Answered step by step

Verified Expert Solution

Question

1 Approved Answer

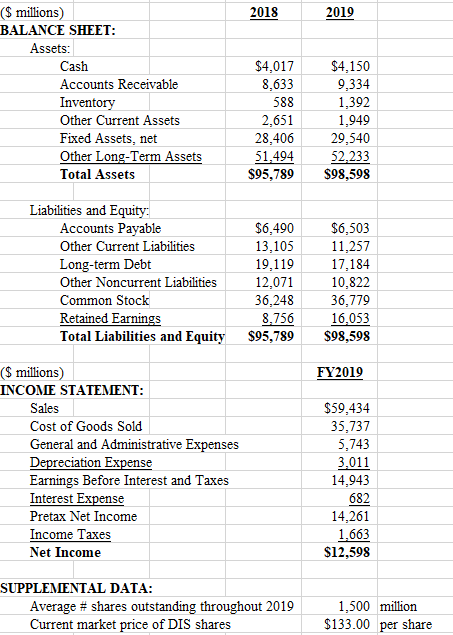

All work must be shown to receive credit, please use Excel. Will give thumbs up for good answer. ($ millions) BALANCE SHEET: 2018 2019 Assets:

All work must be shown to receive credit, please use Excel. Will give thumbs up for good answer.

($ millions) BALANCE SHEET: 2018 2019 Assets: $4,017 $4,150 Cash Accounts Receivable 8,633 9,334 1,392 Inventory Other Current Assets Fixed Assets, net Other Long-Term Assets 588 2,651 1,949 29,540 52,233 $98,598 28,406 51,494 $95,789 Total Assets Liabilities and Equity: Accounts Payable $6,490 $6,503 11,257 Other Current Liabilities 13,105 19,119 12,071 36,248 8,756 $95,789 Long-term Debt Other Noncurrent Liabilities 17,184 10,822 36,779 16,053 $98,598 Common Stock Retained Earnings Total Liabilities and Equity ($ millions) FY2019 INCOME STATEMENT: $59,434 Sales Cost of Goods Sold 35,737 5,743 3,011 14,943 General and Administrative Expenses Depreciation Expense Earnings Before Interest and Taxes Interest Expense 682 Pretax Net Income 14,261 Income Taxes 1,663 $12,598 Net Income SUPPLEMENTAL DATA: Average # shares outstanding throughout 2019 Current market price of DIS shares 1,500 million $133.00 per share 33. What was Disney's quick ratio at the end of fiscal 2019? (round to 2 decimal places)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started