Answered step by step

Verified Expert Solution

Question

1 Approved Answer

all the questions are related to one section Use the below information to answer the following THREE questions (numbered 15 and 17). Miami Company manufactures

all the questions are related to one section

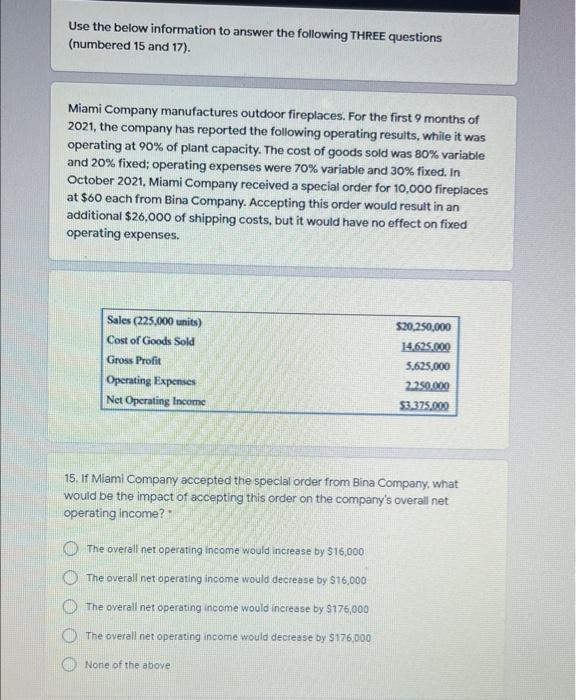

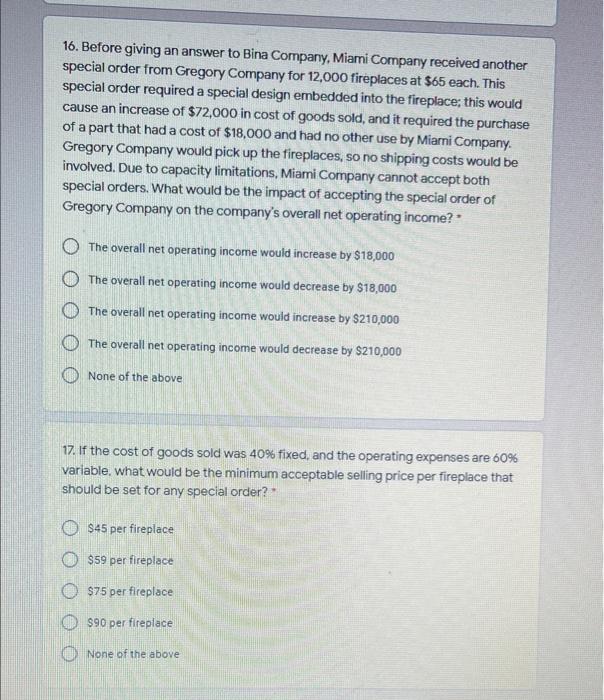

Use the below information to answer the following THREE questions (numbered 15 and 17). Miami Company manufactures outdoor fireplaces. For the first 9 months of 2021, the company has reported the following operating results, while it was operating at 90% of plant capacity. The cost of goods sold was 80% variable and 20% fixed; operating expenses were 70% variable and 30% fixed. In October 2021, Miami Company received a special order for 10,000 fireplaces at $60 each from Bina Company. Accepting this order would result in an additional $26,000 of shipping costs, but it would have no effect on fixed operating expenses. Sales (225,000 units) Cost of Goods Sold Gross Profit Operating Expenses Net Operating Income $20,250,000 14.625.000 5,625,000 2.250,000 $3.375.000 15. If Miami Company accepted the special order from Bina Company, what would be the impact of accepting this order on the company's overall net operating income? The overall net operating income would increase by $16,000 The overall net operating income would decrease by $16,000 The overall net operating income would increase by $175,000 The overall net operating income would decrease by $176 000 None of the above 16. Before giving an answer to Bina Company, Miami Company received another special order from Gregory Company for 12,000 fireplaces at $65 each. This special order required a special design embedded into the fireplace, this would cause an increase of $72,000 in cost of goods sold, and it required the purchase of a part that had a cost of $18,000 and had no other use by Miami Company. Gregory Company would pick up the fireplaces, so no shipping costs would be involved. Due to capacity limitations, Miami Company cannot accept both special orders. What would be the impact of accepting the special order of Gregory Company on the company's overall net operating income? The overall net operating income would increase by $18,000 O The overall net operating income would decrease by $18,000 The overall net operating income would increase by $210,000 The overall net operating income would decrease by $210,000 None of the above 17. If the cost of goods sold was 40% fixed, and the operating expenses are 60% variable, what would be the minimum acceptable selling price per fireplace that should be set for any special order? $45 per fireplace $59 per fireplace $75 per fireplace O $90 per fireplace None of the above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started