All the information has been provided and there is no missing information.

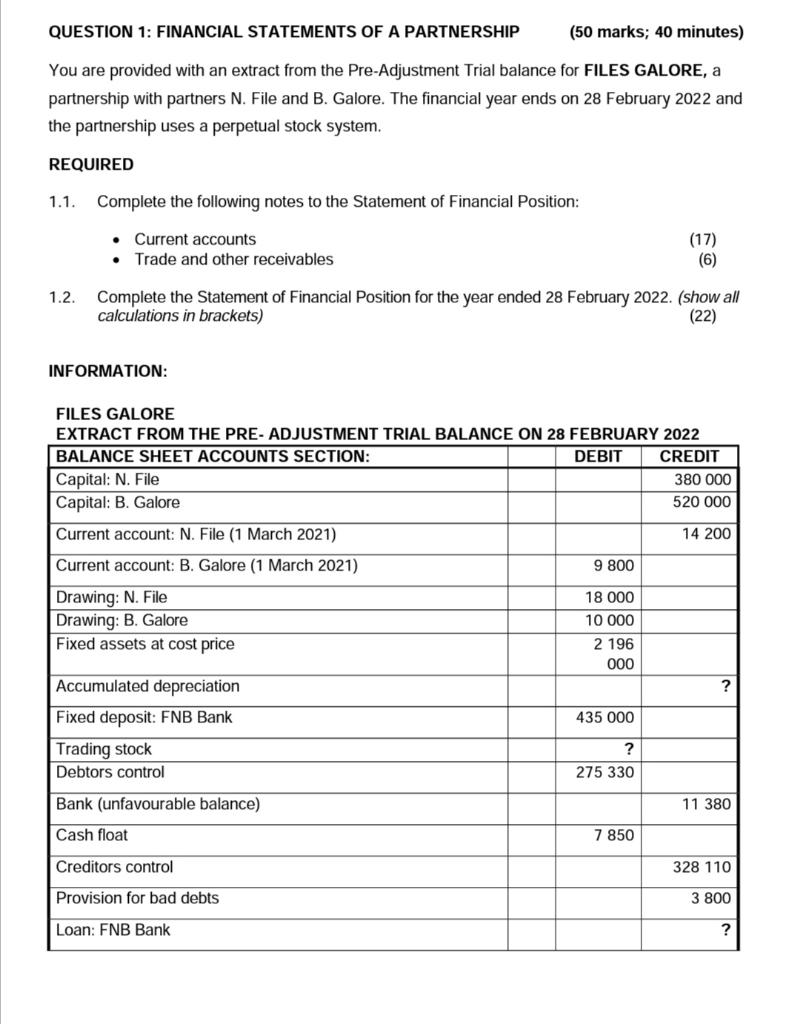

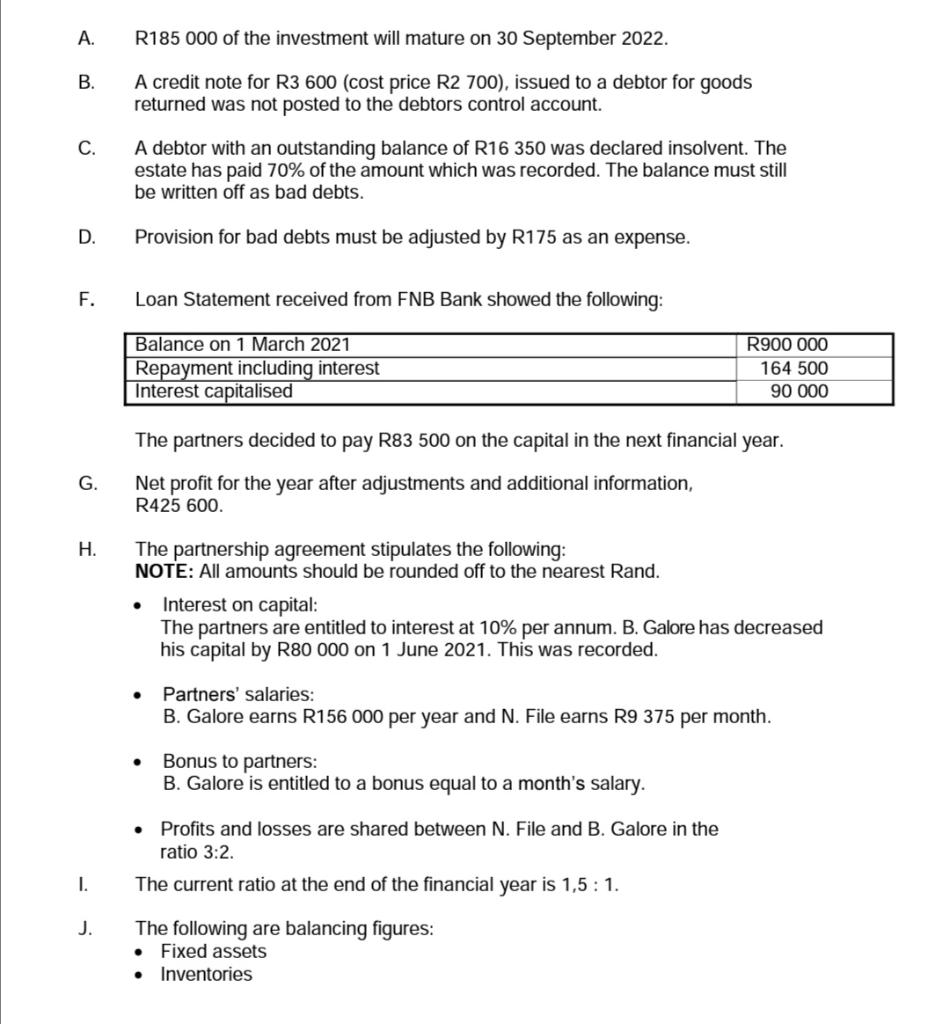

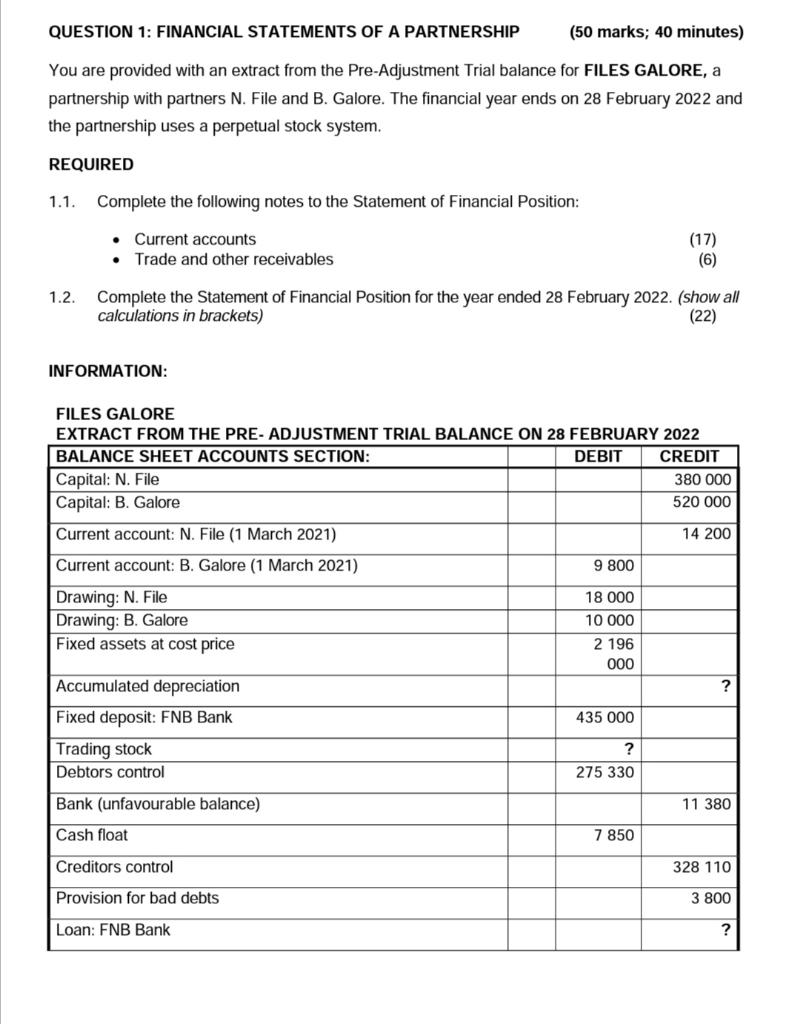

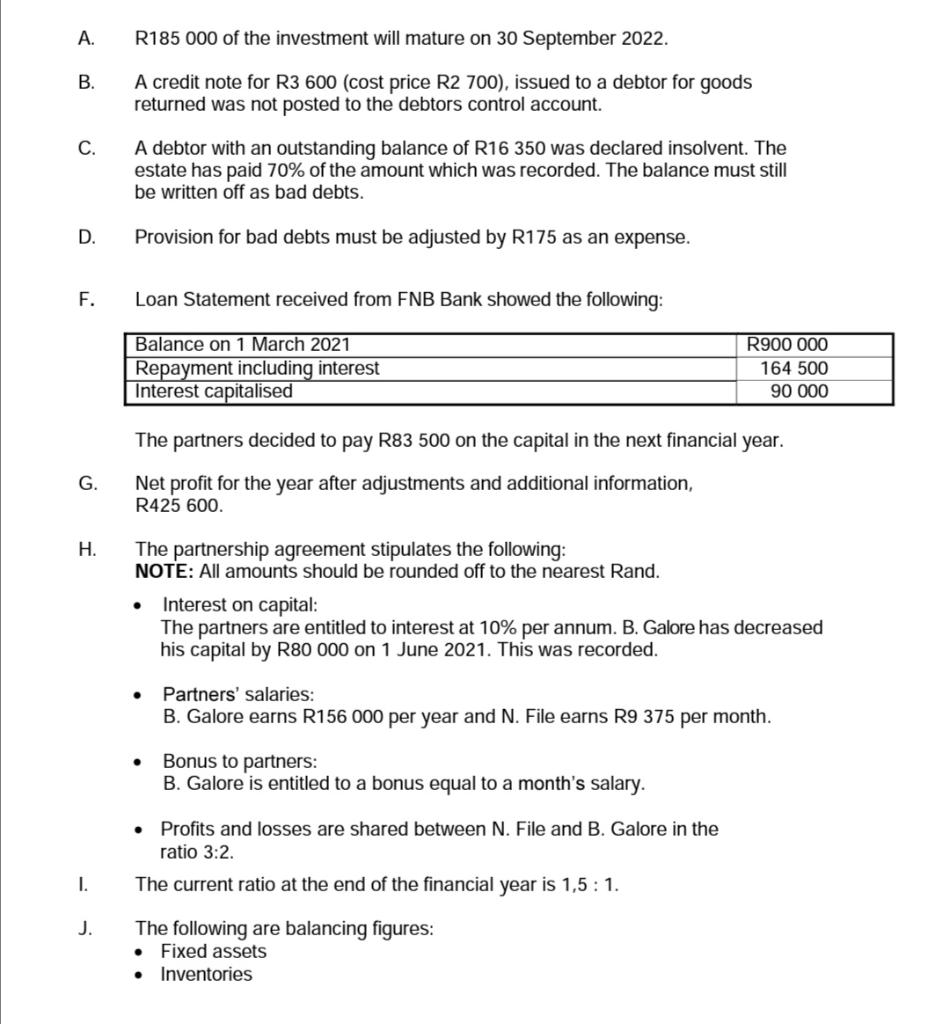

QUESTION 1: FINANCIAL STATEMENTS OF A PARTNERSHIP (50 marks; 40 minutes) You are provided with an extract from the Pre-Adjustment Trial balance for FILES GALORE, a partnership with partners N. File and B. Galore. The financial year ends on 28 February 2022 and the partnership uses a perpetual stock system. REQUIRED 1.1. Complete the following notes to the Statement of Financial Position: Current accounts (17) Trade and other receivables (6) 1.2. Complete the Statement of Financial Position for the year ended 28 February 2022. (show all calculations in brackets) (22) INFORMATION: FILES GALORE EXTRACT FROM THE PRE- ADJUSTMENT TRIAL BALANCE ON 28 FEBRUARY 2022 BALANCE SHEET ACCOUNTS SECTION: DEBIT CREDIT Capital: N. File Capital: B. Galore Current account: N. File (1 March 2021) Current account: B. Galore (1 March 2021) Drawing: N. File Drawing: B. Galore Fixed assets at cost price Accumulated depreciation Fixed deposit: FNB Bank Trading stock Debtors control Bank (unfavourable balance) Cash float Creditors control Provision for bad debts Loan: FNB Bank 9 800 18 000 10 000 2 196 000 435 000 275 330 7 850 380 000 520 000 14 200 ? 11 380 328 110 3 800 ? A. R185 000 of the investment will mature on 30 September 2022. B. A credit note for R3 600 (cost price R2 700), issued to a debtor for goods returned was not posted to the debtors control account. C. A debtor with an outstanding balance of R16 350 was declared insolvent. The estate has paid 70% of the amount which was recorded. The balance must still be written off as bad debts. D. Provision for bad debts must be adjusted by R175 as an expense. F. Loan Statement received from FNB Bank showed the following: Balance on 1 March 2021 Repayment including interest R900 000 164 500 90 000 Interest capitalised The partners decided to pay R83 500 on the capital in the next financial year. Net profit for the year after adjustments and additional information, R425 600. The partnership agreement stipulates the following: NOTE: All amounts should be rounded off to the nearest Rand. Interest on capital: The partners are entitled to interest at 10% per annum. B. Galore has decreased his capital by R80 000 on 1 June 2021. This was recorded. Partners' salaries: B. Galore earns R156 000 per year and N. File earns R9 375 per month. Bonus to partners: B. Galore is entitled to a bonus equal to a month's salary. Profits and losses are shared between N. File and B. Galore in the ratio 3:2. The current ratio at the end of the financial year is 1,5 : 1. The following are balancing figures: . Fixed assets Inventories G. H. 1. J. QUESTION 1: FINANCIAL STATEMENTS OF A PARTNERSHIP (50 marks; 40 minutes) You are provided with an extract from the Pre-Adjustment Trial balance for FILES GALORE, a partnership with partners N. File and B. Galore. The financial year ends on 28 February 2022 and the partnership uses a perpetual stock system. REQUIRED 1.1. Complete the following notes to the Statement of Financial Position: Current accounts (17) Trade and other receivables (6) 1.2. Complete the Statement of Financial Position for the year ended 28 February 2022. (show all calculations in brackets) (22) INFORMATION: FILES GALORE EXTRACT FROM THE PRE- ADJUSTMENT TRIAL BALANCE ON 28 FEBRUARY 2022 BALANCE SHEET ACCOUNTS SECTION: DEBIT CREDIT Capital: N. File Capital: B. Galore Current account: N. File (1 March 2021) Current account: B. Galore (1 March 2021) Drawing: N. File Drawing: B. Galore Fixed assets at cost price Accumulated depreciation Fixed deposit: FNB Bank Trading stock Debtors control Bank (unfavourable balance) Cash float Creditors control Provision for bad debts Loan: FNB Bank 9 800 18 000 10 000 2 196 000 435 000 275 330 7 850 380 000 520 000 14 200 ? 11 380 328 110 3 800 ? A. R185 000 of the investment will mature on 30 September 2022. B. A credit note for R3 600 (cost price R2 700), issued to a debtor for goods returned was not posted to the debtors control account. C. A debtor with an outstanding balance of R16 350 was declared insolvent. The estate has paid 70% of the amount which was recorded. The balance must still be written off as bad debts. D. Provision for bad debts must be adjusted by R175 as an expense. F. Loan Statement received from FNB Bank showed the following: Balance on 1 March 2021 Repayment including interest R900 000 164 500 90 000 Interest capitalised The partners decided to pay R83 500 on the capital in the next financial year. Net profit for the year after adjustments and additional information, R425 600. The partnership agreement stipulates the following: NOTE: All amounts should be rounded off to the nearest Rand. Interest on capital: The partners are entitled to interest at 10% per annum. B. Galore has decreased his capital by R80 000 on 1 June 2021. This was recorded. Partners' salaries: B. Galore earns R156 000 per year and N. File earns R9 375 per month. Bonus to partners: B. Galore is entitled to a bonus equal to a month's salary. Profits and losses are shared between N. File and B. Galore in the ratio 3:2. The current ratio at the end of the financial year is 1,5 : 1. The following are balancing figures: . Fixed assets Inventories G. H. 1. J.