Answered step by step

Verified Expert Solution

Question

1 Approved Answer

all the information needed is added Marginal corporate tax rates Using the corporate tax rato schedule given here perform the following: a. Find the marginal

all the information needed is added

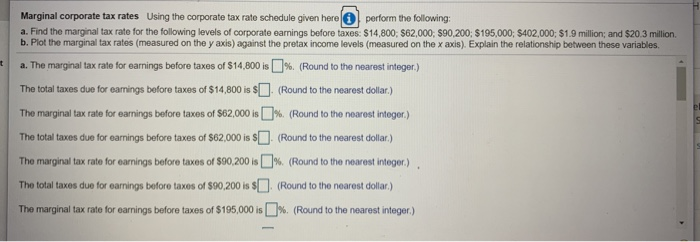

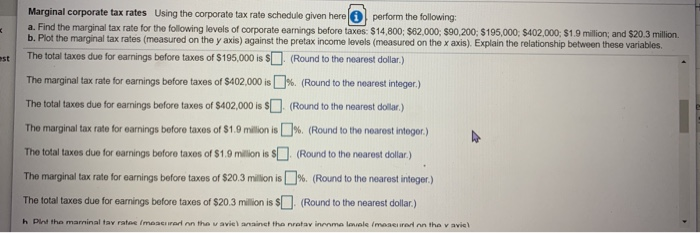

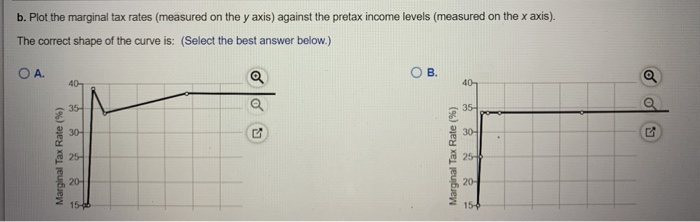

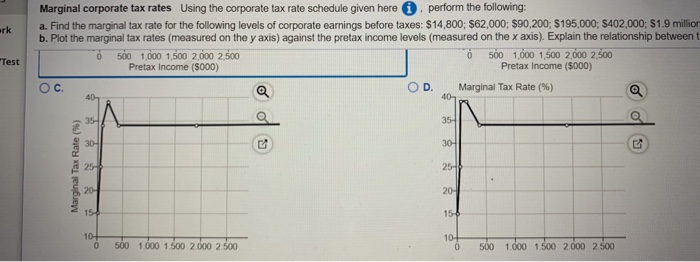

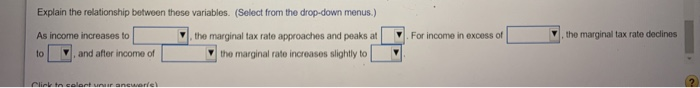

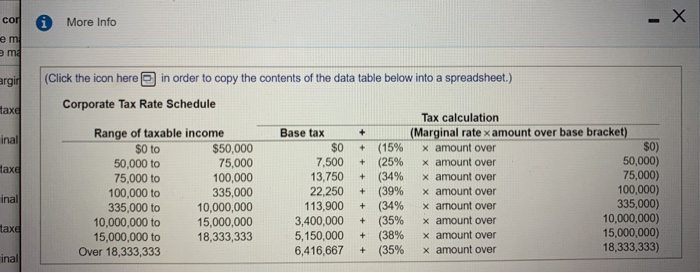

Marginal corporate tax rates Using the corporate tax rato schedule given here perform the following: a. Find the marginal tax rate for the following levels of corporate earnings before taxes: S14,800, 962,000; 890.200; $195,000; 8402,000; S1.9 million; and $20.3 million. b. Plot the marginal tax rates (measured on the y axis) against the pretax income levels (measured on the x axis). Explain the relationship between these variables. a. The marginal tax rate for earnings before taxes of $14,800 is %. (Round to the nearest integer) The total taxes duo for earnings before taxes of $14,800 is $. (Round to the nearest dollar.) The marginal tax rate for earnings before taxes of $62,000 is %. (Round to the nearest integer.) The total taxes due for earnings before taxes of $62,000 is $. (Round to the nearest dollar) The marginal tax rate for earnings before taxes of $90,200 is % (Round to the nearest integer.) The total taxes due for earnings before taxes of $90,200 is $. (Round to the nearest dollar.) The marginal tax rate for earnings before taxes of $195,000 is % (Round to the nearest integer.) Marginal corporate tax rates Using the corporate tax rate schedule given here o perform the following: a. Find the marginal tax rate for the following levels of corporate earnings before taxes: $14,800 $62,000; 890,200 $195,000 $402,000; 81.9 million; and $20.3 million b. Plot the marginal tax rates (measured on the y axis) against the pretax income levels (measured on the x axis). Explain the relationship between these variables. The total taxes due for earnings before taxes of $195,000 is $. (Round to the nearest dollar.) The marginal tax rate for earnings before taxes of $402,000 is [%. (Round to the nearest integer.) The total taxes due for earnings before taxes of $402,000 is $(Round to the nearest dollar) The marginal tax rate for earnings before taxes of $1.9 million is % (Round to the nearest integer) The total taxes due for earnings before taxes of $1,9 million is $. (Round to the nearest dollar.) The marginal tax rate for earnings before taxes of $20.3 million is %. (Round to the nearest integer.) The total taxes due for earnings before taxes of $20.3 million is $(Round to the nearest dollar) h Pind the marinal tax rate imesemann the wavierainet the ratav inoma male Image renn the variel b. Plot the marginal tax rates (measured on the y axis) against the pretax income levels (measured on the x axis). The correct shape of the curve is: (Select the best answer below.) OA. Q B. 40 40 0 35- 35- 30- 30- Marginal Tax Rate (96) Marginal Tax Rate(%) 25 20 20- 154 15-4 ark Marginal corporate tax rates Using the corporate tax rate schedule given here perform the following: a. Find the marginal tax rate for the following levels of corporate earnings before taxes: $14,800; $62,000; $90,200; $195,000; $402,000; $1.9 million b. Plot the marginal tax rates (measured on the y axis) against the pretax income levels (measured on the x axis). Explain the relationship between 500 1,000 1,500 2,000 2,500 500 1,000 1,500 2,000 2,500 Pretax Income (5000) Pretax Income (5000) C. OD Marginal Tax Rate(%) 40 40 Test 35- 35- 30- Marginal Tax Rate (%) 25- 25-0 20 20- 15- 15 10+ 0 500 1.000 1.500 2.000 2 500 10-1 0 500 1.000 1.500 2.000 2500 Explain the relationship between these variables. (Select from the drop-down menus.) As income increases to the marginal tax rate approaches and peaks at to and after income of the marginal rato increases slightly to For income in excess of the marginal tax rate declines Clinton colantaranewortel cor i More Info em: em argir taxe inal + taxe (Click the icon here in order to copy the contents of the data table below into a spreadsheet.) Corporate Tax Rate Schedule Tax calculation Range of taxable income Base tax (Marginal rate x amount over base bracket) $0 to $50,000 $0 + (15% x amount over $0) 50,000 to 75,000 7,500 (25% x amount over 50,000) 75,000 to 100,000 13,750 (34% x amount over 75,000) 100,000 to 335,000 22,250 (39% x amount over 100,000) 335,000 to 10,000,000 113,900 (34% x amount over 335,000) 10,000,000 to 15,000,000 3,400,000 + (35% x amount over 10,000,000) 15,000,000 to 18,333,333 5,150,000 (38% x amount over 15,000,000) Over 18,333,333 6,416,667 (35% x amount over 18,333,333) + + inal + taxe + + inal Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started