Answered step by step

Verified Expert Solution

Question

1 Approved Answer

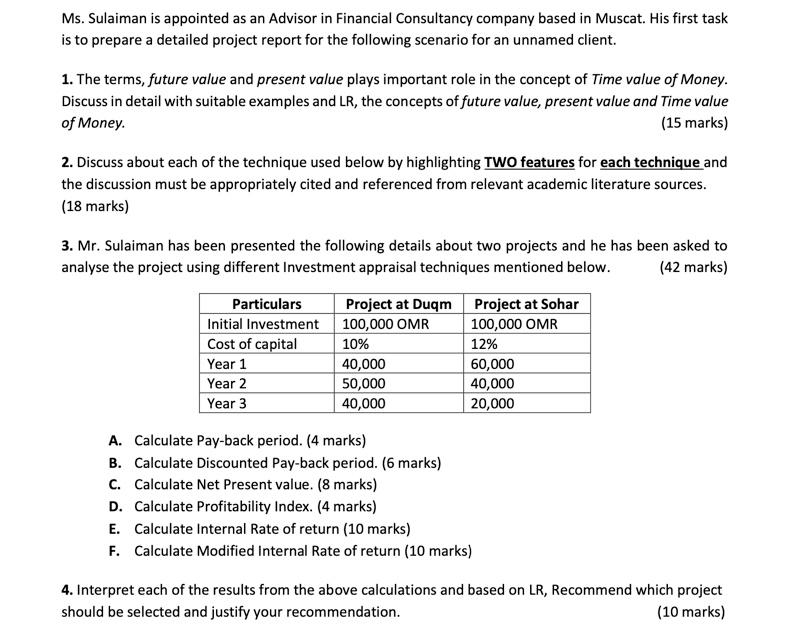

All steps are to be provided for the above calculations. Ms. Sulaiman is appointed as an Advisor in Financial Consultancy company based in Muscat. His

All steps are to be provided for the above calculations.

Ms. Sulaiman is appointed as an Advisor in Financial Consultancy company based in Muscat. His first task is to prepare a detailed project report for the following scenario for an unnamed client. 1. The terms, future value and present value plays important role in the concept of Time value of Money. Discuss in detail with suitable examples and LR, the concepts of future value, present value and Time value of Money. (15 marks) 2. Discuss about each of the technique used below by highlighting TWO features for each technique and the discussion must be appropriately cited and referenced from relevant academic literature sources. (18 marks) 3. Mr. Sulaiman has been presented the following details about two projects and he has been asked to analyse the project using different Investment appraisal techniques mentioned below. (42 marks) Particulars Project at Duqm Project at Sohar Initial Investment 100,000 OMR 100,000 OMR Cost of capital 10% 12% Year 1 40,000 60,000 Year 2 50,000 40,000 Year 3 40,000 20,000 A. Calculate Pay-back period. (4 marks) B. Calculate Discounted Pay-back period. (6 marks) C. Calculate Net Present value. (8 marks) D. Calculate Profitability Index. (4 marks) E. Calculate Internal Rate of return (10 marks) F. Calculate Modified Internal Rate of return (10 marks) 4. Interpret each of the results from the above calculations and based on LR, Recommend which project should be selected and justify your recommendation. (10 marks) Ms. Sulaiman is appointed as an Advisor in Financial Consultancy company based in Muscat. His first task is to prepare a detailed project report for the following scenario for an unnamed client. 1. The terms, future value and present value plays important role in the concept of Time value of Money. Discuss in detail with suitable examples and LR, the concepts of future value, present value and Time value of Money. (15 marks) 2. Discuss about each of the technique used below by highlighting TWO features for each technique and the discussion must be appropriately cited and referenced from relevant academic literature sources. (18 marks) 3. Mr. Sulaiman has been presented the following details about two projects and he has been asked to analyse the project using different Investment appraisal techniques mentioned below. (42 marks) Particulars Project at Duqm Project at Sohar Initial Investment 100,000 OMR 100,000 OMR Cost of capital 10% 12% Year 1 40,000 60,000 Year 2 50,000 40,000 Year 3 40,000 20,000 A. Calculate Pay-back period. (4 marks) B. Calculate Discounted Pay-back period. (6 marks) C. Calculate Net Present value. (8 marks) D. Calculate Profitability Index. (4 marks) E. Calculate Internal Rate of return (10 marks) F. Calculate Modified Internal Rate of return (10 marks) 4. Interpret each of the results from the above calculations and based on LR, Recommend which project should be selected and justify your recommendation. (10 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started