Answered step by step

Verified Expert Solution

Question

1 Approved Answer

AllEquity Limited an all equity firm, pays no corporate taxes. It has 1,000,000 shares outstanding which are trading at $100 each. Mr. NoMoney and

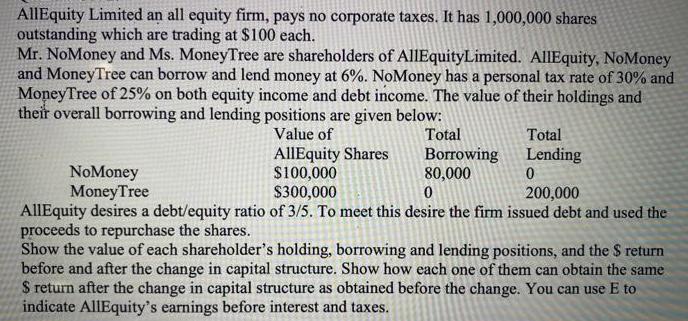

AllEquity Limited an all equity firm, pays no corporate taxes. It has 1,000,000 shares outstanding which are trading at $100 each. Mr. NoMoney and Ms. MoneyTree are shareholders of AllEquityLimited. AllEquity, NoMoney and MoneyTree can borrow and lend money at 6%. NoMoney has a personal tax rate of 30% and MoneyTree of 25% on both equity income and debt income. The value of their holdings and their overall borrowing and lending positions are given below: Value of Total Borrowing 80,000 AllEquity Shares Total Lending 0 200,000 NoMoney MoneyTree $100,000 $300,000 0 AllEquity desires a debt/equity ratio of 3/5. To meet this desire the firm issued debt and used the proceeds to repurchase the shares. Show the value of each shareholder's holding, borrowing and lending positions, and the $ return before and after the change in capital structure. Show how each one of them can obtain the same $ return after the change in capital structure as obtained before the change. You can use E to indicate AllEquity's earnings before interest and taxes.

Step by Step Solution

★★★★★

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Before the Change in Capital Structure NoMoney Value of AllEquity shares 100000 Total Borrowings 80000 Total Lending 0 Net Borrowings Borrowings Lendi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started