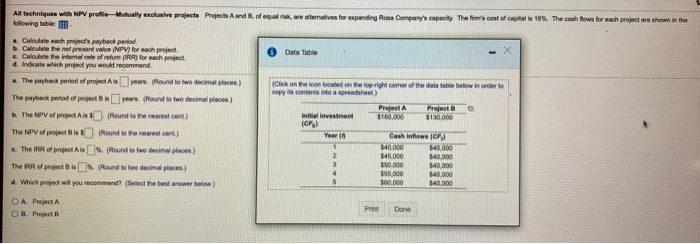

All techniques with NPV profile Mutually exclusive projects Projects and of equal risk, we atematives for expanding Rose Company's capacity The's cost of capital is 18%. The cash Bows for each project are shown in the following table: a. Calolate each project's payback period. b. Calculate the nel present value (NPV) for each project Data Table c. Calculate the internal rate of rain (IRR) for each project d. Indicate which project you would recommend The payback period of project AisyearsRound to we decimal places) (Click on the con cated on the top right comer of the date table below in order to copy its contents into a spost) The payback period of project Byears. (Round to two decimal places Project A Projects o The Never pros Round to the nearest cert) Initial investment $160,000 $130.000 The NPV of projects Pound to the nearest cent) Cash Inflows (CF H0.000 $40.000 c. The IRR of project is % (Round to two decimal places) 2 145.000 140.000 350.000 140.000 The IRR of project is (Round to two decimal places) $55.000 $40.000 d. Which project will you recommend? (Select the best answer below) 300.000 $40.000 Year OA Project OS Project Print Done All techniques with NPV profile Mutually exclusive projects Projects and of equal risk, we atematives for expanding Rose Company's capacity The's cost of capital is 18%. The cash Bows for each project are shown in the following table: a. Calolate each project's payback period. b. Calculate the nel present value (NPV) for each project Data Table c. Calculate the internal rate of rain (IRR) for each project d. Indicate which project you would recommend The payback period of project AisyearsRound to we decimal places) (Click on the con cated on the top right comer of the date table below in order to copy its contents into a spost) The payback period of project Byears. (Round to two decimal places Project A Projects o The Never pros Round to the nearest cert) Initial investment $160,000 $130.000 The NPV of projects Pound to the nearest cent) Cash Inflows (CF H0.000 $40.000 c. The IRR of project is % (Round to two decimal places) 2 145.000 140.000 350.000 140.000 The IRR of project is (Round to two decimal places) $55.000 $40.000 d. Which project will you recommend? (Select the best answer below) 300.000 $40.000 Year OA Project OS Project Print Done