Answered step by step

Verified Expert Solution

Question

1 Approved Answer

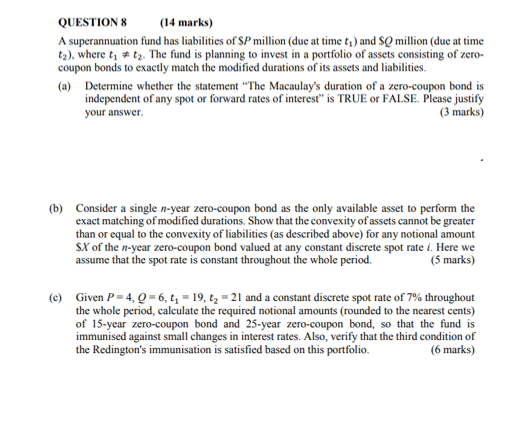

all questions pliz QUESTION 8 (14 marks) A superannuation fund has liabilities of SP million (due at time t,) and SQ million (due at time

all questions pliz

QUESTION 8 (14 marks) A superannuation fund has liabilities of SP million (due at time t,) and SQ million (due at time tz), where to tz. The fund is planning to invest in a portfolio of assets consisting of zero- coupon bonds to exactly match the modified durations of its assets and liabilities. (a) Determine whether the statement "The Macaulay's duration of a zero-coupon bond is independent of any spot or forward rates of interest" is TRUE or FALSE. Please justify your answer (3 marks) (b) Consider a single n-year zero-coupon bond as the only available asset to perform the exact matching of modified durations. Show that the convexity of assets cannot be greater than or equal to the convexity of liabilities (as described above) for any notional amount $X of the n-year zero-coupon bond valued at any constant discrete spot rate i. Here we assume that the spot rate is constant throughout the whole period. (5 marks) (c) Given P = 4,0-6, ty = 19, tz = 21 and a constant discrete spot rate of 7% throughout the whole period, calculate the required notional amounts (rounded to the nearest cents) of 15-year zero-coupon bond and 25-year zero-coupon bond, so that the fund is immunised against small changes in interest rates. Also, verify that the third condition of the Redington's immunisation is satisfied based on this portfolio (6 marks) QUESTION 8 (14 marks) A superannuation fund has liabilities of SP million (due at time t,) and SQ million (due at time tz), where to tz. The fund is planning to invest in a portfolio of assets consisting of zero- coupon bonds to exactly match the modified durations of its assets and liabilities. (a) Determine whether the statement "The Macaulay's duration of a zero-coupon bond is independent of any spot or forward rates of interest" is TRUE or FALSE. Please justify your answer (3 marks) (b) Consider a single n-year zero-coupon bond as the only available asset to perform the exact matching of modified durations. Show that the convexity of assets cannot be greater than or equal to the convexity of liabilities (as described above) for any notional amount $X of the n-year zero-coupon bond valued at any constant discrete spot rate i. Here we assume that the spot rate is constant throughout the whole period. (5 marks) (c) Given P = 4,0-6, ty = 19, tz = 21 and a constant discrete spot rate of 7% throughout the whole period, calculate the required notional amounts (rounded to the nearest cents) of 15-year zero-coupon bond and 25-year zero-coupon bond, so that the fund is immunised against small changes in interest rates. Also, verify that the third condition of the Redington's immunisation is satisfied based on this portfolio (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started