Question

Alliance is a stock market listed manufacturing company that is seeking 10m additional finance to undertake a new project. The finance director of Alliance is

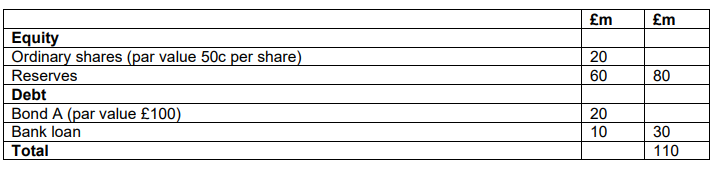

Alliance is a stock market listed manufacturing company that is seeking 10m additional finance to undertake a new project. The finance director of Alliance is currently considering whether to raise the capital by debt or equity finance. The capital structure of the company (before the new finance has been raised) is as follows:

The ordinary shares are currently trading at 1.70 each. The companys cost of equity has been estimated at 15%. Bond A will be redeemed at par in six years time and pays a fixed annual interest of 8%. The pretax cost of this finance has been estimated at 10%. The bank loan is repayable in two years time. It is a floating rate loan at LIBOR + 1%. LIBOR is currently at 3%.

The ordinary shares are currently trading at 1.70 each. The companys cost of equity has been estimated at 15%. Bond A will be redeemed at par in six years time and pays a fixed annual interest of 8%. The pretax cost of this finance has been estimated at 10%. The bank loan is repayable in two years time. It is a floating rate loan at LIBOR + 1%. LIBOR is currently at 3%.

Initial enquiries by the finance director have indicated that further fixed rate debt finance could be raised at an annual posttax cost of 7%. Floating rate debt finance could be obtained for LIBOR + 2%. Market experts are divided over the expectations of future interest rates, with some expecting rates to remain steady for the foreseeable future, and others predicting an increasing of up to 4%. Alliance pays corporation tax at a rate of 30%.

Task

i. Calculate the current market value of Bond A.

m m 20 60 80 Equity Ordinary shares (par value 50c per share) Reserves Debt Bond A (par value 100) Bank loan Total 20 10 30 110Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started