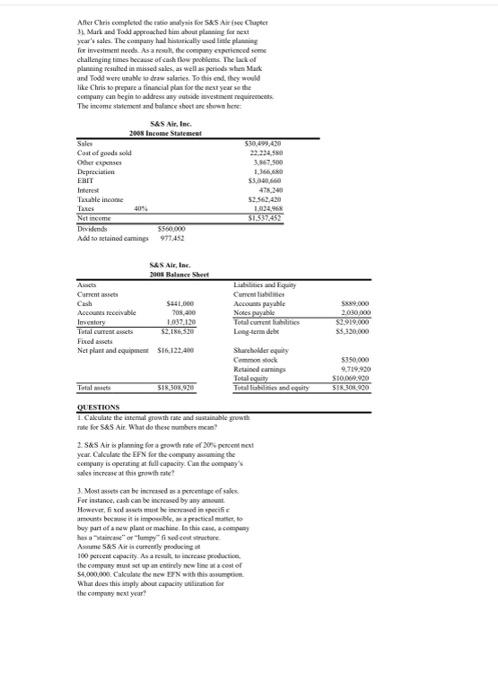

Aller Chris completed the towalysis for 5&Airs Chapter Mark and Todd approached him about planning for et year's sale. The company hasically wed lite for investment neces. As a real the company experienced some challenging times because of cash low poble. The lack of planning resulted in masse sales, as well periods Mark and Tood were able to draw salaries. To this end, they would like Christo prepare a financial plus to the next years the company can begin to address any stade svestment requirements The income semenand balance sheet ansehen S&S Air. Inc. 2008 Income Statement $30,0,430 Cost of goods sold 22224 Other 3.67.500 Depreciation 1.36 ERIT 5. Inst 474 Table icon Taxes 1802 Neeme 31587452 Dividende 5560.000 Add to retained camins 977.452 Stiles MSA, Inc Dos Balance Sheet Current site Cash $1.000 Accounts receivable 708,20 Imestay 1.037.120 Total Ten $2,186,320 Firew Netplant and equipment $16.122.00 Current Accounts payable Notes le Totalces Long-term dhe www. 2030,000 219.000 3.130.000 Shareholder equity Common ock Retained caring Total party Tutallibees and guity $350,000 9719.30 STOMA.920 STR. 301000 Total 518,308,020 QUESTIONS 1.Calculate the late growth rate and sustainable growth role for S&S Air. What do the numbers can 2. S&S Air is planning for a growth of poet year. Calculate the EFX for the coming the company is operating at full capacity. Can the company's anks imaTVSN at this at rist 3. Molts can be in a propose For instance, cash can be increased by any met However, fiabe in specific ante beweit is imposible spectacle to bay part of a new plant or machine to this com a company hermed constructore Asume S&S Ait is currently producing 100 percent capacity. As a result increase production the company in up an entirely new line cost of S4.000.000 Calculane w Ex with this What does this imply out capacity of the company at your Aller Chris completed the towalysis for 5&Airs Chapter Mark and Todd approached him about planning for et year's sale. The company hasically wed lite for investment neces. As a real the company experienced some challenging times because of cash low poble. The lack of planning resulted in masse sales, as well periods Mark and Tood were able to draw salaries. To this end, they would like Christo prepare a financial plus to the next years the company can begin to address any stade svestment requirements The income semenand balance sheet ansehen S&S Air. Inc. 2008 Income Statement $30,0,430 Cost of goods sold 22224 Other 3.67.500 Depreciation 1.36 ERIT 5. Inst 474 Table icon Taxes 1802 Neeme 31587452 Dividende 5560.000 Add to retained camins 977.452 Stiles MSA, Inc Dos Balance Sheet Current site Cash $1.000 Accounts receivable 708,20 Imestay 1.037.120 Total Ten $2,186,320 Firew Netplant and equipment $16.122.00 Current Accounts payable Notes le Totalces Long-term dhe www. 2030,000 219.000 3.130.000 Shareholder equity Common ock Retained caring Total party Tutallibees and guity $350,000 9719.30 STOMA.920 STR. 301000 Total 518,308,020 QUESTIONS 1.Calculate the late growth rate and sustainable growth role for S&S Air. What do the numbers can 2. S&S Air is planning for a growth of poet year. Calculate the EFX for the coming the company is operating at full capacity. Can the company's anks imaTVSN at this at rist 3. Molts can be in a propose For instance, cash can be increased by any met However, fiabe in specific ante beweit is imposible spectacle to bay part of a new plant or machine to this com a company hermed constructore Asume S&S Ait is currently producing 100 percent capacity. As a result increase production the company in up an entirely new line cost of S4.000.000 Calculane w Ex with this What does this imply out capacity of the company at your