All solution hd be provided

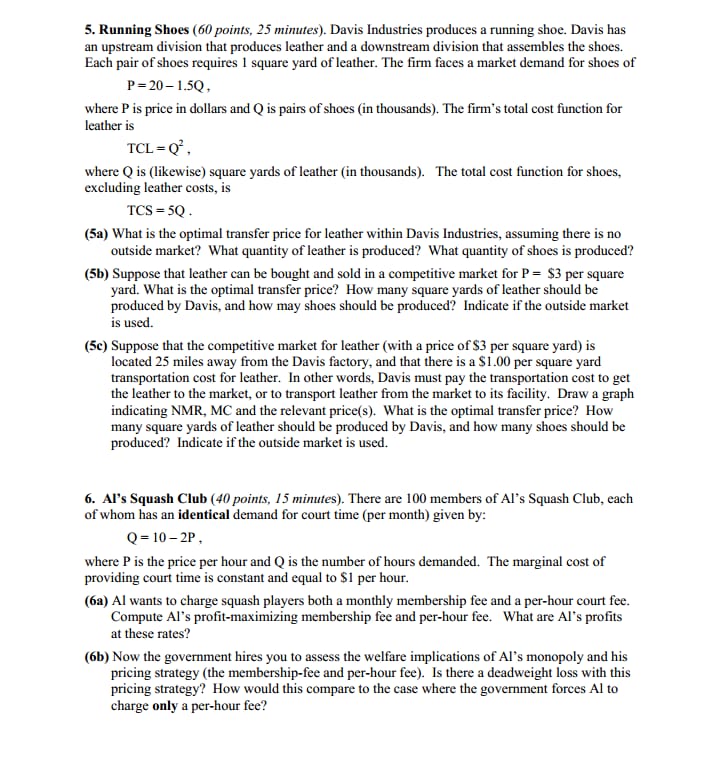

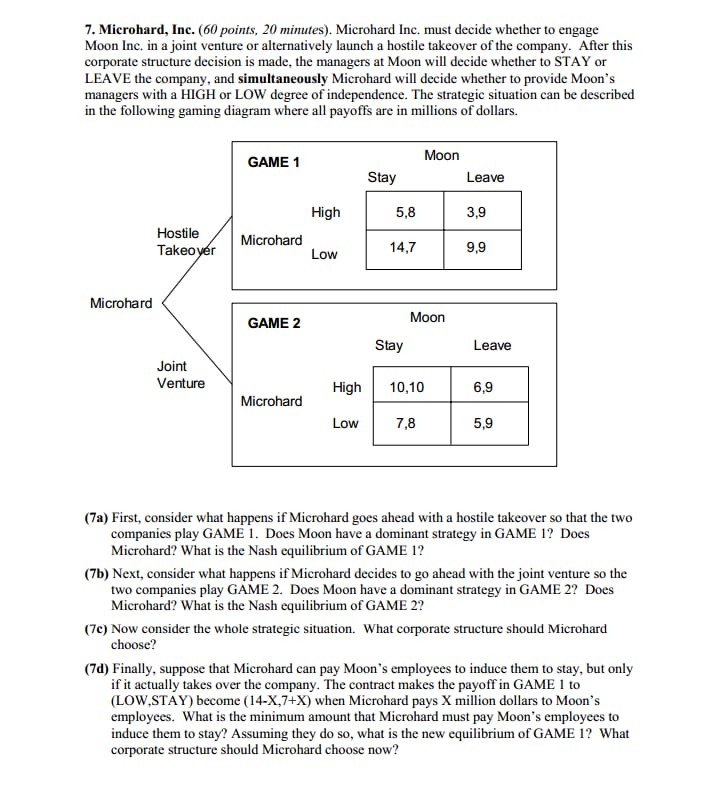

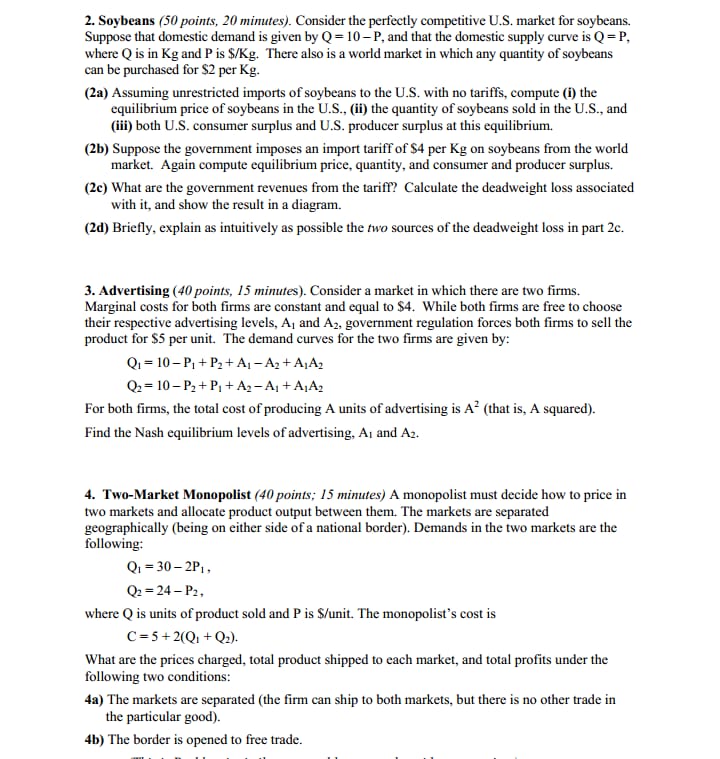

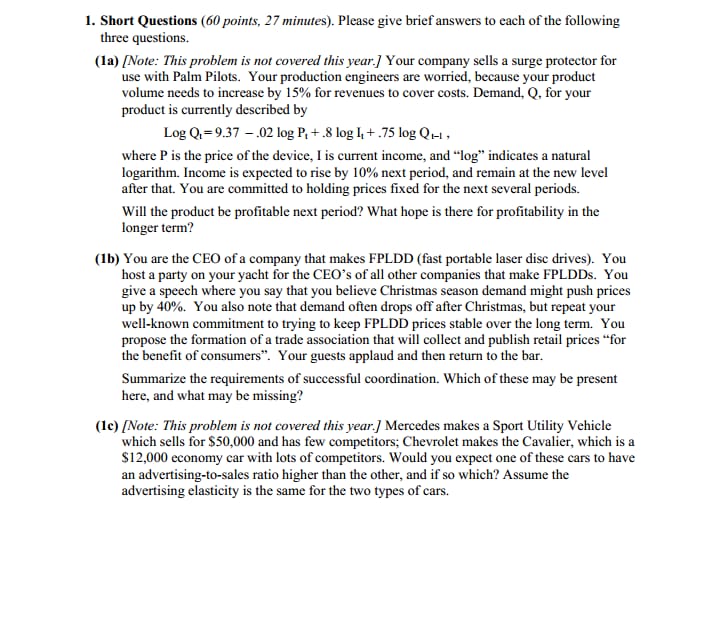

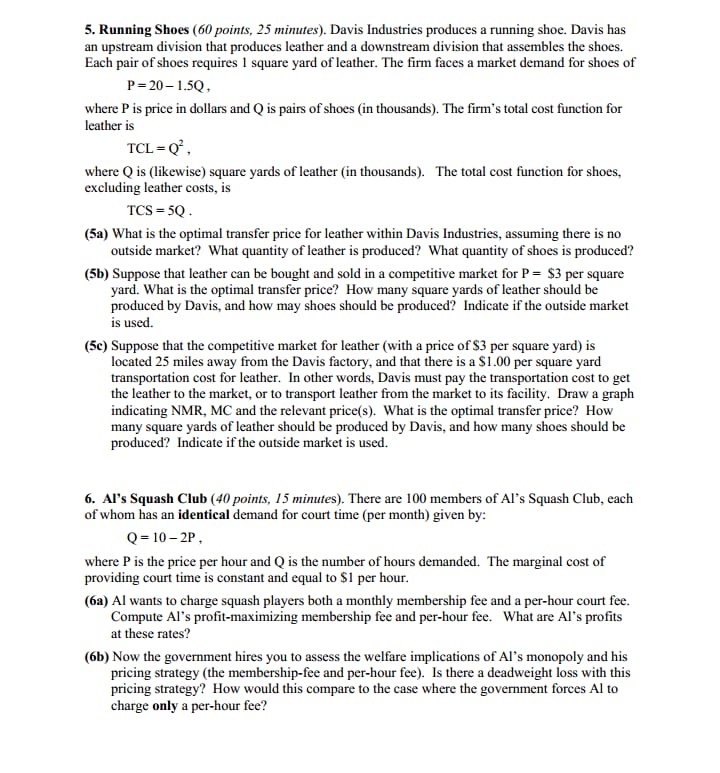

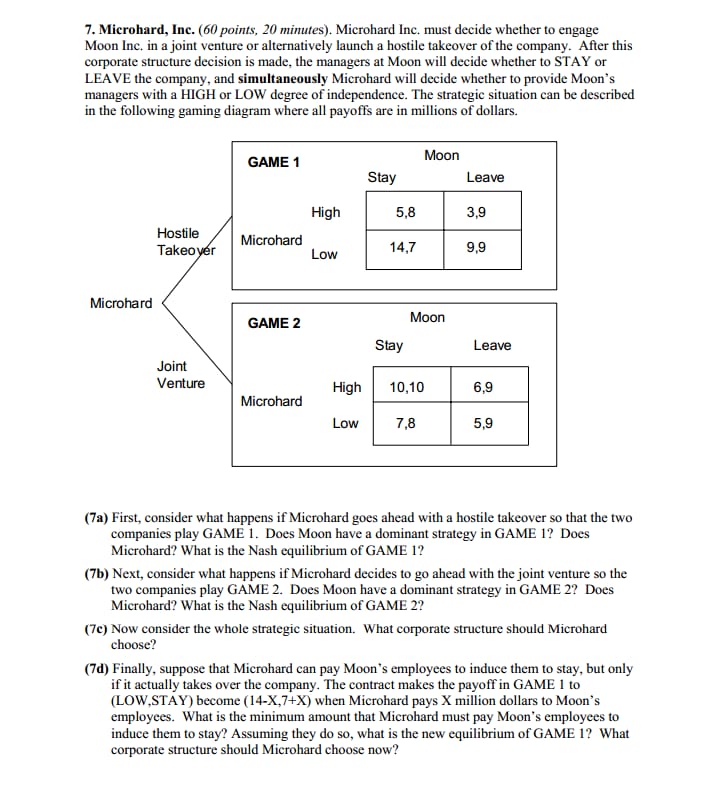

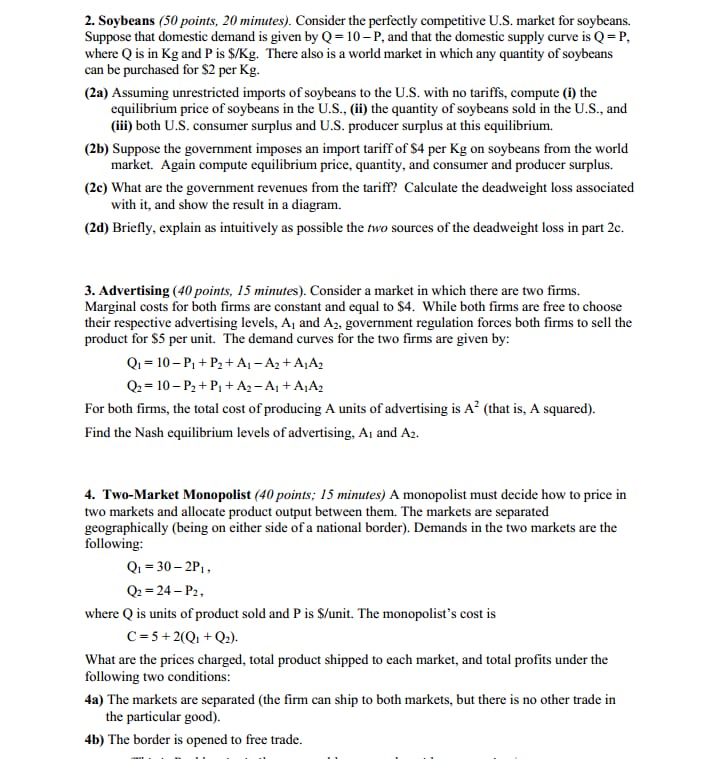

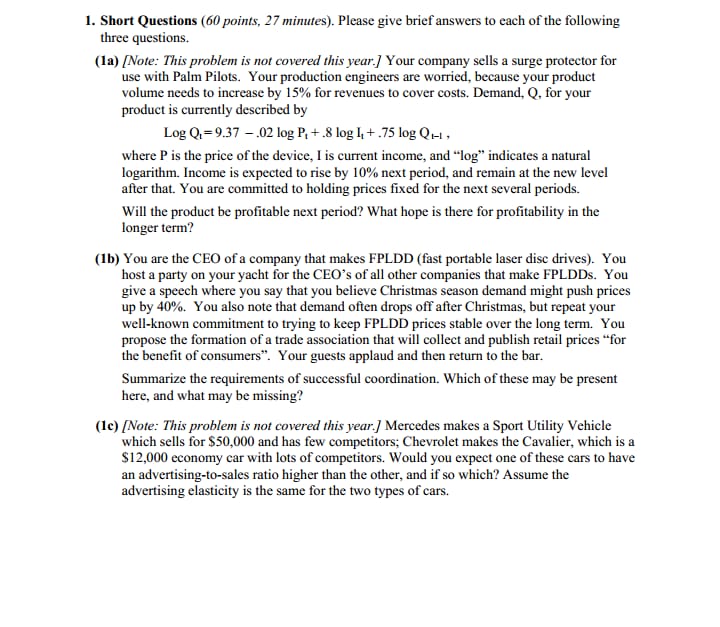

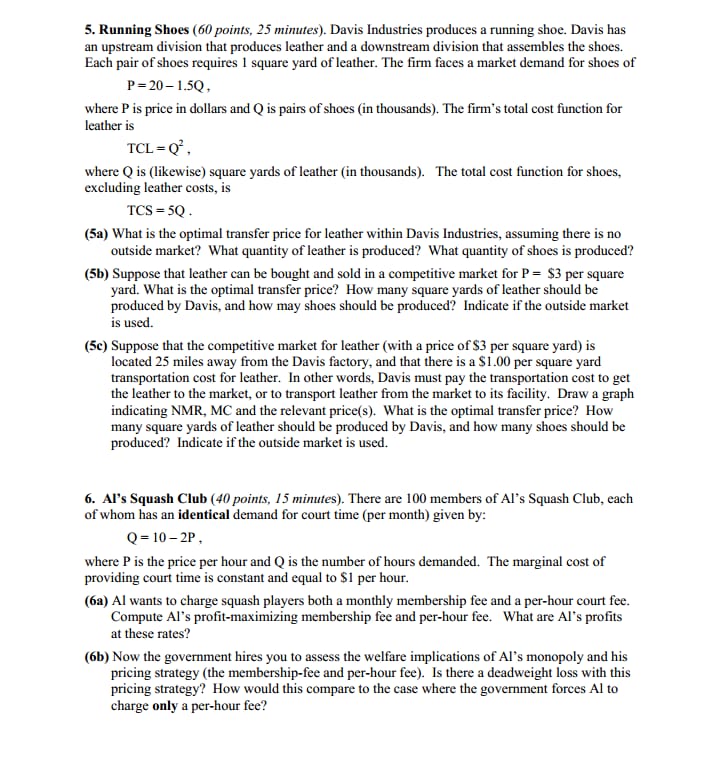

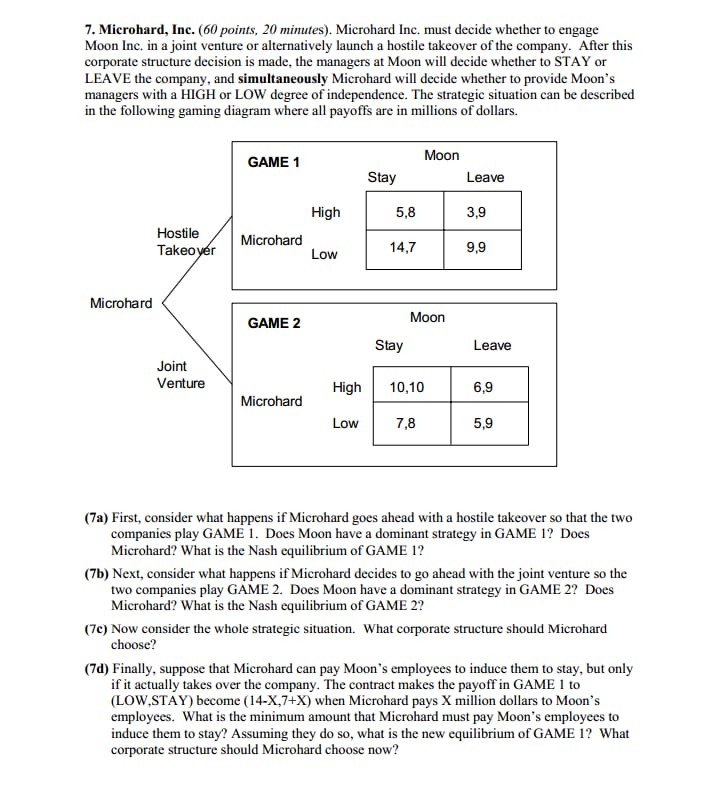

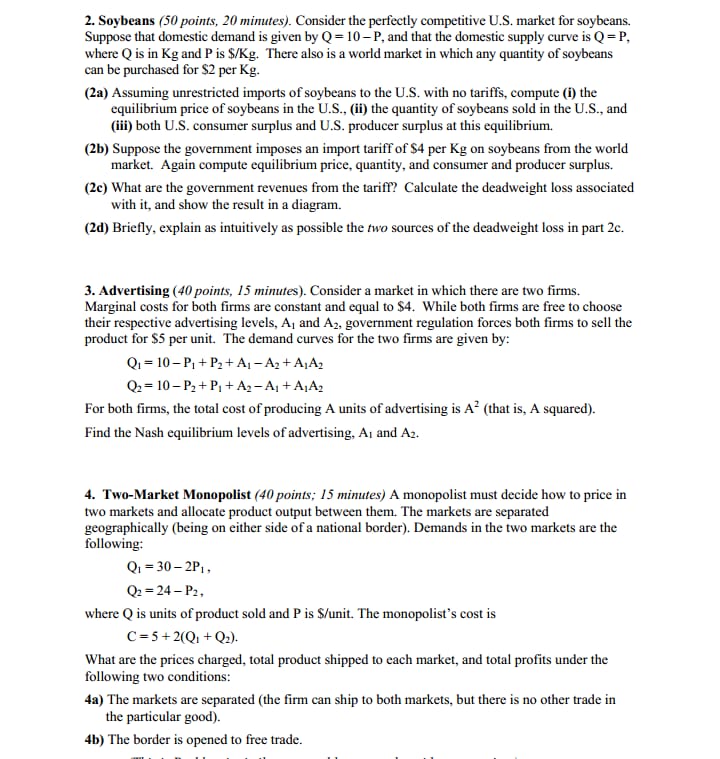

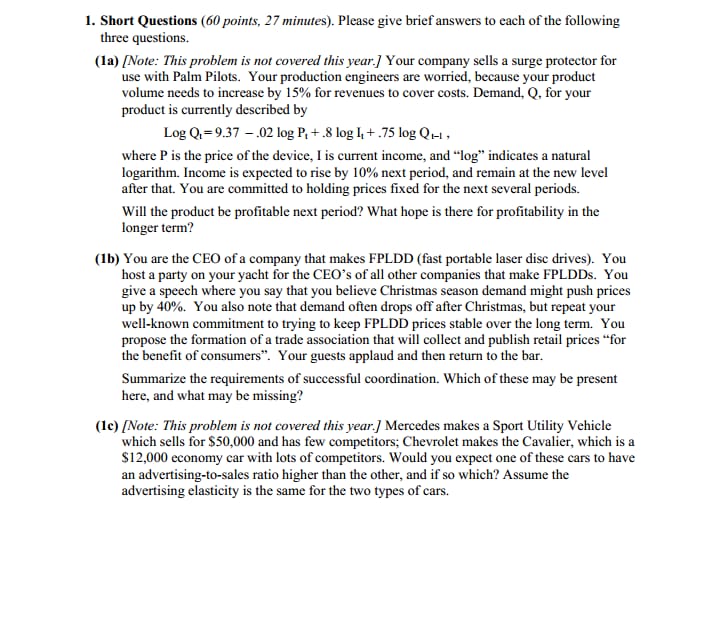

5. Running Shoes (60 points, 25 minutes). Davis Industries produces a running shoe. Davis has an upstream division that produces leather and a downstream division that assembles the shoes. Each pair of shoes requires 1 square yard of leather. The firm faces a market demand for shoes of P=20-1.5Q. where P is price in dollars and Q is pairs of shoes (in thousands). The firm's total cost function for leather is TCL = Q' , where Q is (likewise) square yards of leather (in thousands). The total cost function for shoes, excluding leather costs, is TCS = 5Q . (5a) What is the optimal transfer price for leather within Davis Industries, assuming there is no outside market? What quantity of leather is produced? What quantity of shoes is produced? (5b) Suppose that leather can be bought and sold in a competitive market for P = $3 per square yard. What is the optimal transfer price? How many square yards of leather should be produced by Davis, and how may shoes should be produced? Indicate if the outside market is used. (5c) Suppose that the competitive market for leather (with a price of $3 per square yard) is located 25 miles away from the Davis factory, and that there is a $1.00 per square yard transportation cost for leather. In other words, Davis must pay the transportation cost to get the leather to the market, or to transport leather from the market to its facility. Draw a graph indicating NMR, MC and the relevant price(s). What is the optimal transfer price? How many square yards of leather should be produced by Davis, and how many shoes should be produced? Indicate if the outside market is used. 6. Al's Squash Club (40 points, 15 minutes). There are 100 members of Al's Squash Club, each of whom has an identical demand for court time (per month) given by: Q =10-2P where P is the price per hour and Q is the number of hours demanded. The marginal cost of providing court time is constant and equal to $1 per hour. (6a) Al wants to charge squash players both a monthly membership fee and a per-hour court fee. Compute Al's profit-maximizing membership fee and per-hour fee. What are Al's profits at these rates? (6b) Now the government hires you to assess the welfare implications of Al's monopoly and his pricing strategy (the membership-fee and per-hour fee). Is there a deadweight loss with this pricing strategy? How would this compare to the case where the government forces Al to charge only a per-hour fee?7. Microhard, Inc. (60 points, 20 minutes). Microhard Inc. must decide whether to engage Moon Inc. in a joint venture or alternatively launch a hostile takeover of the company. After this corporate structure decision is made, the managers at Moon will decide whether to STAY or LEAVE the company, and simultaneously Microhard will decide whether to provide Moon's managers with a HIGH or LOW degree of independence. The strategic situation can be described in the following gaming diagram where all payoffs are in millions of dollars. GAME 1 Moon Stay Leave High 5.8 3.9 Hostile Microhard Takeover Low 14,7 9.9 Microhard GAME 2 Moon Stay Leave Joint Venture High 10,10 6,9 Microhard Low 7,8 5,9 (7a) First, consider what happens if Microhard goes ahead with a hostile takeover so that the two companies play GAME 1. Does Moon have a dominant strategy in GAME 1? Does Microhard? What is the Nash equilibrium of GAME 1? (7b) Next, consider what happens if Microhard decides to go ahead with the joint venture so the two companies play GAME 2. Does Moon have a dominant strategy in GAME 2? Does Microhard? What is the Nash equilibrium of GAME 2? (7c) Now consider the whole strategic situation. What corporate structure should Microhard choose? (7d) Finally, suppose that Microhard can pay Moon's employees to induce them to stay, but only if it actually takes over the company. The contract makes the payoff in GAME 1 to (LOW,STAY) become (14-X,7+X) when Microhard pays X million dollars to Moon's employees. What is the minimum amount that Microhard must pay Moon's employees to induce them to stay? Assuming they do so, what is the new equilibrium of GAME 1? What corporate structure should Microhard choose now?2. Soybeans (50 points, 20 minutes). Consider the perfectly competitive U.S. market for soybeans. Suppose that domestic demand is given by Q = 10-P, and that the domestic supply curve is Q = P, where Q is in Kg and P is $/Kg. There also is a world market in which any quantity of soybeans can be purchased for $2 per Kg. (2a) Assuming unrestricted imports of soybeans to the U.S. with no tariffs, compute (i) the equilibrium price of soybeans in the U.S., (ii) the quantity of soybeans sold in the U.S., and (iii) both U.S. consumer surplus and U.S. producer surplus at this equilibrium. (2b) Suppose the government imposes an import tariff of $4 per Kg on soybeans from the world market. Again compute equilibrium price, quantity, and consumer and producer surplus. (2c) What are the government revenues from the tariff? Calculate the deadweight loss associated with it, and show the result in a diagram. (2d) Briefly, explain as intuitively as possible the two sources of the deadweight loss in part 2c. 3. Advertising (40 points, 15 minutes). Consider a market in which there are two firms. Marginal costs for both firms are constant and equal to $4. While both firms are free to choose heir respective advertising levels, A, and Az, government regulation forces both firms to sell the product for $5 per unit. The demand curves for the two firms are given by: Q1 = 10-P1 + P2 + Al -A + AJA Q2 =10-P2+ P, + A2 -A1 + AJA For both firms, the total cost of producing A units of advertising is A" (that is, A squared). Find the Nash equilibrium levels of advertising, A, and Az. 4. Two-Market Monopolist (40 points; 15 minutes) A monopolist must decide how to price in two markets and allocate product output between them. The markets are separated geographically (being on either side of a national border). Demands in the two markets are the following: Q1 = 30-2P1 , Q2 =24-P2, where Q is units of product sold and P is S/unit. The monopolist's cost is C=5+2(Q1 + Q2). What are the prices charged, total product shipped to each market, and total profits under the following two conditions: la) The markets are separated (the firm can ship to both markets, but there is no other trade in the particular good). 4b) The border is opened to free trade.1. Short Questions (60 points, 27 minutes). Please give brief answers to each of the following three questions. (la) [Note: This problem is not covered this year.] Your company sells a surge protector for use with Palm Pilots. Your production engineers are worried, because your product volume needs to increase by 15% for revenues to cover costs. Demand, Q, for your product is currently described by Log Q1=9.37 - .02 log P, + .8 log I, + .75 log QUI , where P is the price of the device, I is current income, and "log" indicates a natural logarithm. Income is expected to rise by 10% next period, and remain at the new level after that. You are committed to holding prices fixed for the next several periods. Will the product be profitable next period? What hope is there for profitability in the longer term? (1b) You are the CEO of a company that makes FPLDD (fast portable laser disc drives). You host a party on your yacht for the CEO's of all other companies that make FPLDDs. You give a speech where you say that you believe Christmas season demand might push prices up by 40%. You also note that demand often drops off after Christmas, but repeat your well-known commitment to trying to keep FPLDD prices stable over the long term. You propose the formation of a trade association that will collect and publish retail prices "for the benefit of consumers". Your guests applaud and then return to the bar. Summarize the requirements of successful coordination. Which of these may be present here, and what may be missing? (lc) [Note: This problem is not covered this year.] Mercedes makes a Sport Utility Vehicle which sells for $50,000 and has few competitors; Chevrolet makes the Cavalier, which is a $12,000 economy car with lots of competitors. Would you expect one of these cars to have an advertising-to-sales ratio higher than the other, and if so which? Assume the advertising elasticity is the same for the two types of cars