Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Allied Products Allied Products Inc., has recently won approval from the Federal Aviation Administration (FAA) for its Enhanced Ground Proximity Warning System (GPWS). This

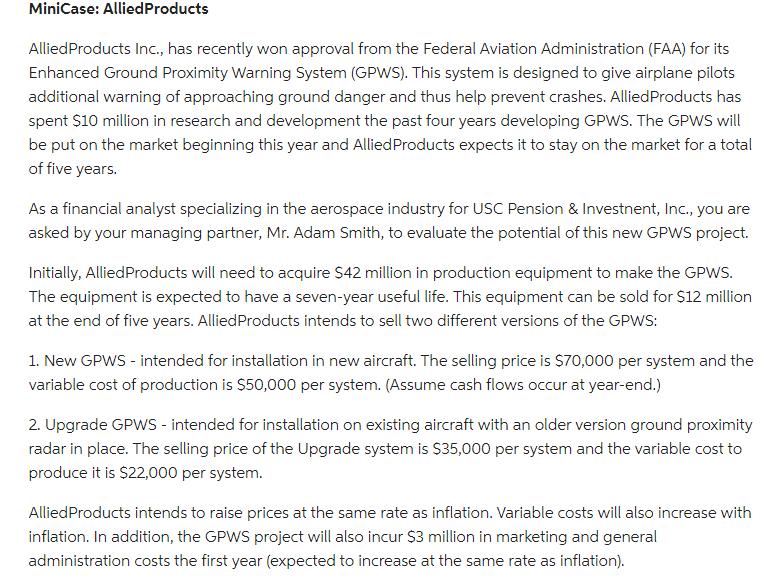

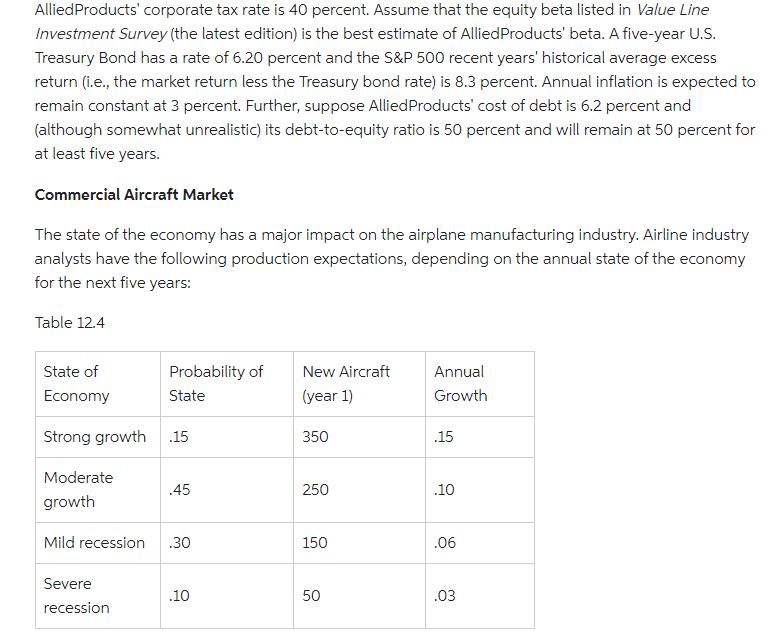

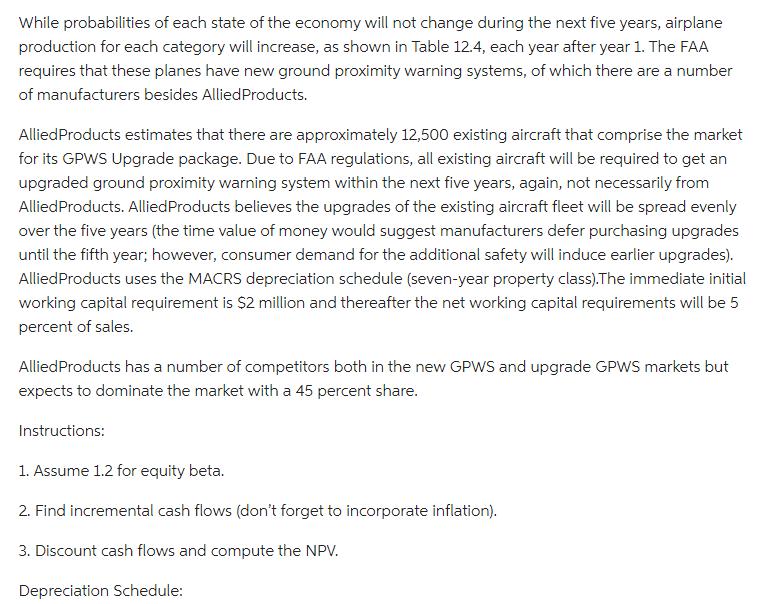

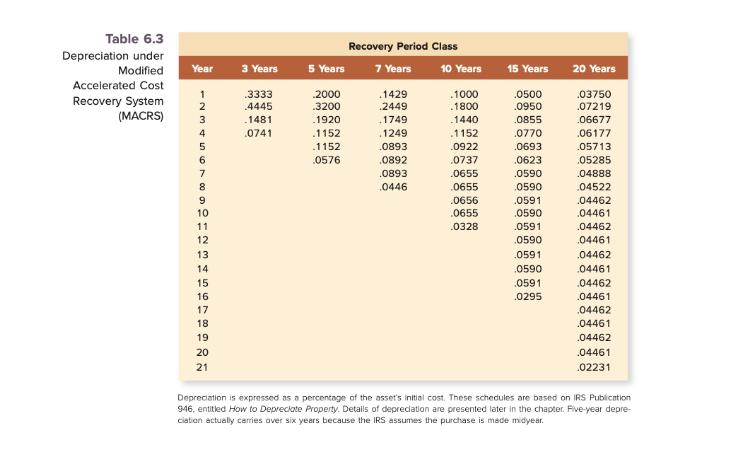

Allied Products Allied Products Inc., has recently won approval from the Federal Aviation Administration (FAA) for its Enhanced Ground Proximity Warning System (GPWS). This system is designed to give airplane pilots additional warning of approaching ground danger and thus help prevent crashes. Allied Products has spent $10 million in research and development the past four years developing GPWS. The GPWS will be put on the market beginning this year and Allied Products expects it to stay on the market for a total of five years. As a financial analyst specializing in the aerospace industry for USC Pension & Investnent, Inc., you are asked by your managing partner, Mr. Adam Smith, to evaluate the potential of this new GPWS project. Initially, Allied Products will need to acquire $42 million in production equipment to make the GPWS. The equipment is expected to have a seven-year useful life. This equipment can be sold for $12 million at the end of five years. Allied Products intends to sell two different versions of the GPWS: 1. New GPWS - intended for installation in new aircraft. The selling price is $70,000 per system and the variable cost of production is $50,000 per system. (Assume cash flows occur at year-end.) 2. Upgrade GPWS - intended for installation on existing aircraft with an older version ground proximity radar in place. The selling price of the Upgrade system is $35,000 per system and the variable cost to produce it is $22,000 per system. Allied Products intends to raise prices at the same rate as inflation. Variable costs will also increase with inflation. In addition, the GPWS project will also incur $3 million in marketing and general administration costs the first year (expected to increase at the same rate as inflation). Allied Products' corporate tax rate is 40 percent. Assume that the equity beta listed in Value Line Investment Survey (the latest edition) is the best estimate of Allied Products' beta. A five-year U.S. Treasury Bond has a rate of 6.20 percent and the S&P 500 recent years' historical average excess return (i.e., the market return less the Treasury bond rate) is 8.3 percent. Annual inflation is expected to remain constant at 3 percent. Further, suppose Allied Products' cost of debt is 6.2 percent and (although somewhat unrealistic) its debt-to-equity ratio is 50 percent and will remain at 50 percent for at least five years. Commercial Aircraft Market The state of the economy has a major impact on the airplane manufacturing industry. Airline industry analysts have the following production expectations, depending on the annual state of the economy for the next five years: Table 12.4 State of Economy Strong growth Moderate growth Probability of State Severe recession 15. .45 Mild recession .30 .10 New Aircraft (year 1) 350 250 150 50 Annual Growth .15 .10 .06 .03 While probabilities of each state of the economy will not change during the next five years, airplane production for each category will increase, as shown in Table 12.4, each year after year 1. The FAA requires that these planes have new ground proximity warning systems, of which there are a number of manufacturers besides Allied Products. Allied Products estimates that there are approximately 12,500 existing aircraft that comprise the market for its GPWS Upgrade package. Due to FAA regulations, all existing aircraft will be required to get an upgraded ground proximity warning system within the next five years, again, not necessarily from Allied Products. Allied Products believes the upgrades of the existing aircraft fleet will be spread evenly over the five years (the time value of money would suggest manufacturers defer purchasing upgrades. until the fifth year; however, consumer demand for the additional safety will induce earlier upgrades). Allied Products uses the MACRS depreciation schedule (seven-year property class). The immediate initial working capital requirement is $2 million and thereafter the net working capital requirements will be 5 percent of sales. Allied Products has a number of competitors both in the new GPWS and upgrade GPWS markets but expects to dominate the market with a 45 percent share. Instructions: 1. Assume 1.2 for equity beta. 2. Find incremental cash flows (don't forget to incorporate inflation). 3. Discount cash flows and compute the NPV. Depreciation Schedule: Table 6.3 Depreciation under Modified Accelerated Cost Recovery System (MACRS) Year 123456 7 8 9 10 11 12 13 14 15 16 17 18 18 19 8 20 21 3 Years .3333 .4445 1481 0741 5 Years 2000 .3200 1920 1152 1152 0576 Recovery Period Class 7 Years .1429 .2449 1749 1249 0893 0892 0893 0446 10 Years .1000 .1800 1440 1152 0922 .0737 .0655 0655 .0656 0655 .0328 15 Years .0500 .0950 0855 .0770 .0693 0623 .0590 0590 0591 0590 .0591 0590 0591 0590 0591 0295 20 Years 03750 07219 06677 .06177 05713 05285 04888 04522 04462 04461 04462 04461 04462 04461 04462 04461 04462 04461 04462 .04461 02231 Depreciation is expressed as a percentage of the asset's initial cost. These schedules are based on IRS Publication 946, entitled How to Depreciate Property. Details of depreciation are presented later in the chapter. Five-year depre- ciation actually carries over six years because the IRS assumes the purchase is made midyear.

Step by Step Solution

★★★★★

3.54 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

The detailed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started