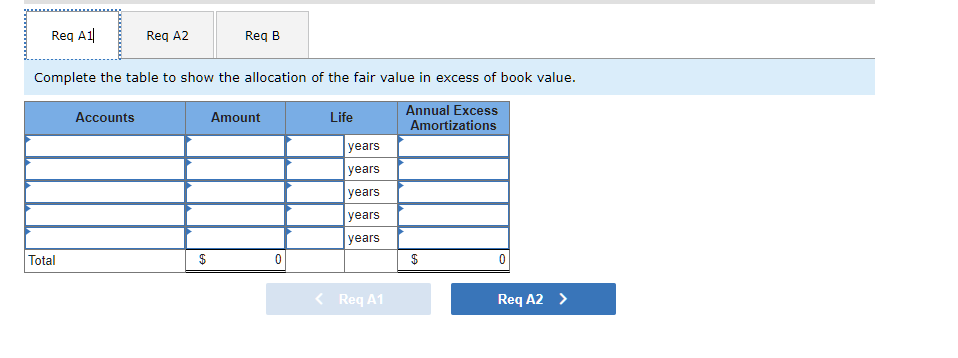

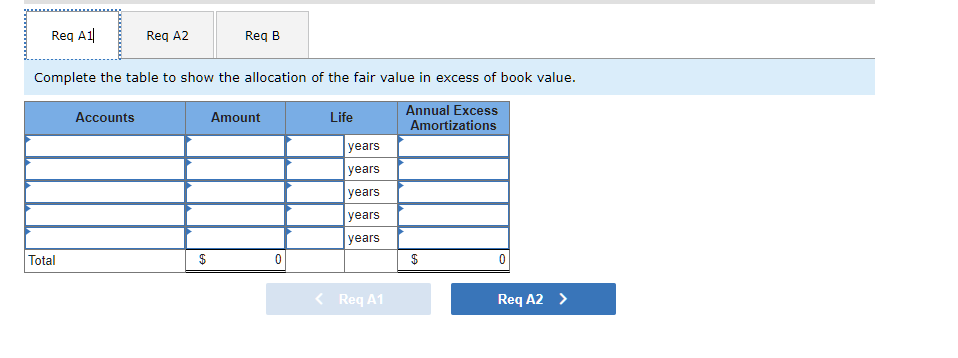

Allen Company acquired 100 percent of Bradford Company's voting stock on January 1, 2017, by issuing 10,000 shares of its $10 par value common stock (having a fair value of $23.00 per share). As of that date, Bradford had stockholders' equity totaling $187,900. Land shown on Bradford's accounting records was undervalued by $14,400. Equipment (with a five-year remaining life) was undervalued by $5,300. A secret formula developed by Bradford was appraised at $22,400 with an estimated life of 20 years. The following are the separate financial statements for the two companies for the year ending December 31, 2021. There were no intra-entity payables on that date. Credit balances are indicated by parentheses. $ Allen Company (572, 000) 189,000 176, 250 (104,920) (311, 670) Bradford Company $ (262,500) 99,000 56, 400 Revenues Cost of goods sold Depreciation expense Subsidiary earnings Net income Retained earnings, 1/1/21 Net income (above) Dividends declared $ (107, 100) $ (770,000) (311, 670) 175, 500 $ (106, 200) (107, 100) 40,000 Retained earnings , 12/31/21 $ (906, 170) $ (173, 300) $ 368,000 269,500 122,000 0 Current assets Investment in Bradford Company Land Buildings and equipment (net) 432,000 740,000 73,500 222, 000 Total assets $ 1,809,500 $ 417,500 Current liabilities $ (179, 200) Additional paid-in capital Retained earnings, 12/31/21 Total liabilities and equity $ (213, 330) (600,000) (90,000) (906, 170) $(1, 809, 500) (5, 000) (173, 300) $ (417,500) a-1. Complete the table to show the allocation of the fair value in excess of book value. a-2. Complete the table to show the computation for Subsidiary Earnings. b. Complete the worksheet by consolidating the financial information for these two companies. Reg A1 Req A2 Reg B Complete the table to show the allocation of the fair value in excess of book value. Accounts Amount Life Annual Excess Amortizations years years years years years Total $ $ $ 0 Reg A1 Req A2 Req B Complete the table to show the computation for Subsidiary Earnings. (Negative amounts should be indicated by a minus sign.) Amounts Equity earnings $ 0 ALLEN AND SUBSIDIARY Consolidation Worksheet For Year Ending December 31, 2021 Consolidation Entries Accounts Allen Co. Bradford Co. Debit Credit Consolidated Totals Income Statement Revenues $ (572,000) $ (262,500) 189,000 99,000 176,250 56,400 Cost of goods sold Depreciation expense Amortization expense Equity in subsidiary earnings 0 0 0 (104,920) (311,670) $ Net income $ (107,100) (770,000) (106,200) Statement of Retained Earnings Retained earnings 1/1 Net income (above) Dividends declared Retained earnings 12/31 (311,670) (107,100) 175,500 40,000 (906,170) $ (173,300) $ Balance Sheet Current assets Investment in Bradford Co. $ 368,000 $ 122,000 269,500 0 Land 432,000 73,500 740,000 222,000 Buildings and equipment (net) Formula 0 0 Total assets $ 1,809,500 $ 417,500 Current liabilities (213,330) (179,200) Common stock (600,000) (60,000) (90,000) (5,000) Additional paid-in capital Retained earnings 12/31 Total liabilities and equity (906,170) $ (1.809,500) $ (173,300) (417,500) $ 0 $ 0