Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Allen Enterprises acquired Brookfield, Inc. as a wholly owned subsidiary in a taxable transaction on January 1, 2016. The $550,000 excess of cost over

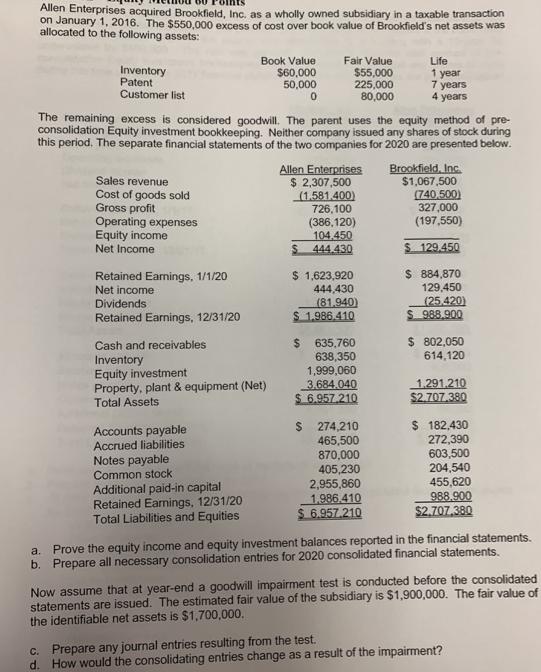

Allen Enterprises acquired Brookfield, Inc. as a wholly owned subsidiary in a taxable transaction on January 1, 2016. The $550,000 excess of cost over book value of Brookfield's net assets was allocated to the following assets: Book Value S60,000 50,000 Fair Value $55,000 225,000 80,000 Life 1 year 7 years 4 years Inventory Patent Customer list The remaining excess is considered goodwill. The parent uses the equity method of pre- consolidation Equity investment bookkeeping. Neither company issued any shares of stock during this period. The separate financial statements of the two companies for 2020 are presented below. Allen Enterprises $ 2,307,500 (1.581.400) 726,100 (386,120) 104.450 444.430 Brookfield, Inc. $1,067,500 Sales revenue Cost of goods sold Gross profit Operating expenses Equity income Net Income (740,500) 327,000 (197,550) S. 129,450 $ 884,870 129,450 Retained Eamings, 1/1/20 Net income Dividends $ 1,623,920 444,430 (81.940) S 1,986.410 (25.420) S 988.900 Retained Earnings, 12/31/20 $4 $ 802,050 Cash and receivables Inventory Equity investment Property, plant & equipment (Net) Total Assets 635,760 638,350 1,999,060 3.684.040 $ 6.957.210 614,120 1.291.210 $2.707.380 Accounts payable Accrued liabilities Notes payable Common stock Additional paid-in capital Retained Earnings, 12/31/20 Total Liabilities and Equities 274,210 465,500 870,000 405,230 2,955,860 1,986.410 $ 6.957.210 $ 182,430 272,390 603,500 204,540 455,620 988.900 $2.707,380 a. Prove the equity income and equity investment balances reported in the financial statements. b. Prepare all necessary consolidation entries for 2020 consolidated financial statements. Now assume that at year-end a goodwill impairment test is conducted before the consolidated statements are issued. The estimated fair value of the subsidiary is $1,900,000. The fair value of the identifiable net assets is $1,700,000. C. Prepare any journal entries resulting from the test. d. How would the consolidating entries change as a result of the impairment?

Step by Step Solution

★★★★★

3.52 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

EQUITY INCOME AND EQUITY INCOME BALANCES IN FINANCIAL STATEMENTS OF ALLEN ENTERPRISES INVESTMENT INCOME INCOME NET INCOME OF BROOKFIELD FOR THE YEAR 129450 104450 LESS DIVIDEND DECLARED FOR THE YEAR 2...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started