Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Alla Engineering Ltd (AEL) has just won a large consulting project. They work with governments, construction companies, and resource companies around the world and

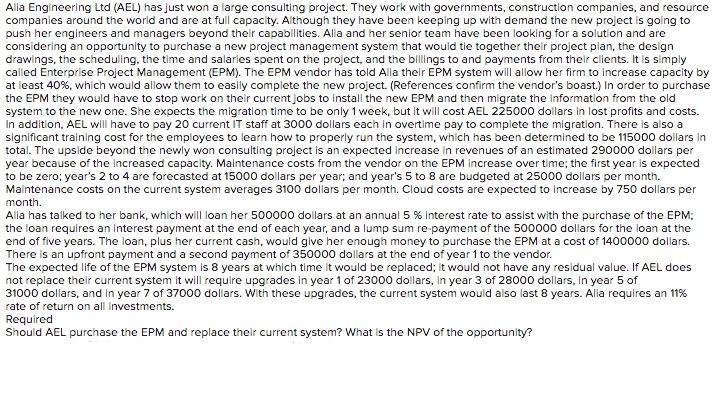

Alla Engineering Ltd (AEL) has just won a large consulting project. They work with governments, construction companies, and resource companies around the world and are at full capacity. Although they have been keeping up with demand the new project is going to push her engineers and managers beyond their capabilities. Alla and her senior team have been looking for a solution and are considering an opportunity to purchase a new project management system that would tie together their project plan, the design drawings, the scheduling, the time and salaries spent on the project, and the billings to and payments from their clients. It is simply called Enterprise Project Management (EPM). The EPM vendor has told Alla their EPM system will allow her firm to increase capacity by at least 40%, which would allow them to easily complete the new project. (References confirm the vendor's boast.) In order to purchase the EPM they would have to stop work on their current jobs to install the new EPM and then migrate the information from the old system to the new one. She expects the migration time to be only 1 week, but it will cost AEL 225000 dollars in lost profits and costs. In addition, AEL will have to pay 20 current IT staff at 3000 dollars each in overtime pay to complete the migration. There is also a significant training cost for the employees to learn how to properly run the system, which has been determined to be 115000 dollars in total. The upside beyond the newly won consulting project is an expected increase in revenues of an estimated 290000 dollars per year because of the increased capacity. Maintenance costs from the vendor on the EPM increase over time; the first year is expected to be zero; year's 2 to 4 are forecasted at 15000 dollars per year; and year's 5 to 8 are budgeted at 25000 dollars per month. Maintenance costs on the current system averages 3100 dollars per month. Cloud costs are expected to increase by 750 dollars per month. Alla has talked to her bank, which will loan her 500000 dollars at an annual 5 % Interest rate to assist with the purchase of the EPM; the loan requires an interest payment at the end of each year, and a lump sum re-payment of the 500000 dollars for the loan at the end of five years. The loan, plus her current cash, would give her enough money to purchase the EPM at a cost of 1400000 dollars. There is an upfront payment and a second payment of 350000 dollars at the end of year 1 to the vendor. The expected life of the EPM system is 8 years at which time it would be replaced; it would not have any residual value. If AEL does not replace their current system it will require upgrades in year 1 of 23000 dollars. In year 3 of 28000 dollars, in year 5 of 31000 dollars, and in year 7 of 37000 dollars. With these upgrades, the current system would also last 8 years. Alla requires an 11% rate of return on all investments. Required Should AEL purchase the EPM and replace their current system? What is the NPV of the opportunity?

Step by Step Solution

★★★★★

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Required Should A EL purchase the E PM and replace their current system ANS WER Yes A EL should purc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started