Answered step by step

Verified Expert Solution

Question

1 Approved Answer

All the data are adequate. Thank you Problem 4-3 (102) 70%, equity, beginning and ending inventory, subsidia seller. Refer to the preceding facts for Packard's

All the data are adequate. Thank you

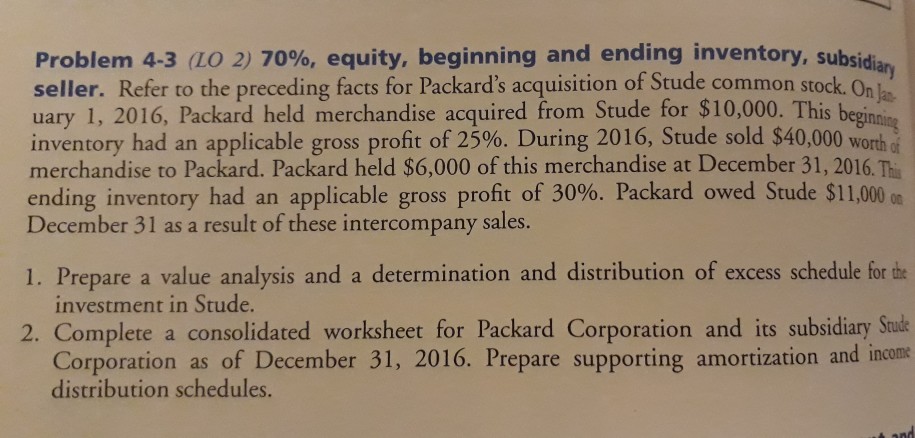

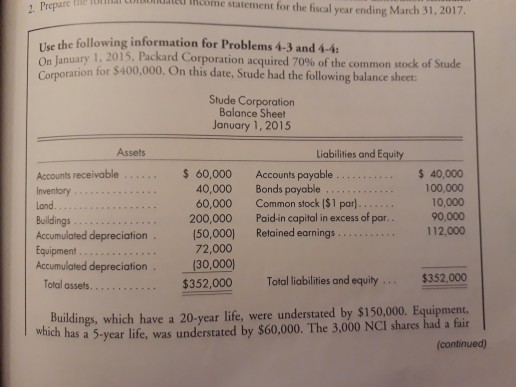

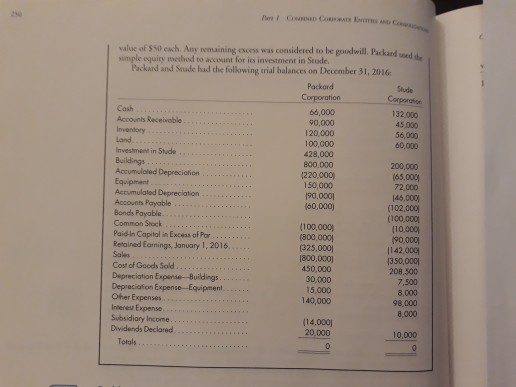

Problem 4-3 (102) 70%, equity, beginning and ending inventory, subsidia seller. Refer to the preceding facts for Packard's acquisition of Stude common stock. Onl uary 1, 2016, Packard held merchandise acquired from Stude for $10,000. This begintos inventory had an applicable gross profit of 25%. During 2016, Stude sold $40,000 worth. merchandise to Packard. Packard held $6,000 of this merchandise at December 31, 2016. TH ending inventory had an applicable gross profit of 30%. Packard owed Stude $11,000 on December 31 as a result of these intercompany sales. ry 1. Prepare a value analysis and a determination and distribution of excess schedule for the investment in Stude. 2. Complete a consolidated worksheet for Packard Corporation and its subsidiary Stude Corporation as of December 31, 2016. Prepare supporting amortization and incomt distribution schedules. Problem 4-3 (102) 70%, equity, beginning and ending inventory, subsidia seller. Refer to the preceding facts for Packard's acquisition of Stude common stock. Onl uary 1, 2016, Packard held merchandise acquired from Stude for $10,000. This begintos inventory had an applicable gross profit of 25%. During 2016, Stude sold $40,000 worth. merchandise to Packard. Packard held $6,000 of this merchandise at December 31, 2016. TH ending inventory had an applicable gross profit of 30%. Packard owed Stude $11,000 on December 31 as a result of these intercompany sales. ry 1. Prepare a value analysis and a determination and distribution of excess schedule for the investment in Stude. 2. Complete a consolidated worksheet for Packard Corporation and its subsidiary Stude Corporation as of December 31, 2016. Prepare supporting amortization and incomt distribution schedulesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started