Question

Allen Products, Inc., wants to do a scenario analysis for the coming year. The pessimistic prediction for sales is $899,000; the most likely amount of

Allen Products, Inc., wants to do a scenario analysis for the coming year. The pessimistic prediction for sales is $899,000; the most likely amount of sales is

$1,121,000; and the optimistic prediction is $1,282,000.

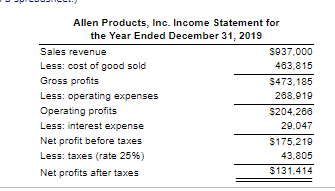

Allen's income statement for the most recent year is shown here:

A. Use the percent-of-sales method, the income statement for December 31, 2019, and the sales revenue estimates to develop pessimistic, most likely, and optimistic pro forma income statements for the coming year.

B. Explain how this method could result in overstatement of profits for the pessimistic case and understatement of profits for the most likely and optimistic cases.

c. Restate the pro forma income statements prepared in part a. to incorporate the following assumptions about the 2019 costs: $284,550 of the cost of goods sold is fixed; the rest is variable. $220,414 of the operating expenses is fixed; the rest is variable. All the interest expense is fixed.

d.Compare your findings in part c. to your findings in part a. Do your observations confirm your explanation in part b?

Allen Products, Inc. Income Statement for the Year Ended December 31, 2019 \begin{tabular}{lr} \hline Sales revenue & $937,000 \\ Less: cost of good sold & 463,815 \\ Gross profits & $473,185 \\ Less: operating expenses & 268,919 \\ \hline Operating profits & $204,266 \\ Less: interest expense & 29,047 \\ Net profit before taxes & $175,219 \\ Less: taxes (rate 25% ) & 43,805 \\ Net profits after taxes & $131,414 \\ \cline { 2 } \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started