All the data as requested, I need help with the summary and conclusion please 95% of the project it already completed. The variables and inuts are listed and the spread sheet shows the forumals within it.

All the data as requested, I need help with the summary and conclusion please 95% of the project it already completed. The variables and inuts are listed and the spread sheet shows the forumals within it.

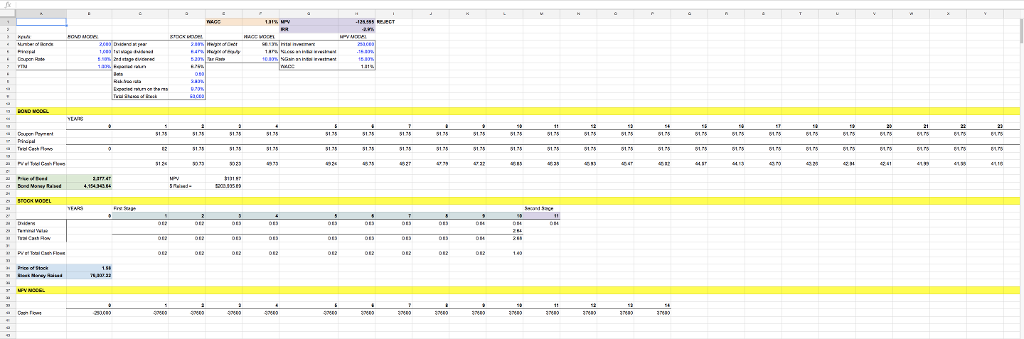

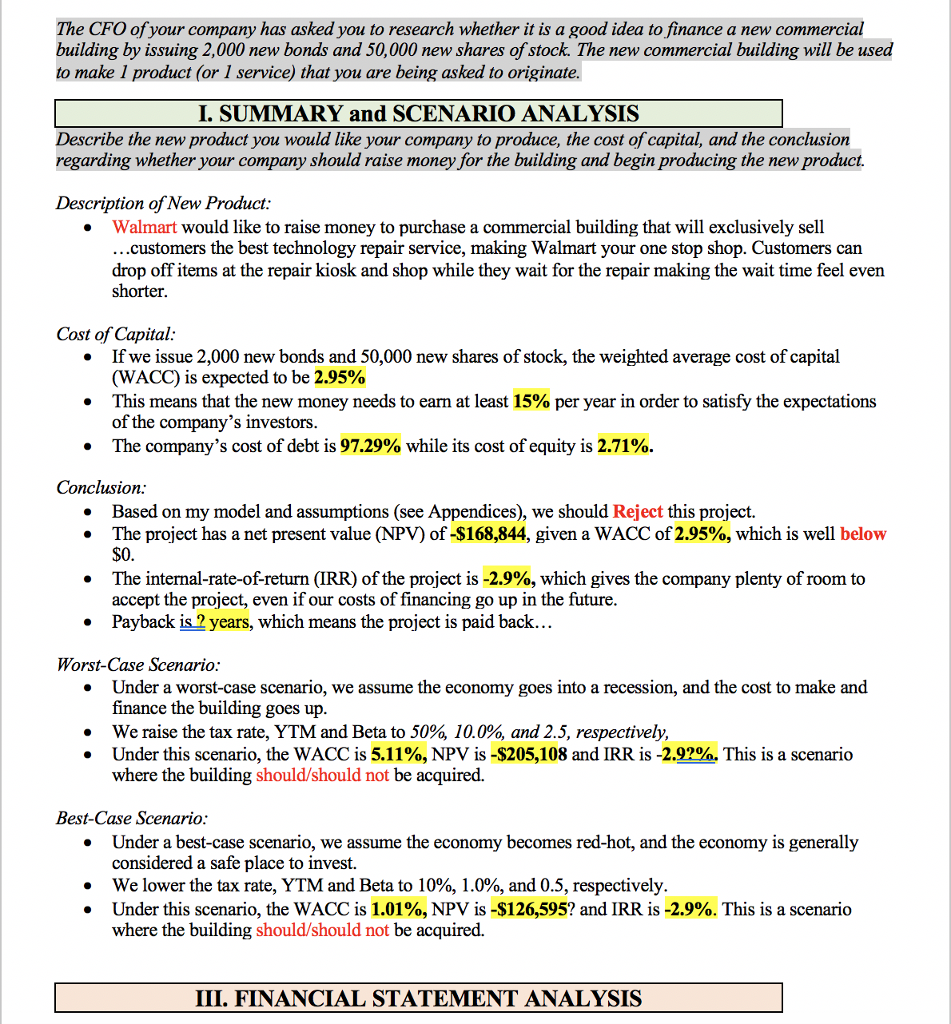

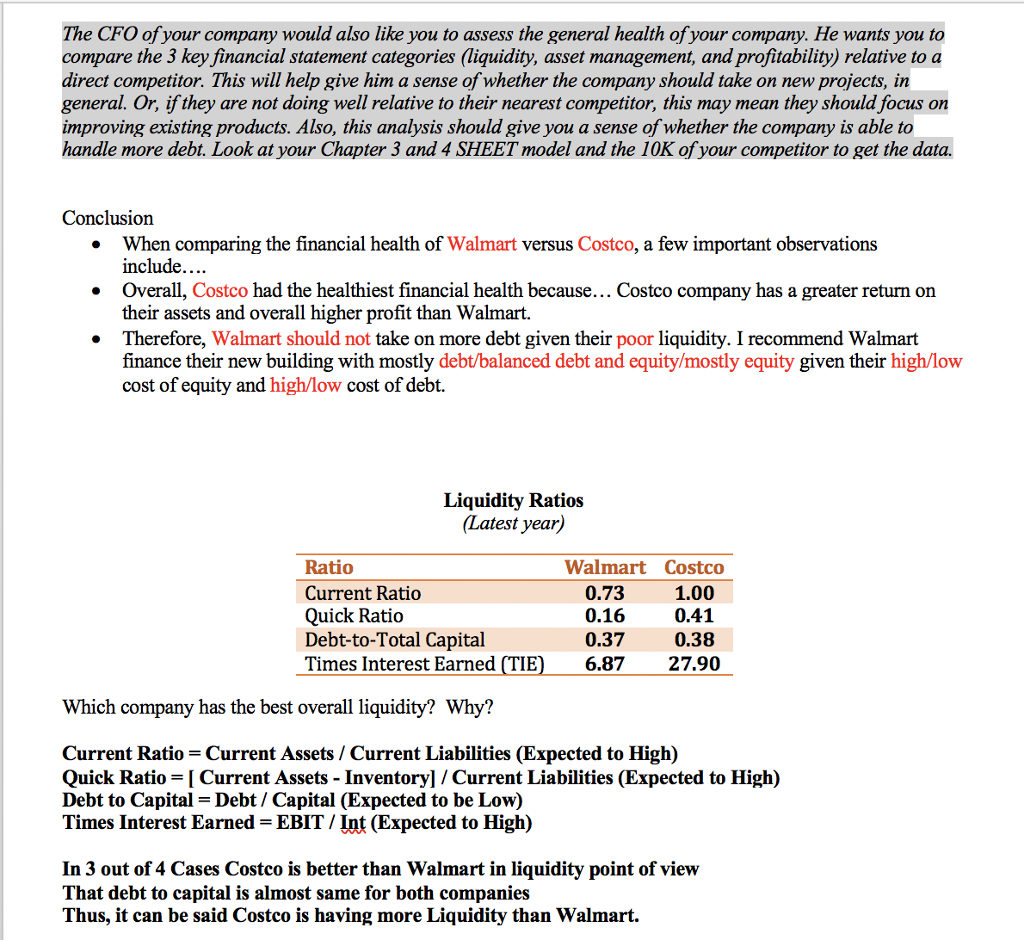

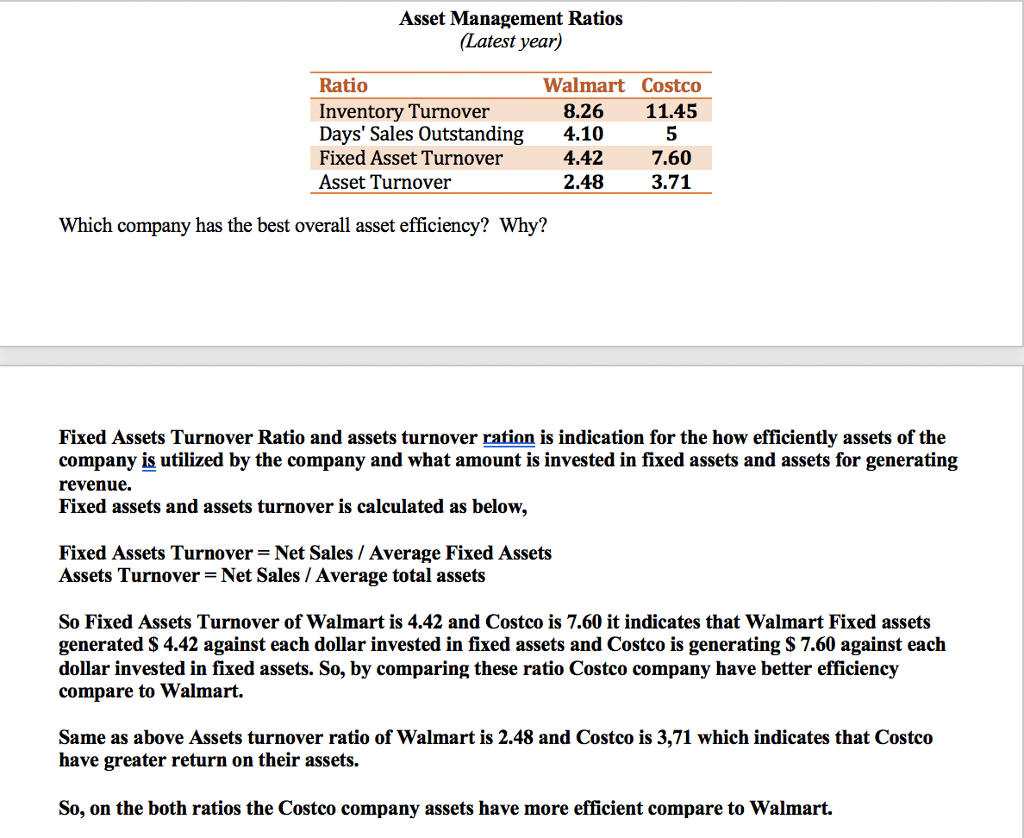

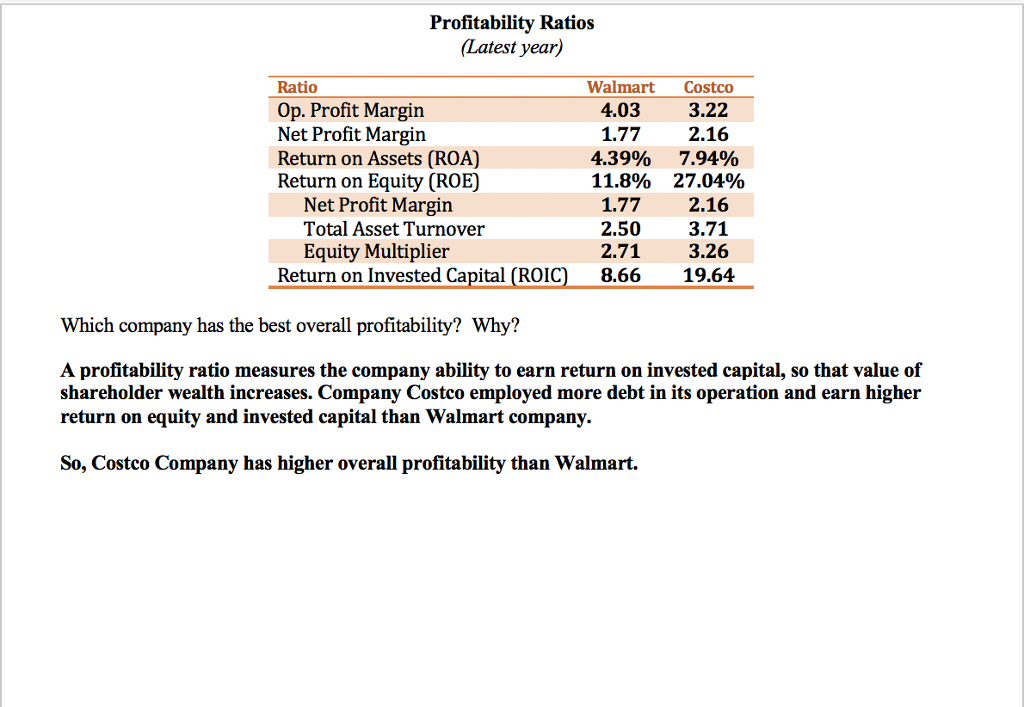

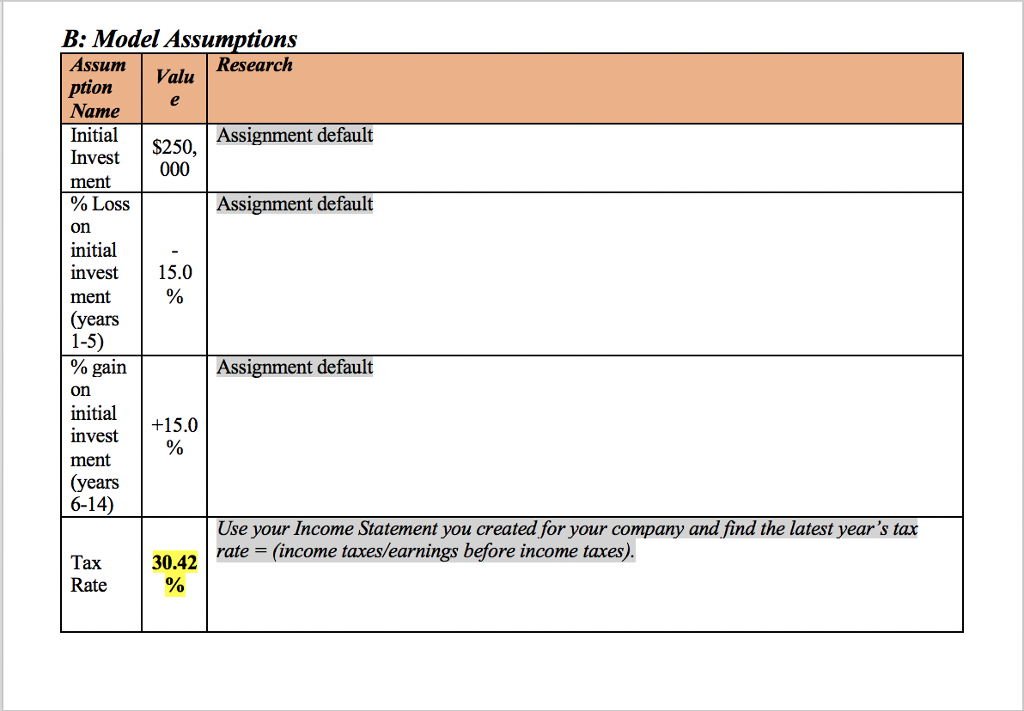

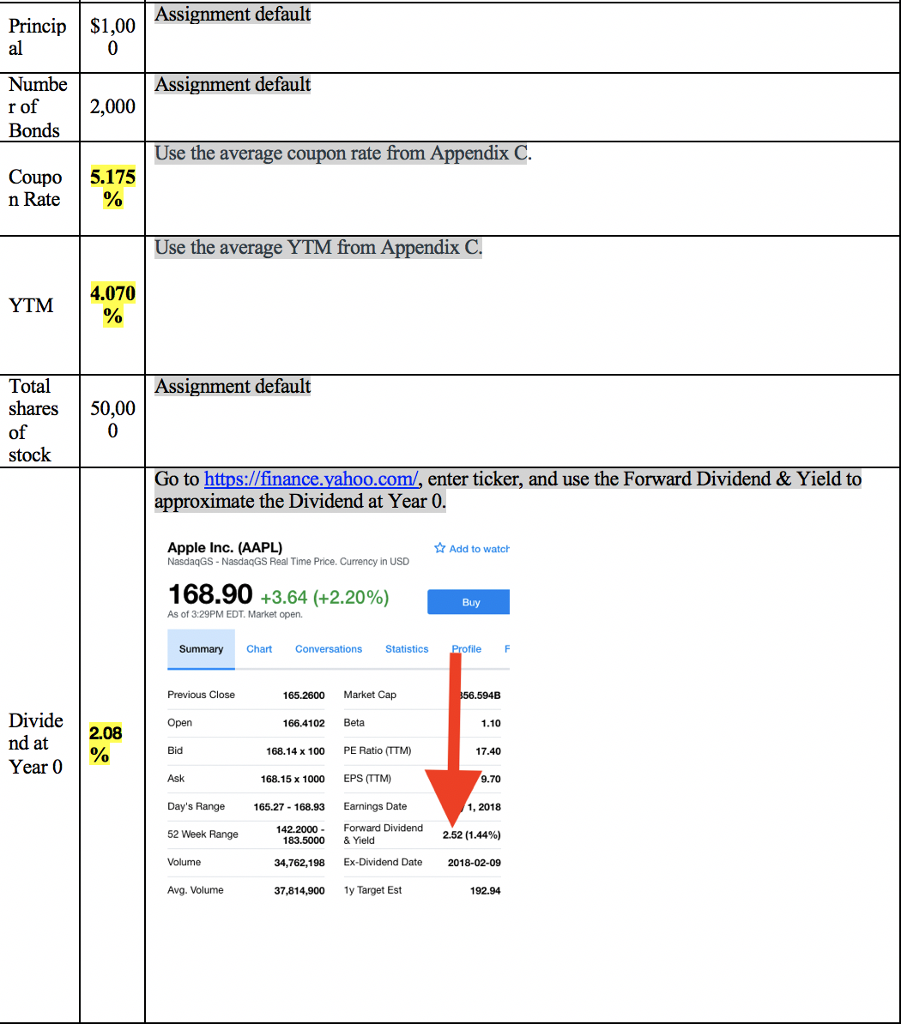

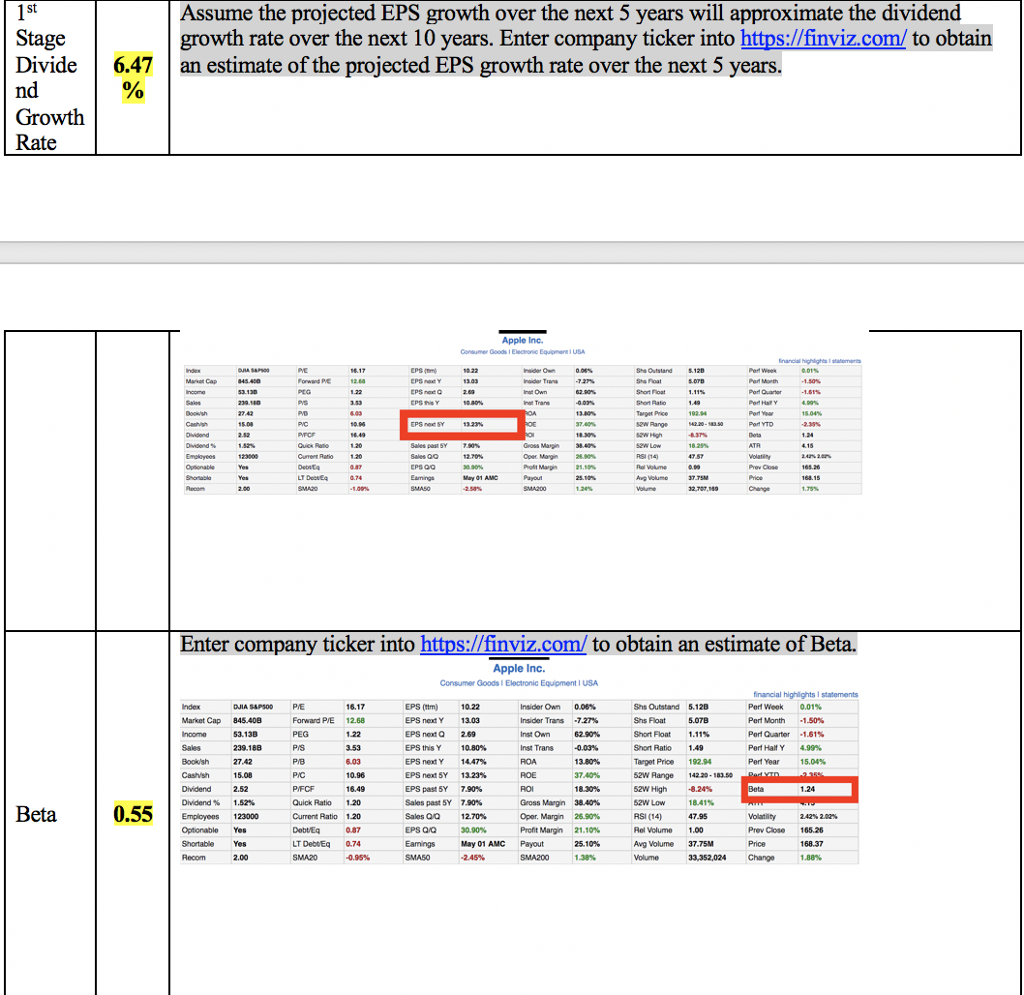

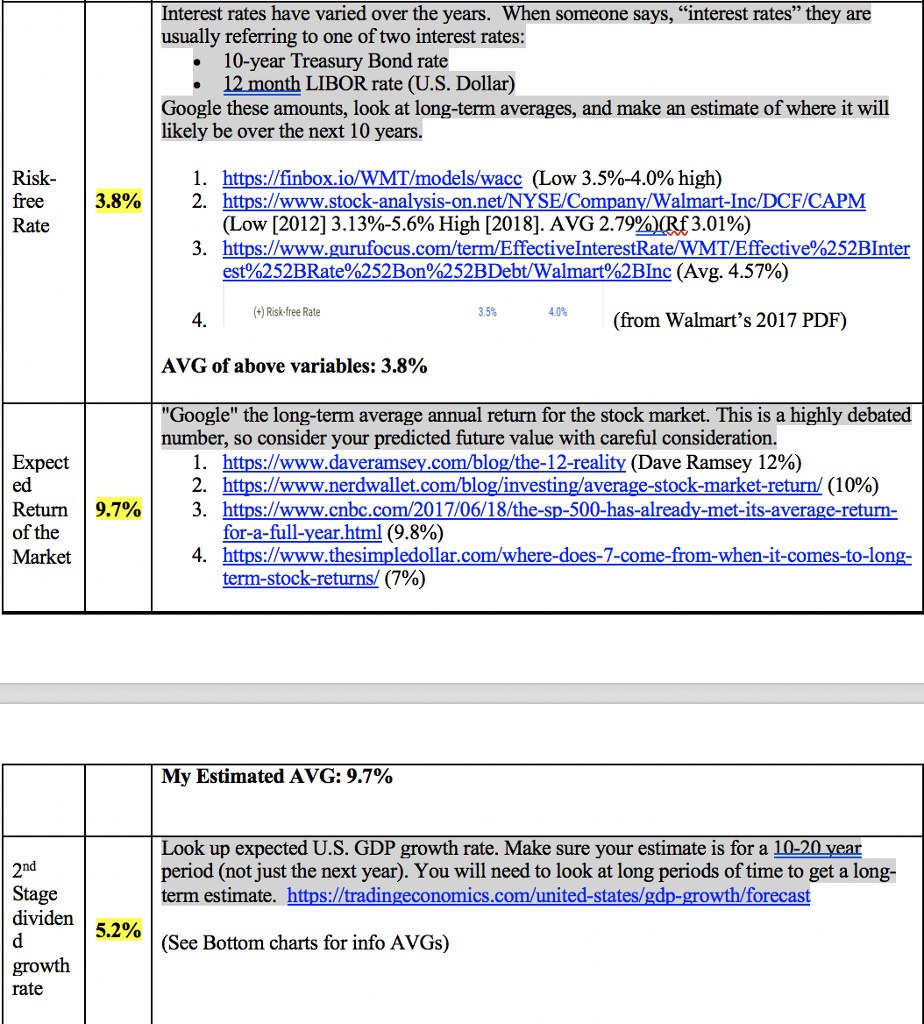

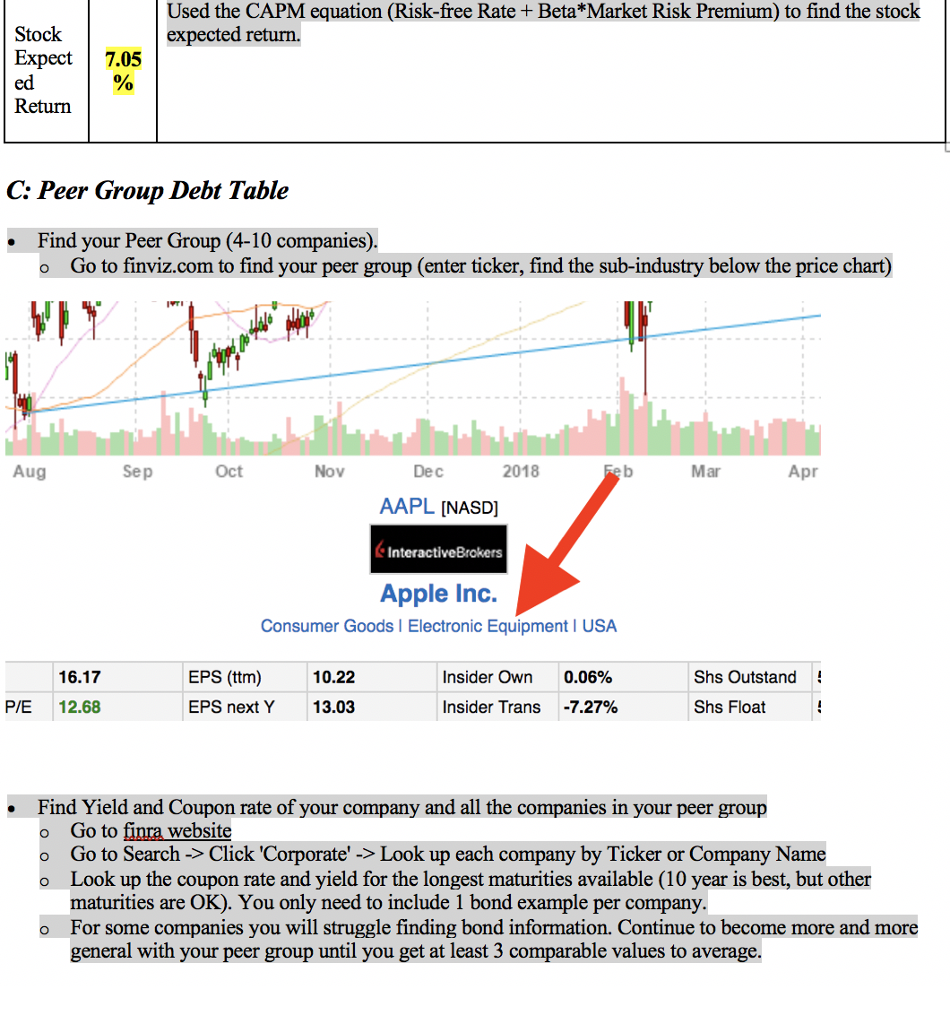

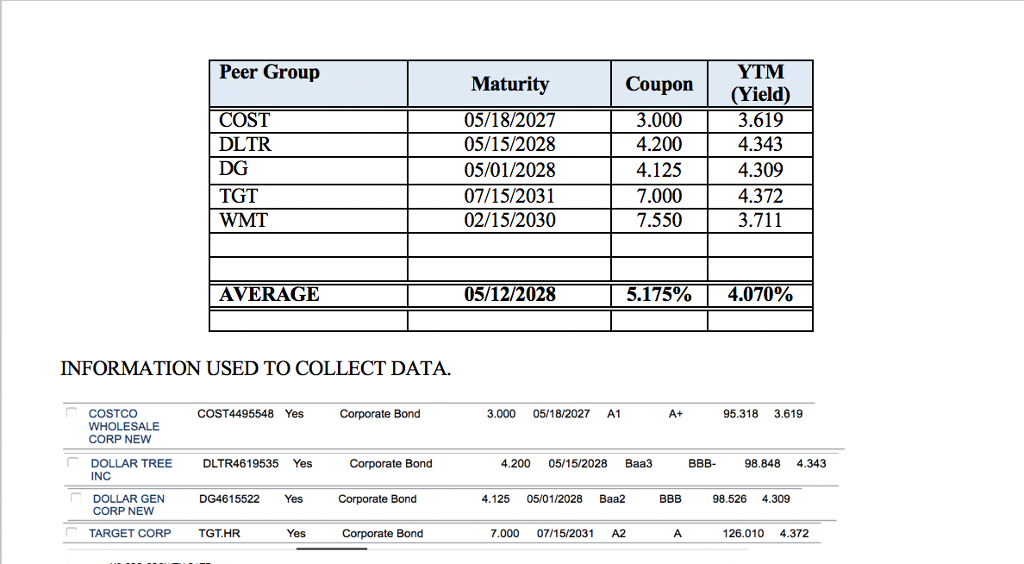

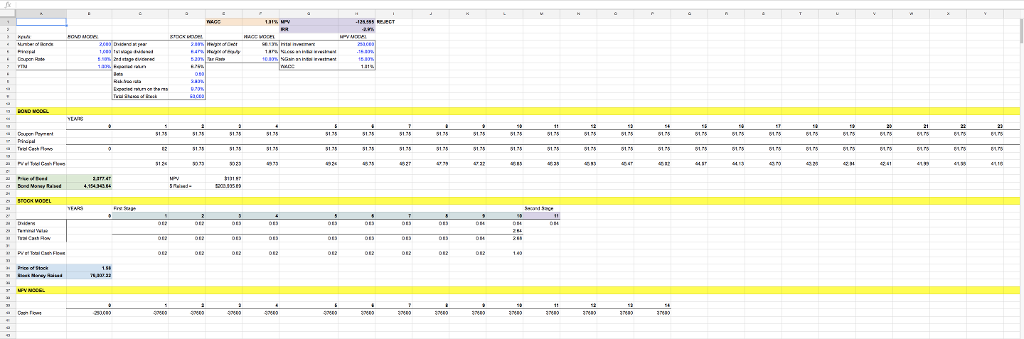

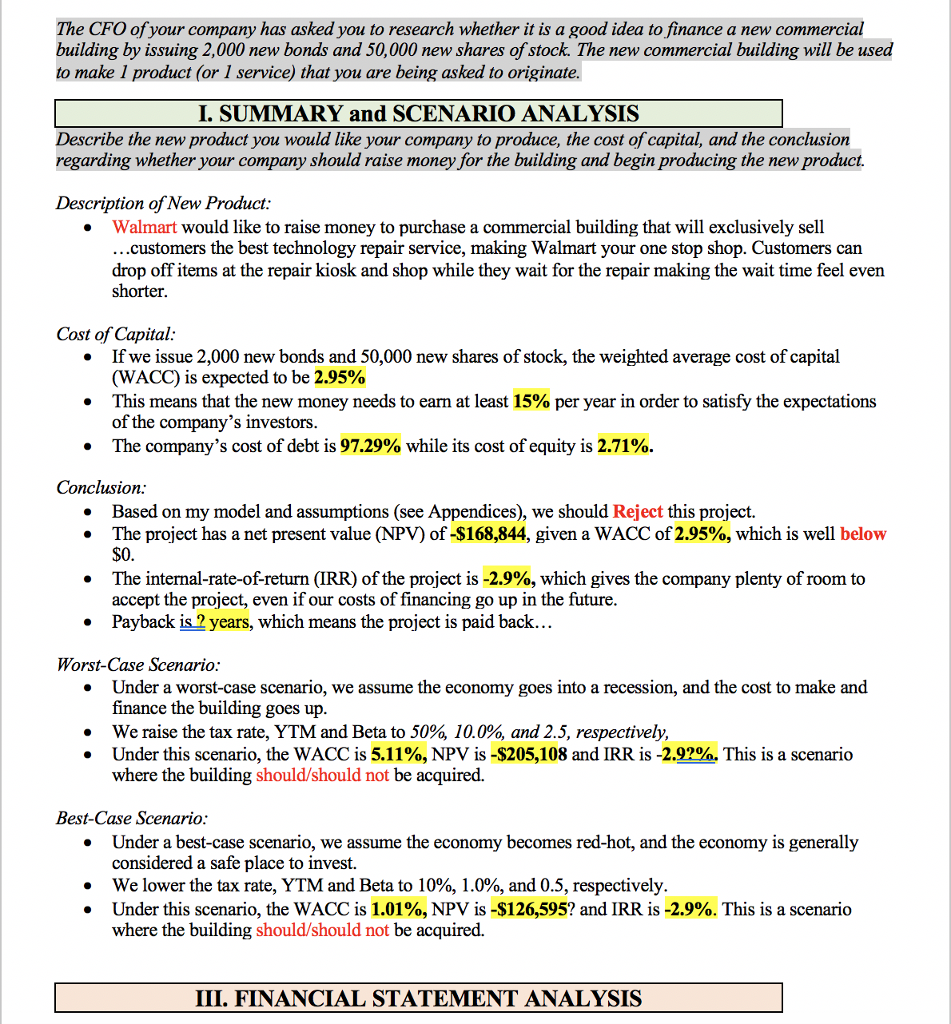

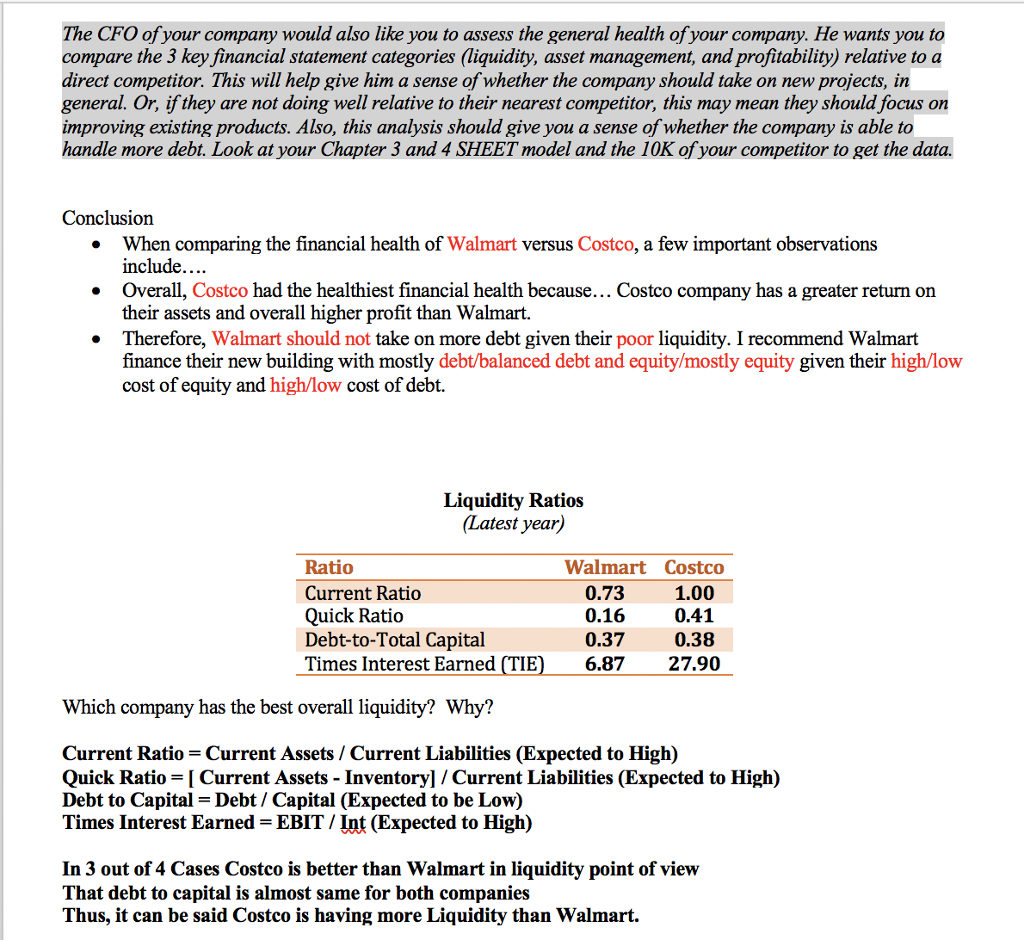

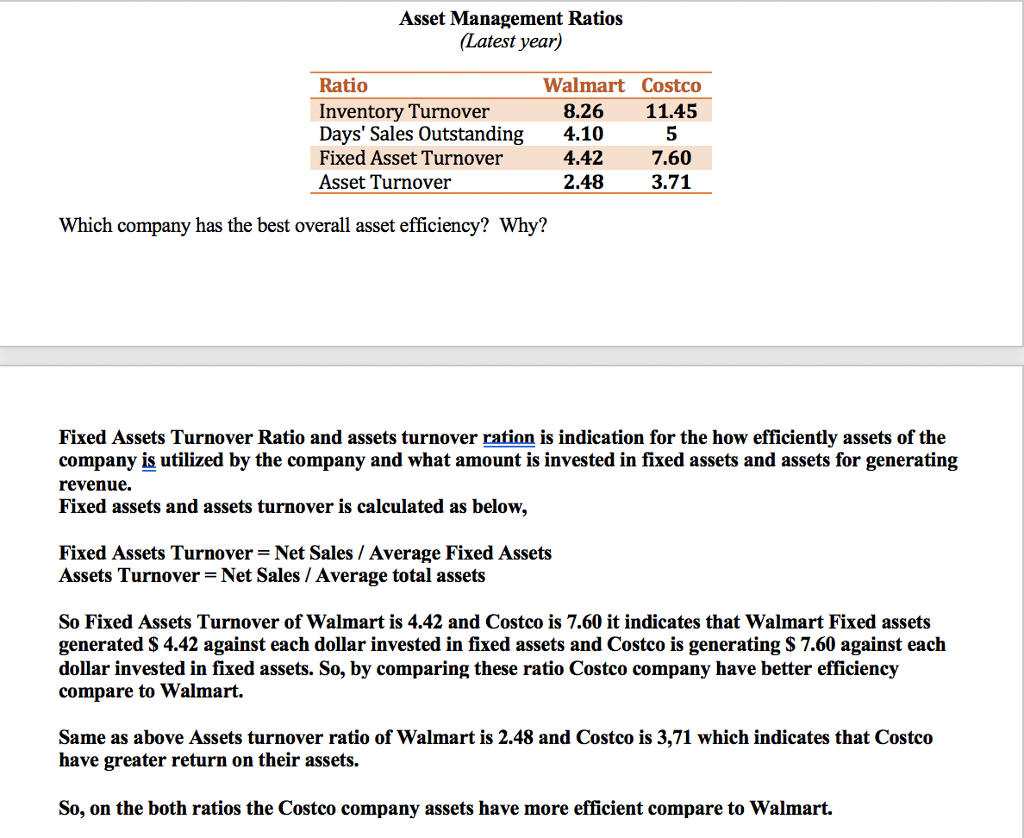

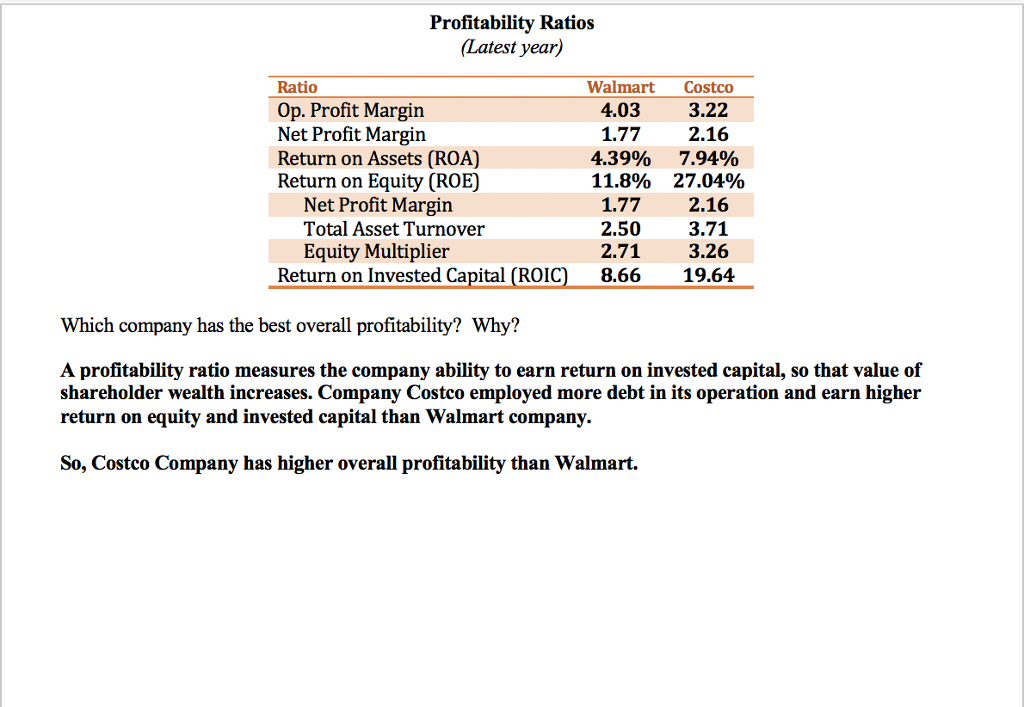

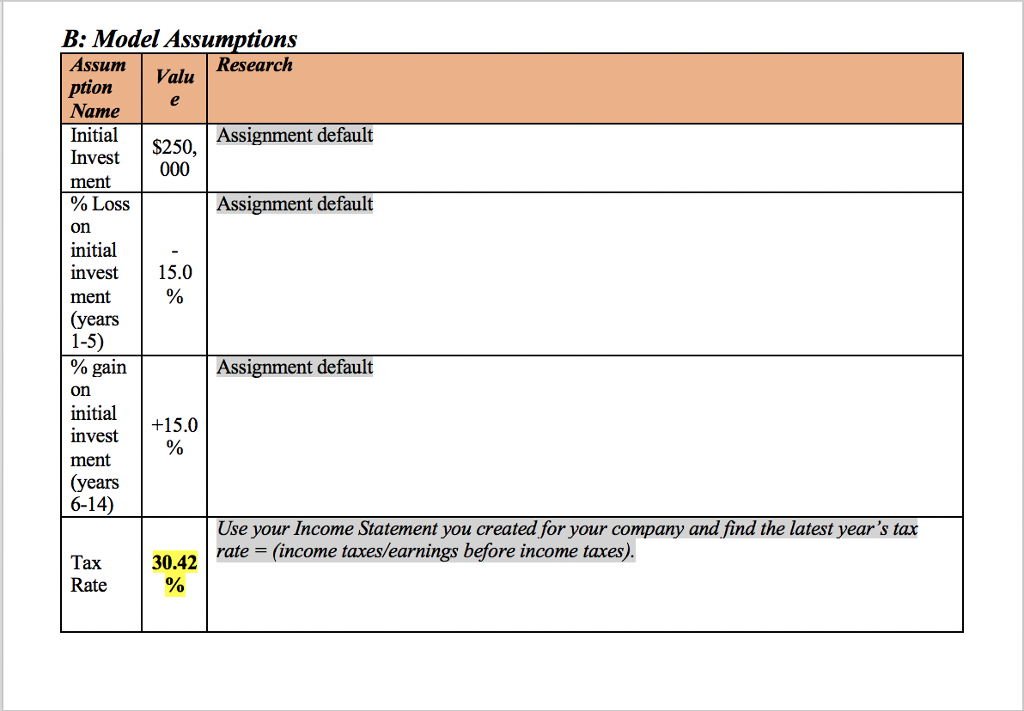

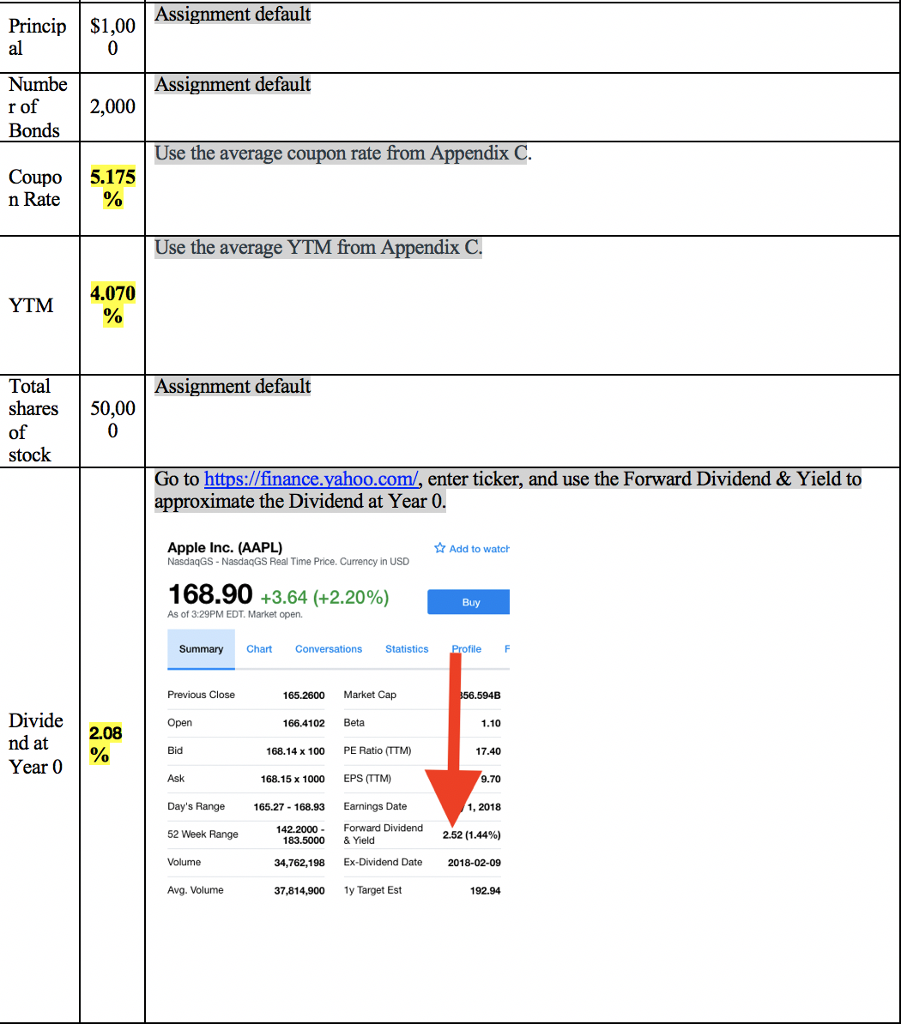

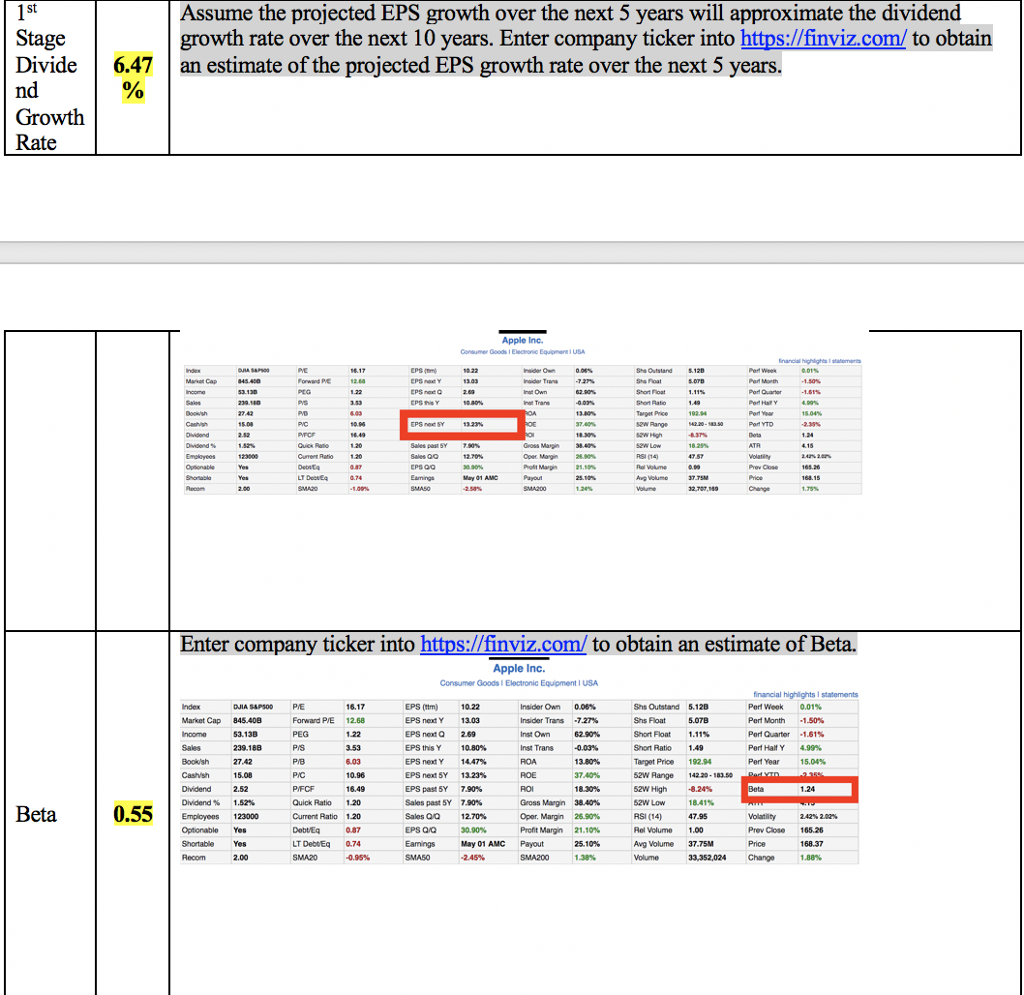

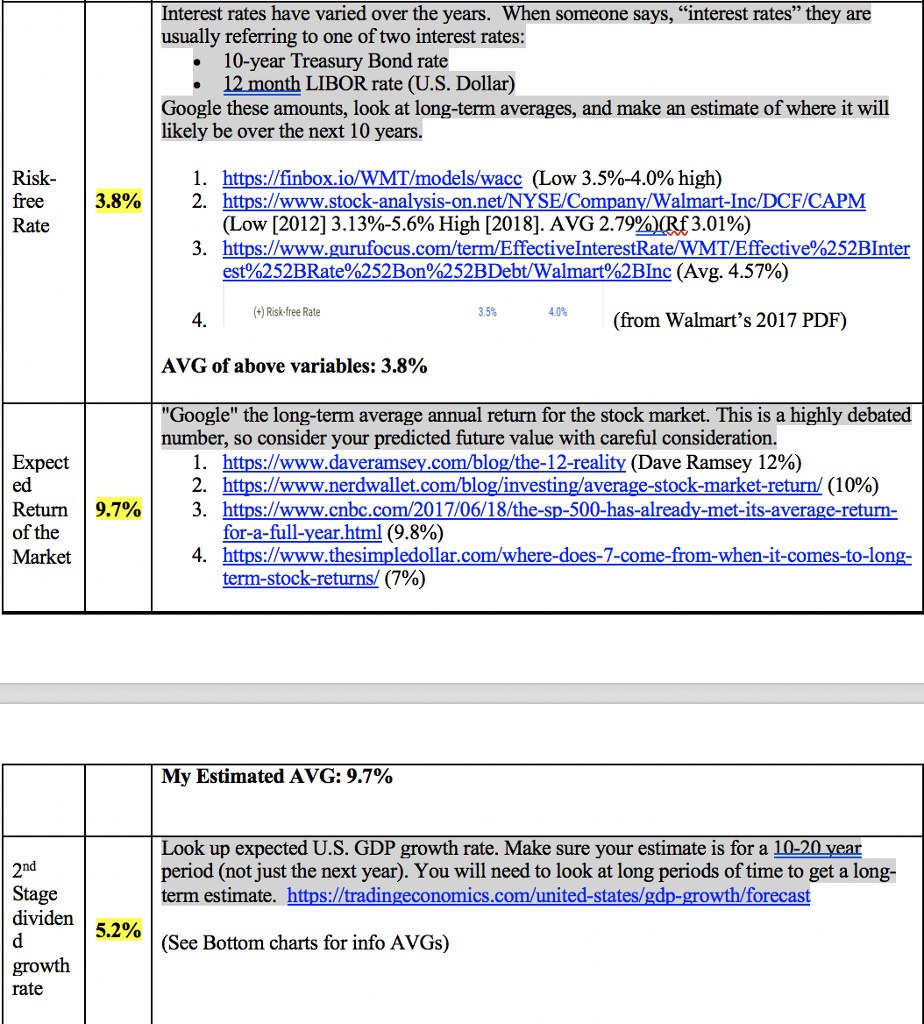

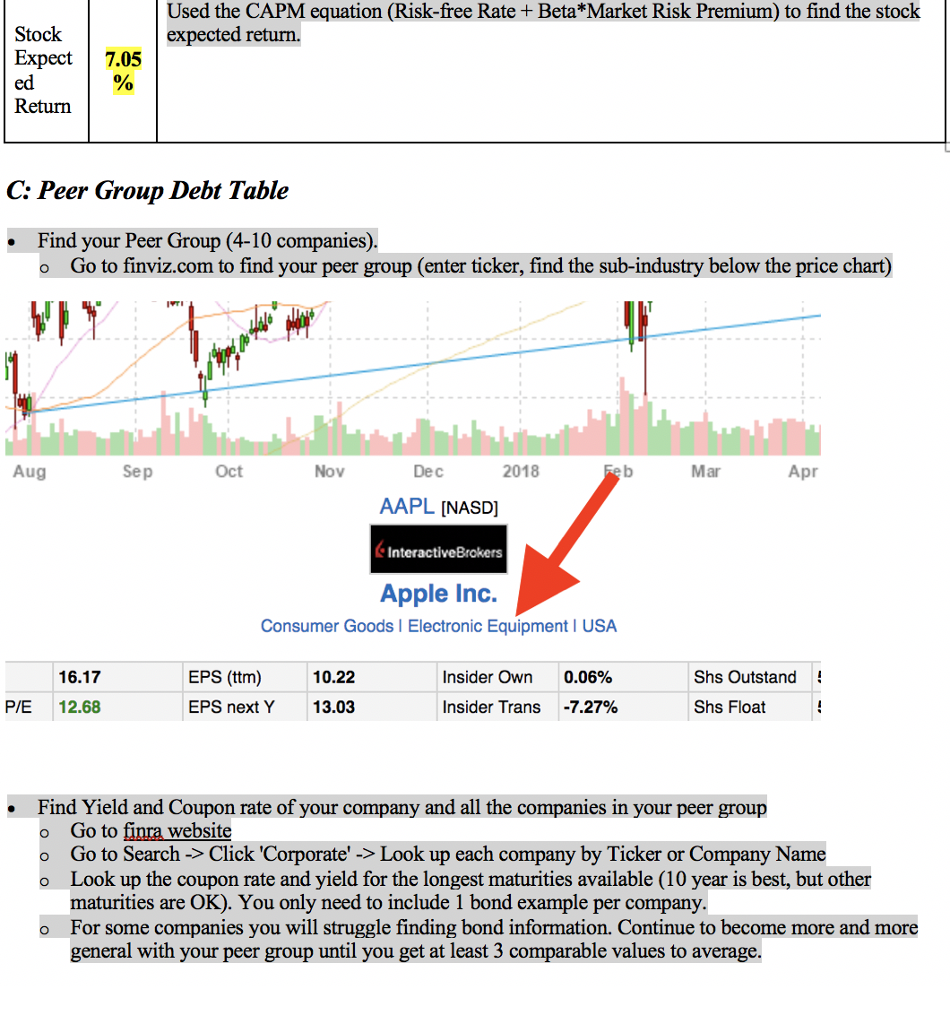

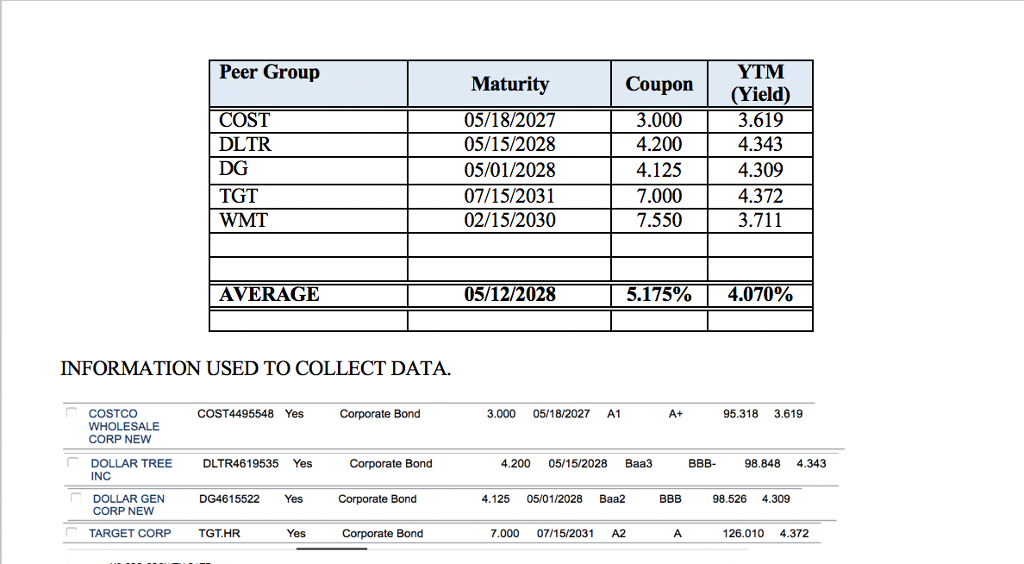

I. SUMMARY and SCENARIO ANALYSIS Describe the new product you would like your company to produce, the cost of capital, and the conclusion regarding whether your company should raise money for the building and begin producing the new product. Description of New Product. Walmart would like to raise money to purchase a commercial building that will exclusively sell ...customers the best technology repair service drop off items at the repair kiosk and shop while they wait for the repair making the wait time feel even shorter . , making Walmart your one stop shop. Customers can Cost of Capital If we issue 2,000 new bonds and 50,000 new shares of stock, the weighted average cost of capital (WAC) is expected to be 2.95% This means that the new money needs to earn at least 15% per year in order to satisfy the expectations of the company's investors The company's cost of debt is 97.29% while its cost of equity is 2.71% . . Conclusion: Based on my model and assumptions (see Appendices), we should Reject this project. The project has a net present value (NPV) of-$168,844, given a WACC of 2.95%, which is well below S0. The internal-rate-of return (IRR) of the project is-29%, which gives the company plenty of room to accept the project, even if our costs of financing go up in the future * . . . Payback is 2 years, which means the project is paid back... Worst-Case Scenario: Under a worst-case scenario, we assume the economy goes into a recession, and the cost to make and finance the building goes up We raise the tax rate, YTM and Beta to 50% 10.0% and 2.5, respectively, Under this scenario, the WACC is 5.11%, NPV is-S205, 108 and IRR is-232%. This is a scenario where the building should/should not be acquired. . Best-Case Scenario Under a best-case scenario, we assume the economy becomes red-hot, and the economy is generally considered a safe place to invest. We lower the tax rate, YTM and Beta to 10%, 1.0%, and 0.5, respectively. Under this scenario, the WACC is 1.01%, NPV is-$126,595? and IRR is-2.9%. This is a scenario where the building should/should not be acquired. . . I. SUMMARY and SCENARIO ANALYSIS Describe the new product you would like your company to produce, the cost of capital, and the conclusion regarding whether your company should raise money for the building and begin producing the new product. Description of New Product. Walmart would like to raise money to purchase a commercial building that will exclusively sell ...customers the best technology repair service drop off items at the repair kiosk and shop while they wait for the repair making the wait time feel even shorter . , making Walmart your one stop shop. Customers can Cost of Capital If we issue 2,000 new bonds and 50,000 new shares of stock, the weighted average cost of capital (WAC) is expected to be 2.95% This means that the new money needs to earn at least 15% per year in order to satisfy the expectations of the company's investors The company's cost of debt is 97.29% while its cost of equity is 2.71% . . Conclusion: Based on my model and assumptions (see Appendices), we should Reject this project. The project has a net present value (NPV) of-$168,844, given a WACC of 2.95%, which is well below S0. The internal-rate-of return (IRR) of the project is-29%, which gives the company plenty of room to accept the project, even if our costs of financing go up in the future * . . . Payback is 2 years, which means the project is paid back... Worst-Case Scenario: Under a worst-case scenario, we assume the economy goes into a recession, and the cost to make and finance the building goes up We raise the tax rate, YTM and Beta to 50% 10.0% and 2.5, respectively, Under this scenario, the WACC is 5.11%, NPV is-S205, 108 and IRR is-232%. This is a scenario where the building should/should not be acquired. . Best-Case Scenario Under a best-case scenario, we assume the economy becomes red-hot, and the economy is generally considered a safe place to invest. We lower the tax rate, YTM and Beta to 10%, 1.0%, and 0.5, respectively. Under this scenario, the WACC is 1.01%, NPV is-$126,595? and IRR is-2.9%. This is a scenario where the building should/should not be acquired

All the data as requested, I need help with the summary and conclusion please 95% of the project it already completed. The variables and inuts are listed and the spread sheet shows the forumals within it.

All the data as requested, I need help with the summary and conclusion please 95% of the project it already completed. The variables and inuts are listed and the spread sheet shows the forumals within it.