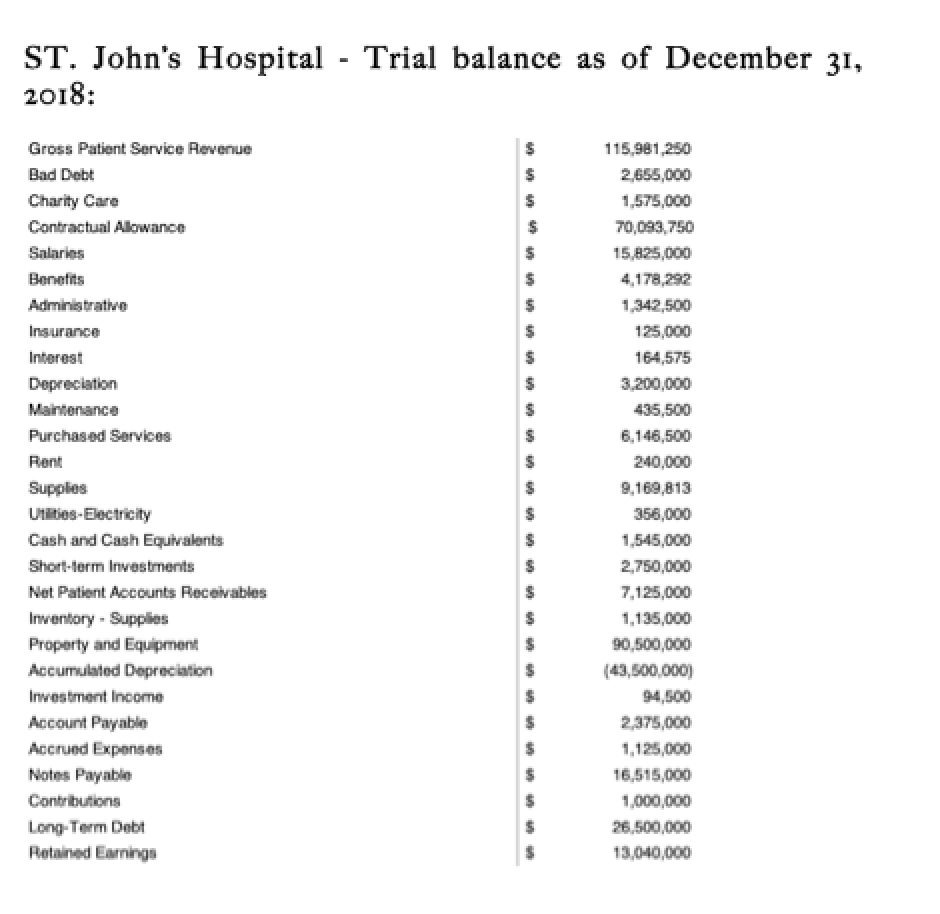

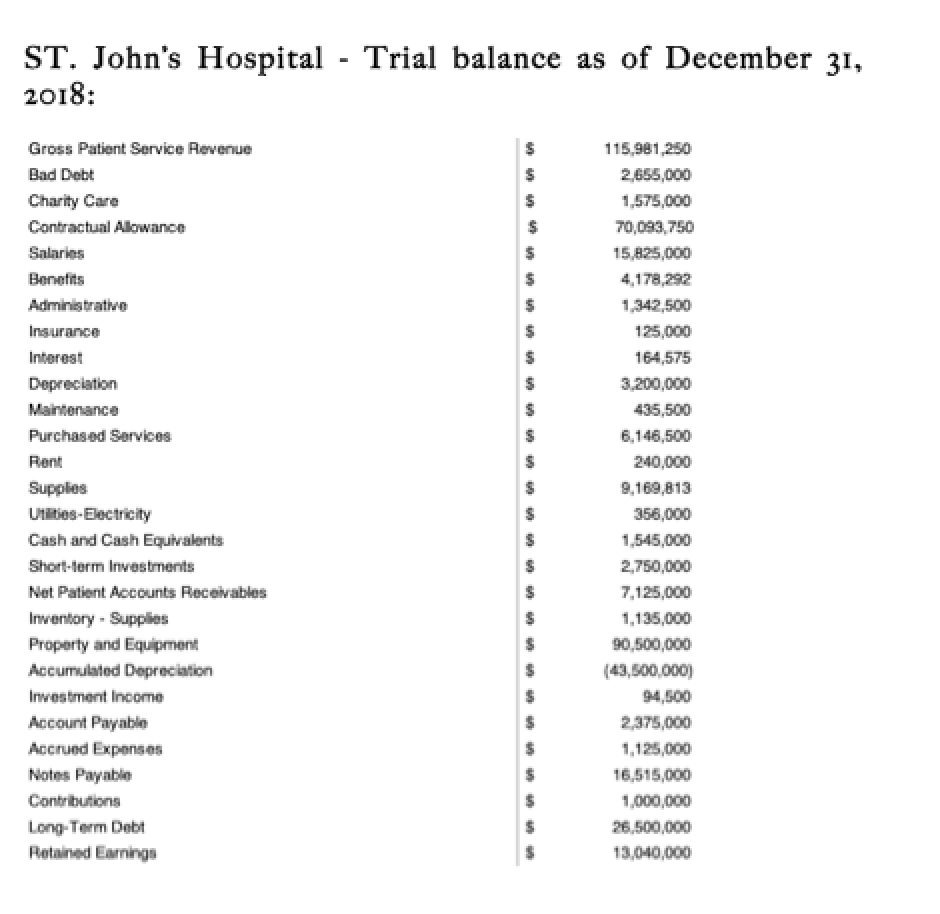

All Three of these line items are reductions from Gross Patient Revenues (Billed Charges) and Net Patient Revenucs (Collection). The Contractual Allowance, Charity Care deductions and Bad debt write offs reduce Gross Patient Revenue to Net Patient revenues. Net Patient revenues will reflect on Financial Statements what the HealthCare organization actually expects to collect Using the information given above, construct the Income Statement and Balance Sheet for the Fiscal Year endcd December 31, 2018. 2. What is the difference between gross patient service revenue and the net patient service revenue in the hospital accounting? Please explain your understanding of this difference, what it is comprised of, and why it is important to a Hospital 3What is the Operating Margin (both definition and in words)? If the benchmarkfor operating income is 2.7 for the Health Care industry, how does St. John's compare to this benchmark? Why is managing the Operating Margin so important for all Health Care Organiations? What are the implications to St. John's of this ratio? 4 What is the Profit Margin (both definition and in words) Ifthe benchmark for operating income is 4.67 for the Health Care industry, how does St. John's compare to this benchmark? What are the implications to St. John's of this ratio? 5What is thedifference between operating margin and net income and why is it important to manage both? 6. What is the estimated Cash Fkow, or the actual amount of cash generated during the FY 2018 (Cash-Net Income Noncashexpnses Why is this calculation Important to Manag 7. What is the Deht to Assets Ratio (both definition and in words)? What does it measure and why is it important? What is St. John's Debt-to-assets ratio? Ifthe Healthcare industry benchmark is 4 for this measure, how does this ratio compare to the benchmark? L 8. Basd on the information prowided, would you accept the job if offered to you? Please provide 3 reasons why you would or wouldn't accept the job ST. John's Hospital - Trial balance as of December 31, 2018 115,981,250 Gross Patient Service Revenue Bad Debt 2655,000 Charity Care 1,575,000 Contractual Alowance 70,093,750 Salaries 15,825,000 Benefits 4,178,292 1,342,500 Administrative Insurance 125,000 Interest 164,575 Depreciation 3,200,000 Maintenance 435,500 Purchased Services 6,146,500 Rent 240,000 9,169,813 Supplies Utlities-Electricity 356,000 Cash and Cash Equivalents 1,545,000 Short-lerm Investments 2,750,000 7,125,000 Net Patient Accounts Receivables Inventory Supplies 1,135,000 Property and Equipment 90,500,000 (43,500,000) Accumulated Deprociation Investment Income 94,500 Account Payable 2,375,000 Accrued Expenses 1,125,000 Notes Payable 16,515,000 Contributions 1,000,000 Long-Term Debt 26,500,000 Retained Earnings 13,040,000 All Three of these line items are reductions from Gross Patient Revenues (Billed Charges) and Net Patient Revenucs (Collection). The Contractual Allowance, Charity Care deductions and Bad debt write offs reduce Gross Patient Revenue to Net Patient revenues. Net Patient revenues will reflect on Financial Statements what the HealthCare organization actually expects to collect Using the information given above, construct the Income Statement and Balance Sheet for the Fiscal Year endcd December 31, 2018. 2. What is the difference between gross patient service revenue and the net patient service revenue in the hospital accounting? Please explain your understanding of this difference, what it is comprised of, and why it is important to a Hospital 3What is the Operating Margin (both definition and in words)? If the benchmarkfor operating income is 2.7 for the Health Care industry, how does St. John's compare to this benchmark? Why is managing the Operating Margin so important for all Health Care Organiations? What are the implications to St. John's of this ratio? 4 What is the Profit Margin (both definition and in words) Ifthe benchmark for operating income is 4.67 for the Health Care industry, how does St. John's compare to this benchmark? What are the implications to St. John's of this ratio? 5What is thedifference between operating margin and net income and why is it important to manage both? 6. What is the estimated Cash Fkow, or the actual amount of cash generated during the FY 2018 (Cash-Net Income Noncashexpnses Why is this calculation Important to Manag 7. What is the Deht to Assets Ratio (both definition and in words)? What does it measure and why is it important? What is St. John's Debt-to-assets ratio? Ifthe Healthcare industry benchmark is 4 for this measure, how does this ratio compare to the benchmark? L 8. Basd on the information prowided, would you accept the job if offered to you? Please provide 3 reasons why you would or wouldn't accept the job ST. John's Hospital - Trial balance as of December 31, 2018 115,981,250 Gross Patient Service Revenue Bad Debt 2655,000 Charity Care 1,575,000 Contractual Alowance 70,093,750 Salaries 15,825,000 Benefits 4,178,292 1,342,500 Administrative Insurance 125,000 Interest 164,575 Depreciation 3,200,000 Maintenance 435,500 Purchased Services 6,146,500 Rent 240,000 9,169,813 Supplies Utlities-Electricity 356,000 Cash and Cash Equivalents 1,545,000 Short-lerm Investments 2,750,000 7,125,000 Net Patient Accounts Receivables Inventory Supplies 1,135,000 Property and Equipment 90,500,000 (43,500,000) Accumulated Deprociation Investment Income 94,500 Account Payable 2,375,000 Accrued Expenses 1,125,000 Notes Payable 16,515,000 Contributions 1,000,000 Long-Term Debt 26,500,000 Retained Earnings 13,040,000