Answered step by step

Verified Expert Solution

Question

1 Approved Answer

All Reqs Please Cleary Ceramics, a division of Fielding Corporation, has an operating income of $64,000 and total assets of $400,000. The required rate of

All Reqs Please

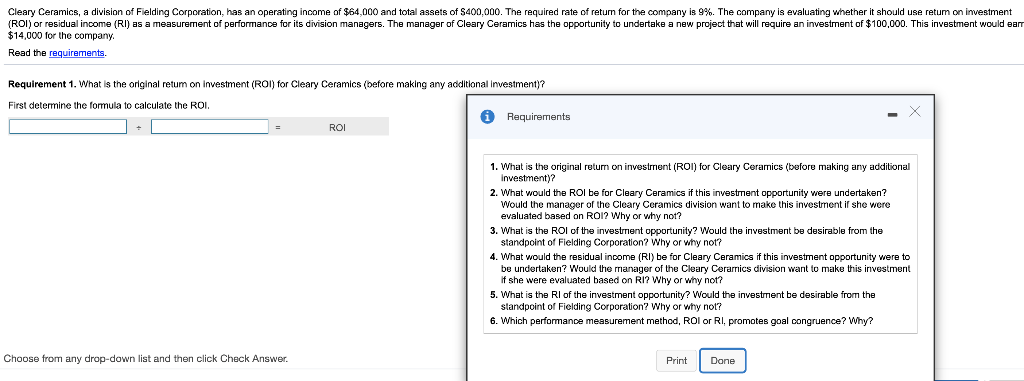

Cleary Ceramics, a division of Fielding Corporation, has an operating income of $64,000 and total assets of $400,000. The required rate of return for the company is 9%. The company is evaluating whether it should use retum on investment (ROI) or residual income (RI) as a measurement of performance for its division managers. The manager of Cleary Ceramics has the opportunity to undertake a new project that will require an investment of $100,000. This investment would earr $14,000 for the company. Read the requirements. Requirement 1. What is the original retum on investment (ROI) for Cleary Ceramics (before making any additional Investment)? First determine the formula to calculate the ROI. i Requirements + = ROL 1. What is the original return on investment (ROI) for Cleary Cerarnics (before making any additional Investment)? 2. What would the ROI be for Cleary Ceramics if this investment opportunity were undertaken? Would the manager of the Cleary Ceramics division want to make this investment if she wore evaluated based on ROI? Why or why not? 3. What is the ROI of the investment opportunity? Would the investment be desirable from the standpoint of Fielding Corporation? Why or why not? 4. What would the residual income (RI) be for Cleary Ceramics if this investment opportunity were to be undertaken? Would the manager of the Cleary Cerarrics division want to make this investment if she were evaluated based on RI? Why or why not? 5. What is the Rl of the investment opportunity? Would the investment be desirable from the standpoint of Fielding Corporation? Why or why not? 6. Which performance measurement method, ROI or RI, promotes goal congruence? Why? Choose from any drop-down list and then click Check Answer. Print DoneStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started