculate the value of the future dividend payments on 14 January 2019, at an effective interest rate of 7% per annum. For now, ignore the impact of inflation. (5 marks) We assume the following values for the consumer price index (CPI): Year 2019 2020 2021 2022 CPI on 16 January 110.0 112.4 114.5 113.8 Table 1 (b) Suppose the investor bought the 1,000 shares for $15.5 per share on 1 January 2019. Based on the CPI values shown in Table 1, write down the equation of value in order to calculate the investor's expected real rate of return if he/she sells all shares for $16 per share on 1 January 2022 (immediately after dividend payments). You DO NOT need to solve the equation. (5 marks) QUESTION 4 (10 marks) Company ABC issues ordinary shares that pay dividends on every 1" January. The dividend growth was 2% from I" January 2018 to 19 January 2019, and is expected to be 4% from 1 January 2019 to 1" January 2020 and 5%p.a. compound in perpetuity thereafter. We know that the dividend payment on 1 January 2018 was 35 cents per share. An investor bought 1,000 shares from Company ABC on 19 January 2019 (immediately after dividend payments). (a) Suppose the investor decides to hold onto these shares forever, calculate the value of the future dividend payments on 14 January 2019, at an effective interest rate of 7% per annum. For now, ignore the impact of inflation. (5 marks) We assume the following values for the consumer price index (CPI): Year 2019 2020 2021 2022 CPI on 16 January 110.0 112.4 114.5 113.8 Table 1 (b) Suppose the investor bought the 1,000 shares for $15.5 per share on 1 January 2019. Based on the CPI values shown in Table 1, write down the equation of value in order to calculate the investor's expected real rate of return if he/she sells all shares for $16 per share on 1 January 2022 (immediately after dividend payments). You DO NOT need to solve the equationStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started